To ensure successful decisions and actions of companies in the dynamic market, it is necessary to quickly obtain information, including detailed financial data and indicators. As an entrepreneur, you most likely don’t really like doing bookkeeping or simply do not have enough time.

Fortunately, modern tools and solutions help with bookkeeping in many ways. It will still take some time, but in this review, we will introduce you to a tool that aims to reduce this time to a minimum. Small and medium businesses in the United States and other English-speaking countries widely use this software.

There are various versions of QuickBooks Online: with sales tax and US GAAP standards for the USA market, and versions with VAT and IFRS developed for the European countries, in particular for the UK. There are also various versions of functionality.

With a variety of plans, your business will surely find an option that offers functionality that fits your needs and requirements the best. Users are able to check QuickBooks Online pricing on their official website and also take advantage of a free 30-day trial. The QuickBooks Online support team as well as QuickBooks tutorials online are valuable resources when you just get started. QuickBooks Online customer help includes a live chat, email, and phone number.

What is QuickBooks Online?

QuickBooks Online is the product of Intuit. Although QuickBooks desktop version was and stays popular, the online version is gaining more and more popularity. It is very easy to set up an account and you do not need to purchase and set up the software to use QuickBooks Online. All you need is just internet access and QuickBooks login. Moreover, a multi-user mode allows to set up an account with customizable access by role for up to 25 users.

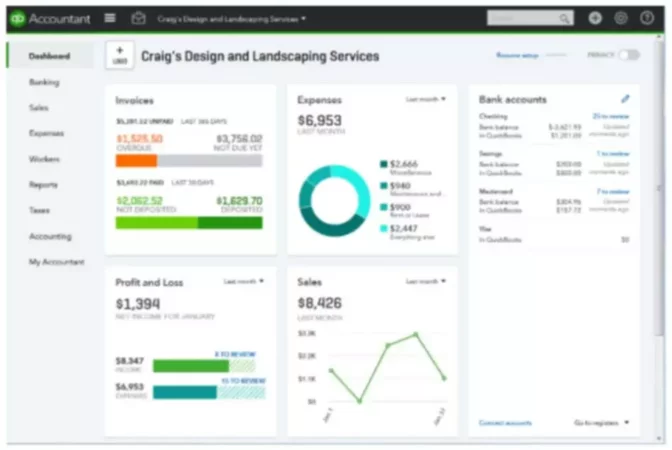

All the financial data is literally at your fingertips. On the home page, you get a quick analysis of a business’s invoices, expenses, bank accounts, profit and loss, and sales. There are many other features, which we will talk about separately, but here are just some advantages of an online version:

- Automatic online synchronization with bank

- Access to the latest version of QuickBooks Online

- Access from any computer or mobile device

- Access for minimum 5 and up to 25 users

- Files saved in the cloud

Overview of QuickBooks features

- Create and manage (custom) accounts with multiple users

- Integration with a cash register, bar code scanner, and web store

- Exchange documents between devices

- Track sales and expenses

- Inventory management

- Print receipts/checks

- Track miles and time

- Create and manage purchase orders, invoices and track payments

- Automated online banking and bank data synchronization

- Automatic tax calculations and deduction maximization

- Financial reports, analytics, and insights

QuickBooks Mobile App

QuickBooks Online service simplifies accounting procedures and tasks. With QuickBooks app, it becomes even more convenient to use this program. Businesses use QuickBooks Online iOS and Android mobile apps to run their business right from their phone. There are also many QuickBooks apps available to expand the capabilities of QuickBooks Online.

What can you do in QuickBooks mobile app? Well, you can create estimates and invoices quickly and easily, record your expenses on the go, create notes to refer to in the future, manage your banking transactions, review your customers, check your Profit and Loss and Balance Sheet. Everything is synchronized with your QuickBooks Online account whether you access it through the web or the app.

In the mobile app, you have two main views – a Dashboard tab and an Activity tab. No matter in which view you are in, you always see the Create menu right at the bottom of the screen. You would go to the Create menu to create sales receipts, estimate, expense, invoice, payment, or notes.

To illustrate, creating an invoice would look something like this. With your invoice screen displayed, you have the customer name at the top and the invoice number get automatically generated. The invoice date, terms, and due date follow. Then, you add services or products by simply clicking on the plus sign. If you want taxes to be applied, just check the appropriate fiels. The total due is displayed at the bottom.

In the top right corner, you would save the invoice and send it to your customer. A really useful feature on the QuickBooks mobile app is the ability to obtain a signature on invoices and estimates. Thus, before sending the invoice, you can sign it in the signature box just using your finger. Your signature is permanently attached to this invoice.

Now, let’s look at creating an expense function. It is very handy that the app enables one to record the costs on the go, right when you incur them. You can enter all the information manually or take a picture of your receipt using a little camera icon. The information will be automatically imported into the expense record.

The app allows to specify if this expense was for a specific customer and if the customer should be billed this expense in the future. Moreover, you have the ability to split this transaction (e.g. taxes). Finally, you are able to add notes, so you can remember what you spent the money on. All the transactions will appear in your Activity log.

When you use the Notes feature, you can assign the notes to a specific customer and also attach documents or photos to your notes. No need to carry a notebook with you or have a separate app to take your notes.

QuickBooks Payroll Service

Intuit Payroll is a QuickBooks Online payroll service. Intuit Full Service Payroll is a premium payroll service. It makes running payroll as simple as making a couple of clicks. The Intuit payroll specialists take care of the rest. If you need help figuring it out the first time around, the payroll specialist will walk you through the whole process, so you would feel confident doing your payroll accurately.

When you are ready to run the payroll, you simply click the Enter Payday Information button. The first step is to enter the hours. You would select the employees you want to pay and specify the number of regular, overtime, vacation, or bonus hours for each individual. Paying salaried employees is even simpler because you do not need to enter anything, unless they have overtime or vacation hours.

The second step is previewing and submitting it for processing. In the Preview window, you can see each employee’s paycheck information and your total payroll liability. A nice feature is an icon that appears next to a name will open a pop-up and alert you about any significant differences in the entered information. This helps to prevent errors before you confirm the payroll.

Intuit will confirm that the payroll was submitted and let you know if you need to do anything else. Employers are able to look at historical payroll data in the Reports tab and import the payroll data into the QuickBooks Online to keep a record of the payroll expense.

The team of payroll specialists also reminds you about upcoming tax payments, then files them on your behalf. They will also process and distribute W-2 at the end of the year. Intuit guarantees that your paychecks and payroll taxes are always free of errors. If you have any questions, the specialists are available via phone, chat, or email.

The QuickBooks Payroll Service price depends on the plan you choose. There are three plans available: Core, Premium, and Elite, with more advanced features added as the price goes up. The most advanced (Elite) plan allows to track time and projects on the go and has a tax penalty protection and personal HR advisor. You can check the price for each plan as well as the list of all the features on the official QuickBooks website. You will also see regular sale offers and deals, such as 50% off for 3 months, proposed on the website.

What is QuickBooks Self-Employed?

Freelancers, independent contractors, and other self-employed people that are struggling to keep track of their income, expenses, and taxes find that the QuickBooks Self-Employed Online version greatly simplifies their life and makes their business more successful. There are actually two options choose from. The first one provides all the features of the Self-Employed version. The second option also allows you to pay estimated quarterly taxes online. It is connected with TurboTax, which makes it easy to file taxes.

You can access your account through the QuickBooks Online web portal or the app. The Self-Employed version makes it really simple to track your freelance activity income. All you would do is enter your bank (or credit card) account and QuickBooks Online links with your account to retrieve information. Then, you can set up the rules that actually will track whatever your income source is.

The Home tab as well as the Transactions tab reflect the business profit, which is your income minus your expenses. For each month throughout the year, a graphical representation of your income and expense is presented, so you can compare how much you made this month versus last month and figure out what you did differently to make more money.

Managing your expenses in an easy way is another feature that makes people get QuickBooks Self-Employed. As with income, linking your bank account allows automatic tracking of your expenses as well as their categorization. The QuickBooks Self-Employed app makes it really simple to ensure that all expenses are categorized correctly. Any reoccurring transactions will be categorized based on the rules you set up previously without additional participation on your side.

As was mentioned earlier, you can take a photo of your receipt and enter your expenses that were made using a different bank account or cash into the system. This saves you a lot of time and hassle trying to find all the receipts and categorize them for your accountant when the tax time is just around the corner. Being able to track mileage automatically is also a valuable tool.

The create invoice feature discussed earlier is also available in QuickBooks Self-Employed Online. Your invoices will look professional and can even be done on the go. You can also use an option to enable online payments, which your clients will surely appreciate and you will get your money faster. Being able to send an overdue invoice reminder to your clients is an awesome bonus.

Another great feature is the automatically estimated quarterly taxes. If you are new to freelancing or you are self-employed, managing your taxes is one of the most important things. If you make a certain amount of money, you are required by law to pay estimated quarterly taxes. Otherwise, you will have to pay penalties and fees when you file your taxes. Thus, you can not only avoid paying penalties, but also spread your tax burden throughout the year.

Moreover, it makes it easy to generate reports of all your income and expenses along with all the receipts. You can use this information to file taxes yourself or bring it to your accountant to help you file your taxes. Of course, if you choose the Self-Employed with tax services option, you will make tax filing even easier on yourself. You can have one state and one federal tax return filed on your behalf and even have a CPA look over your return before it is submitted. The CPA will also be available to offer consultation throughout the year.

What is QuickBooks Online Accountant?

There is another version of QuickBooks called QuickBooks Accountant, which has many tools to help accountants do their job better. It is a QuickBooks online software that allows accountants to see a list of all of their clients on the dashboard with a quick snapshot of where they are at. The accountants do not need to look through a stash of papers or files on their computers to find the documents that they need for a specific client because everything is stored in one place and is easily retrievable.

All their work is concentrated in one place. They able to assign tasks and set up projects for themselves and their team. There is no need to keep unnecessary paperwork, which allows to efficiently share information between the accountant and each client. One can see the main information about each client listed under the Clients tab. To see more details, such as notes from your team or you and documents, you would simply click on the name of the client. Sharing documents with clients or your team is done in a secure way, so no worries there.

By clicking on the icon next to the name, you would go right into their QuickBooks account, which is very convenient. Once in the client’s account, you can access features that are specifically created for accountants, such as reclassifying transactions, bank reconciliation, and financial reports. Adding new clients is also uncomplicated and effortless. Another item that accessible from your Accountant account is the tax returns.

In addition to working with your client’s books, there is a possibility to manage your own accounting practice by going to the Work tab. You will see a snapshot of projects and tasks that are due today, the current and the next week, and within the month. Just like adding clients, adding new members to your team, and customizing their access level is just as straightforward. You can also manage and add apps compatible with QuickBooks Online Accountant for your practice or your clients to make accounting even more enjoyable and less time-consuming.

Accountants are also able to get access to the training and support offered under the ProAdvisor program without having to pay anything extra, which we will explain in more detail later. Moreover, QuickBooks Online Plus and QuickBooks Payroll are also included in the QuickBooks Online Accountant.

How to Become a QuickBooks ProAdvisor

QuickBooks Online ProAdvisor is an accounting/bookkeeper certification that one receives after completing QuickBooks Online training and passing the tests for certification. The QuickBooks ProAdvisor program is accessible via the QuickBooks Accountant. Thus, your first step would be to sign up for the QuickBooks Accountant. The good news is that you do not have to pay anything to do this. Just enter your name, email, phone, and other basic information and you will be granted access to all the training material and certification itself.

This is a free bookkeeper certification and we encourage anyone who wants to use QuickBooks Online for their clients to go and get it. The ProAdvisor program allows you to get a basic understanding of QuickBooks, so you can better assist your clients. You can either opt to do the self-paced training or register for the online webinars. This program also allows you to earn CPE credits, which is great if you are a Certified Public Accountant.

Individuals who do not have experience with the QuickBooks Online are suggested to compete an introduction course. Otherwise, they can proceed to earning the certification. During the training, they teach you how to navigate QuickBooks Online along with showing you how to create bills, sales receipts, pay bills, and other features you need to know to be a true professional in QuickBooks Online.

The best part of the training is that it is split into sections and the estimated time you would be spending on each section. This allows to plan the whole process better. Once you do all the training and receive the QuickBooks Online Certification, you can choose to get an Advanced Certification. Naturally, this would require more training courses and another exam to pass.

As an accounting professional, the time you need to stay current on industry trends, handle client calls and emails, find new clients, and search for CPE credits really eats up your schedule. Why would one want to go to all that trouble and get the certification? If you want a cost-efficient way to deliver the best client service, the online ProAdvisor program can actually help you.

When you become a ProAdvisor, you will get the QuickBooks software product you need to serve any client for free or at a discounted price plus unlimited dedicated U.S.-based technical support and valuable training. Moreover, you will have an exposure that can help you grow your accounting practice. How? ProAdvisors are listed on the Intuit QuickBooks Find-a-ProAdvisor online directory. This means that more businesses will see your practice and they will be more confident in cooperation with you thanks to your certification.

Bottom Line – QuickBooks Online Benefits

Let’s look at what makes QuickBooks truly unique and attractive to business owners.

- Access

QuickBooks gives you an ability to access the software online from anywhere and also have multiple users in the file at the same time.

- Third-Party Integrations

Users have an ability to have an automatic feed of bank and credit card transactions into the software will save the business a lot of time. Billing, payroll, and other integrations will also benefit any business.

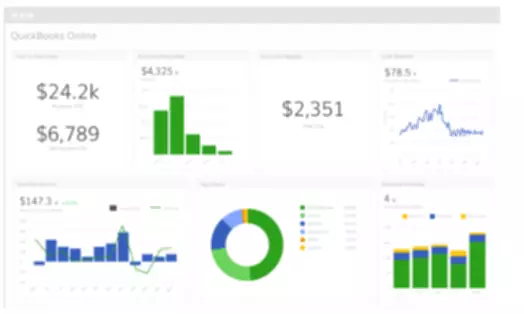

- Reports and Dashboard

QuickBooks offers great financial reports and beautiful dashboards that are the hallmark of the product. In particular, you can analyze pie charts that show how your business has been working for several years.

- Sellers

QuickBooks is the only tool that lets you list your suppliers. You are even able to filter them by debt status and other characteristics.

- Back-Ups and Updates

An ability to have automatic online back-ups and automatic updates is huge for large businesses and even smaller ones. No more worrying about your office being flooded or your laptop stolen because everything is saved and backed-up in the cloud.

- Expandability

QuickBooks is the oldest bookkeeping and certainly one of the largest players in this sphere. This is one of the solutions businesses use from a startup to working with hundreds of employees, as it offers corporate solutions. QuickBooks Online can grow with your business, allowing you to choose add-ons and tools based on your needs. It saves companies money over time.

Users reviews

“We have been moving most of our apps to cloud-based solutions as the industry heads more and more in that direction and for many good reasons. Cloud-based gives us the ability to have our accounting system with us while we’re traveling, it allows multiple users from different parts of the country, and it ostensibly provides a high level of security and backup.”

John Brandon, AGE-u-cate Training Institute

“We are fascinated by its ease of deployment in the cloud, ideal for the storage of all kinds of accounting documents. We liked its single ledger system, which allows all data to be very accessible, and we like it to be easy to import banking transactions within the platform. Quickbooks has proven to be excellent in terms of integration with external hosting services, or open API platforms, for its best use. Quickbooks customer service is one of the best we have had to work with. They are very quick responding, and offer quality answers.”

Jose L, Marketing Specialist

“QuickBooks Online is used across the whole organization. We use it for reporting purposes as well as accounting purposes. We also use it to send and receive payments. It is an extremely helpful tool, you can send a payment instantly via card or bank account. We keep track of all revenues via QuickBooks Online as well. It is simple to set up clients and send invoices as well as invoice reminders using QuickBooks Online.”

Chloe Tollefson, Ameriquote Incorporated

“I’m an old-school accountant who likes tracking expenses and getting things done with a pen in my hand. Had you told me that I will find an online program to do accounting for me, I would never believe that’s possible. But it was! QuickBooks is doing everything for me, and I feel less stressed than I used to when dealing with spreadsheets. I like the feeling of effortless reporting and having all of my business data in one place. Was I spending too much? Where should I concentrate money next year? How can I grow my business? All of my questions are answered now!”

Dean, Public Relations and Communications

QuickBooks Online Trial

You can start working with QuickBooks Online using its risk-free trial version. Just go to the official QuickBooks website and choose a plan based on your needs and preferences. You can test the features available under the chosen plan for a whole month after creating a QBO login without having to pay anything. An exception is its Advanced plan, but you can still get a product demo.

Getting Started – QBO Login

To start using QuickBooks Online, you first need to undergo a registration process. This literally takes less than half an hour. You will be prompted to enter basic information for your organization to create your QuickBooks Online login and ultimately your new account. A fact that you do not have to provide your credit card information when creating a QBO login to start using your free subscription allows anyone to try this product without any worries.

Your next step would be to add a bank account and complete other settings to further customize your account. If you would like to speed up the whole setup process, you can get a one-time expert setup. This will mean that you will get live professional help adding a business bank account to import your transactions into the online software, creating a chart of accounts specifically for your business, and automating bookkeeping as much as possible.

Check out our guide on how to set up a new company in Quickbooks if you would like to learn more about QBO registration process.