When you have a business, it is crucial to stay organized and keep accurate financial records. The organization is key not just for the business and tax time, but also for the personal life of the business owner because business owners can be very busy and not staying organized can be devastating for both the business and personal life.

Modern society simply cannot function without bookkeeping, which is fundamental for business, banks investment funds and even start-ups, freelancers and other self-employed individuals. Yet, many new companies and self-employed do not even know their profitability, and what their income is and have not filed or checked taxes for years. As you might guess, they are not able to review their effectiveness and keep their company afloat for very long, let alone lead it to success.

What Does It Mean to be Self-Employed?

Being self-employed is the simplest way to start running a business. This status allows you to keep all the profits that your activity generates. However, should a self-employed individual incur any debts, they will also be personally responsible for clearing them. That means your personal assets (car, house, savings) can be at risk.

As a self-employed person, you issue invoices and receipts to your clients, work your own schedule and hours and are responsible for the business’ profits and losses. You have control of what type of service to provide, how to provide the service as well as where and when it is provided. A QuickBooks ProAdvisor is somebody informed with the QuickBooks product.

Intuit QuickBooks Online Self-Employed

Although it takes money to make money, self-employed individuals do not need to spend more on accounting than they need to. One of the cost-effective ways to keep a record of your financials is turn to the Self-Employed solution by Intuit QuickBooks. After the initial setup, you can let the Intuit software take care of the bookkeeping and accounting while you spend this time running your business and focus on advertisement of product or service. Intuit QuickBooks Self-Employed also has an app that can give the user immediate access to their Intuit account and all the functions no matter where they are with just Intuit online login information.

Features of Intuit QuickBooks Self-Employed

Intuit QuickBooks Self-Employed has an array of tools and features that make it an exceptional assistant for self-employed individuals for a relatively affordable price.

- One-month trial and test drive

- Manage transactions

- Track mileage tool

- Invoicing and direct deposits

- Get tax estimates quarterly

- Increase tax savings

- Get federal tax returns filed

- Experienced CPA support

- Many integrations and free tools

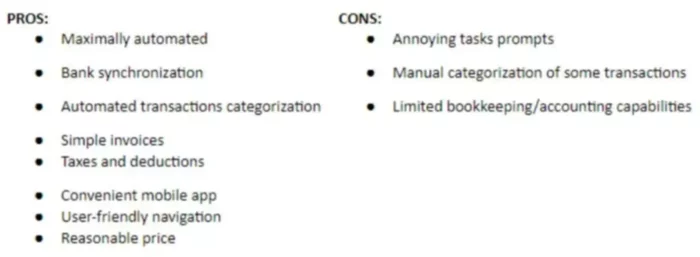

Advantages of QuickBooks Self-Employed

So, why do people like Intuit QuickBooks Self-Employed, use it, and plan to continue to use Intuit QuickBooks products? Let’s go over the main Intuit Self-Employed features that everyone likes so much.

- Self-running accounting software

Once you set up all the parts of your Intuit account, which is super easy to do, Intuit QuickBooks Self-Employed practically runs itself. You do not have to do a thing. All you have to do is check your Intuit QuickBooks Self-Employed service every week and month to review where your income is, where your spendings were, and what you made this month.

- Account synchronization

It is very easy to link your various financial accounts, such as Amazon, Coinbase, PayPal, and your bank account. The Intuit QuickBooks software will download your recent transactions and from now on, you will no longer have to go between different accounts to check your income, review spendings or find a specific transaction. Transactions synchronization is conveniently automated for all users.

- Expenses and income organization

A big thing for every entrepreneur is doing taxes, whether it is yearly or quarterly. With Intuit QuickBooks Self-Employed, the expenses are tracked and recorded in the same way as to how you would track it on a tax form. Thus, taxes will not take much time whether you are doing it yourself or need to give data to the tax specialist for review or filing. On the Transactions page, the user can organize the income and spendings based on the category they belong to in just a couple of clicks. Any recurring transactions will be automatically categorized for you. Moreover, you can set up rules that will further automate the whole process.

- Tagging

Additionally, users can enable a tagging feature in Intuit QuickBooks Self-Employed, which allows you to further organize your transactions for easy review later. For example, you can add a client, location, project, product or service it is associated with and other tags. Furthermore, each tag can be assigned a specific color for even better visualization of where the money goes to and comes from.

- Invoices

Being able to create invoices and send invoices is an important tool for self-employed. All you have to do to bill a client is open Intuit QuickBooks Self-Employed, open invoices tool, add info to the invoice template, and click send. The client has an option to pay the invoice directly on your invoice with their bank account. Once they pay, the money goes to your account within Intuit QuickBooks, and the payment is recorded. You can check how many invoices you have sent, which have been viewed, paid, and which are unpaid. The mobile app also allows to send invoices at a convenient time and place.

- Taxes

One of the main feature why some consider getting the Intuit QuickBooks Self-Employed is the taxes. It will prepare reports and summaries and calculate your tax deductions, so you can be fully ready for tax time. All the data is organized and categorized in a super convenient way and allows you to have a quick overview as well as dive in deeper, checking where each number came from. QuickBooks will also calculate your annual and quarterly taxes and allows you to file and pay them online or by mail.

- Mobile app

A mobile app has all the functionality of the web version of Intuit QuickBooks Self-Employed. You can send invoices and receive payments right from the app. You can easily scan your receipts with the help of your phone, and they will be added to an appropriate category of expenses. The mileage tracking feature will track your travel distance using your phone’s GPS and automatically record it in your Intuit QuickBooks account.

Disadvantages of Intuit QuickBooks Self-Employed

Are there any cons of using Intuit QuickBooks Self-Employed? No software is perfect, and there might be some things that you might want to improve.

- Reminders and notifications

Some individuals find reminders and notifications that appear at the top of the screen as one logs into the account rather annoying. Although these reminders can be helpful to many, they distract and take extra time to make them go away.

- Expense and income categorization

Although most spendings and income are put into their category automatically or after you assign recurring transactions to a specific category, you might still need to manually categorize some transactions. Nonetheless, the majority of the work is still done without your participation, and QuickBooks will alert you about transactions that are not categorized or it does not know how to categorize.

- Limited capabilities

QuickBooks Self-Employed doesn’t offer extended bookkeeping or accounting features. For example, you cannot do inventory, payroll, job costing, and do not have a Balance Sheet report. This means that it is only suitable for freelancers, independent contractors, and other self-employed people. If you hire employees and need more features, you would need to look at alternative options QuickBooks has to offer.

Who is QuickBooks Self-Employed Best for?

Are you a freelancer or a start-up struggling to keep track of income, business spendings, and taxes? QuickBooks Self-Employed by Intuit can be the best solution for freelancers, solopreneurs, creatives, independent contractors, and demand economy workers. This software is not recommended, though for retailers and online sellers because with that you also need to track your sales taxes, which you cannot do here. Otherwise, it is a go-to tool for people that are starting to provide some kind of service and need to send invoices in addition to simple record keeping.

This accounting software will drastically simplify your life and will be your time-saver. You will not have to worry about managing, recording, and organizing all the money coming in and going out. The software will create profit and loss reports, taking all the guesswork out of everything that you do. When the tax time comes, it will be really easy to get taxes filed and submitted without stressing about getting all the numbers right and on-time. Having all the data and receipts readily available is especially helpful if you get audited.

Plans and Pricing

The price for this version of Intuit QuickBooks is very affordable no matter what option you choose. Moreover, Intuit QuickBooks regularly has 30% off regular, 50% off regular price, and similar offers in addition to a whole free month for people to try the service.

- Self-Employed

With this is a simple plan, you get basic bookkeeping functions, mileage tracking, and ability to send invoices. The QuickBooks Payroll Service also provides you with estimated taxes every quarter and a list of deductions you accumulated. The price is $15 a month or less.

- Self-Employed Tax Bundle

This option will deliver even more tax advantages in addition to basic features, such as invoices and mileage tracking. It is integrated with TurboTax and automatically exports tax info at the end of the year. One state and one federal tax filing are included in the price. You can even pay your quarterly taxes right from the QuickBooks. Accordingly, it will cost you a little more – the price is $25 per month or less if you catch a good price offer.

- Self Employed Live Tax Bundle

If you find tax season is especially stressful, then this is a perfect choice for you. The price is $35 a month and in addition to the features included in the other plans, you will have the support of an experienced CPA that you can talk to whenever you need. The CPA will also check your tax return and guarantee that everything is done correctly.

How to Use It

Are you ready to start using QuickBooks Self-Employed by Intuit? Do you happen to have an Intuit account? If not, you will need to click on the Sign-up link. It will walk you through the registration process, and you will be asked to read the License Agreement and agree with the terms. During the registration, you will create your QuickBooks online login. The online login is necessary to be able to use your Intuit QuickBooks Self-Employed account on any device.

QuickBooks Self-Employed is very different from what you would see in regular Intuit QuickBooks. Yet, everything makes sense and navigation is intuitive. When you sign in to Intuit QuickBooks, the first thing you will see is the Home page with navigation pane on the left. The Home page is where self-employed individuals can review how they are doing at a glance, including check to date profit and loss and a breakdown of what they have spent. You will also review your account balances, invoices, estimated tax, and mileage tracking.

The quick tasks area helps you stay up to date with items that you can tackle immediately, such as creating and adjusting your tax profile and entering healthcare information. The Home page can be customized to your needs.

To look at the transactions in more detail, you can jump to the Transactions page using the left-hand navigation. If you choose to securely connect your bank account or credit cards, your Amazon, PayPal, or Square account, the service will automatically import all your activities. If you need assistance with navigation through this process, just ask customer support for help. There are also many helpful videos online that will walk your through the set-up. You can also manually add cash payments or upload Excel files to the Intuit QuickBooks Self-Employed account.

When transaction just come in, QuickBooks shows them as unreviewed. You can then sort them in seconds by clicking business, personal, or split (if using a mobile app, you would just swipe right or left). You can easily classify them by the Schedule C expense category. Just select the item in the category column and review a list of categories (e.g. office, advertisement, auto insurance) to choose the right fit. Thanks to a recent update, personal transactions can also be categorized and reviewed later.

If you have mileage to track for your company, just click Miles in the navigation bar, then click Add trip, fill in the information, and click Save. A new trip is then added to your list with the mileage deduction automatically calculated and displayed. For mobile app users, there is a track mileage tool. You can just turn on mileage tracking on any trip you take and will be automatically recorded, so you can review and check mileage history later.

The Reports page is where you can view, read, print, download and share your Income statement, a tax summary, which splits all your Schedule C deductions, and detailed tax report with your QuickBooks Accountant or tax professional. This is also a great way to start analyzing your financials through Intuit QuickBooks. Additionally, you can view a mileage log and user receipts.

Finally, the Taxes tab is a place where you can review your annual and quarterly taxes. Since you will be using this information for your personal tax returns, you will need to make sure to first go to Tax settings and edit your tax profile. This would include the number of dependents, marital status, and other basic data. This way, QuickBooks can calculate your federal estimated tax payments.

Before you pay quarterly estimated taxes, you can view or download the reports to review the information and make sure it looks right. The service also allows you to safely share them with an accountant who can review and double-check everything for you. When the time comes to file the taxes, you would follow the prompts that make the whole process very simple. Once you are ready, you will click Pay now and many fields will be pre-populated in the 1040-ES form by the service. Users have an option to send it by mail or file and pay online.

User Opinions

“I love the simple workflow for most things invoices, quotes, expenses, time, etc. I hate accounting, and bookkeeping, so to be able to add these rapid-fire with little effort makes me very happy. It also is very handy come tax time because I can easily grab all the information and hand it off to turbo tax or an accountant for them to deal with. I also really like the dashboard so I can quickly view the status of my freelance accounts.”

“I use QuickBooks Self-Employed for all of my accounting needs. I am able to track all of my profits and losses through the product, keep track of miles driven, connect my banking account, organize all of my expenses, and even use the product to charge my customers. This is especially helpful as I file my quarterly estimated taxes.”

– Reagan Baird Edwards

“I use Quickbooks self-employed (QBSE) to track all of my daily expenses and categorize them as either business, personal, or excluded expenses. QBSE does a great job in allowing me to not only follow my spending, but it provides me a quarterly tally of my estimated taxes which I can pay directly online. The software also allows me to generate quarterly or annual profit and loss reports as well as accumulate all of my tax information which I can migrate seamlessly to TurboTax.”

– Lawson Brooks III

“I absolutely LOVE QuickBooks self-employed. It is convenient, easy to use and even tracks mileage! That’s huge as most of my business is conducted on the road. I also love how I can invoice and accept payment right from the mobile app.”

– Andrew from North River Marketing

The Bottom Line

The Self-Employed solution by Intuit QuickBooks is a better, more efficient way to manage all of your business transactions, send invoices, do mileage tracking, and review profitability. When it comes time for filing tax returns and paying taxes, you do not have a box of receipts that you need to sort through or a spreadsheet that is a mess because you never found time to properly record the information.

The best part is that the service also helps you to claim all the deductions possible, which can be a great deal for self-employed individuals who are looking for ways to reduce their costs. This product is a perfect choice for side hasslers, freelancers, entrepreneurs, and other individuals who need basic bookkeeping functions. The price is also surprisingly very affordable even for self-employed plus great price offers are available on regular basis. Simple navigation is a valuable feature of Intuit QuickBooks Self-Employed service.