In the formation of accounting data, a basic accounting equation is used for financial statement no matter if you are just a small business or a multimillion company. The Italian mathematician Luca Pacioli formulated a basic accounting equation formula in 1494 in his work “A Treatise on Accounts and Records.” Accounting systems of all countries are based on the use of this basic accounting equation. Virtually every business transaction to be reflected in accounting can be formalized within the framework of this equation or within its several variations that we will review later in this article. So, what is the accounting equation? Let’s look at its definition from a dictionary.

Equation Definition

The basis of accounting balances and reports on profits and losses (financial statements) of almost all foreign organizations is based on a basic accounting equation. This equation has the following formula (the accounting equation may be expressed as):

Assets = Liabilities + Owner’s equity

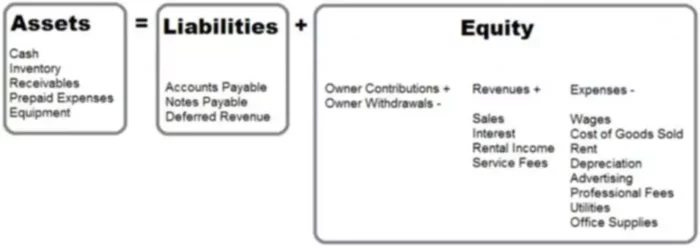

Let’s take a close look at accounting equation components:

Assets

Assets reflect the total value of the property that the business has, and which is in its turnover. In other words, it is what it owns.

Liabilities

Liabilities reflect the size of the financing of an organization’s assets by third parties, banks, and private financial institutions. This is what the company owes.

Equity

Owner’s equity characterizes the value of investments made in this organization by its owner/s (shareholders). Owner’s equity is everything that is left from the assets after paying all the liabilities.

What is the Accounting Equation Used for?

In the financial reporting system, one of the financial statements – the balance sheet continues to play a fundamental role. It performs important functions. The balance sheet, first of all, introduces owners to the management, property status of an economic entity. They will find out from the balance sheet what the owner owns, i.e., what is the quantity and quality of the company’s resources that the company can dispose of, and who was involved in the creation of these resources.

Secondly, according to the balance sheet, it is determined whether the enterprise will be able to cover the obligations to third parties (shareholders, investors, creditors, buyers, sellers, etc.) soon. Thirdly, the content of capital and liability items makes it possible to use it both by internal and external users. As the central form of financial reporting, the balance sheet allows determining at the reporting date the composition and structure of an enterprise’s assets, liquidity, and turnover of current assets, availability of owner’s equity and liabilities, condition and dynamics of receivables and payables, creditworthiness and solvency of an enterprise.

Balance sheet data allows you to evaluate the efficiency of placement of the enterprise’s capital, its adequacy for the current and forthcoming economic activity, the size and structure of borrowed sources, as well as the effectiveness of their attraction. Thus, the balance sheet is the most informative form for analyzing and evaluating the financial situation of an economic entity, and without the accounting equation, it would not be possible to create this financial report. Thus, it is necessary both for large and small businesses.

Balance in Accounting

The basis of accounting and bookkeeping is the principle of balance. To carry out economic activities, the company needs funds and that these funds should be given to the company by someone. The funds owned by the company are called assets. The owner, the founder, provides a part of these assets. The total amount of funds contributed by them is called capital.

If the owner is the only one who contributed, then the equation Assets = Owner’s Equity will be fair. However, assets may be contributed by someone else who is not the owner. The debt of the company for these assets is called liabilities. Therefore, now the equation will take the following form: Assets = Liabilities and Owner’s Equity.

The left and right sides of the equation always coincide because the same assets are considered from two points of view. The equality on both sides of the equation is forever preserved and does not depend on the number of business transactions.

Rearranging the Accounting Equation

Formulation 1

Now that you know the answer to the question “What is the accounting equation?”, you should know that like every algebraic equality, the basic accounting equation can be transformed and represented as follows:

Owner’s Equity = Assets – Liabilities

Written in this form, it means that the creditors of organizations have the priority right to satisfy their financial requirements in comparison to its owners. The equation shows what the total value of the organization’s assets is, what part of it is the primary reimbursement account of the organization’s debt obligations to creditors, and what part of the assets is secured by the financial participation of the owners (shareholders) of the organization and therefore remains in their ownership after all debt obligations are repaid.

Formulation 2

Assets = Liabilities + Owner’s Equity

Elements of financial reporting form the basic accounting equation or balance equation (balance sheet equation), which characterizes the financial position of the organization and reflects the interrelation of the two main reporting forms: balance sheet and income statement.

Formulation 3

Net Assets (Net Worth/Owner’s Equity) = Assets – Liabilities

You might also come across the term “net assets” or “net worth.” Its value is defined as the difference between the value of an organization’s assets less its liabilities. In other words, the value of the organization’s net assets is equal to its owner’s equity. The use of the adjective “net” concerning assets means deducting the corresponding liabilities; for example, net current assets are current assets less current (short-term) liabilities.

Formulation 4

Based on the definitions of the concepts “income” and “expenses,” the basic accounting equality can be represented as follows:

Assets = Liabilities + Capital + Revenues – Expenses.

In this form, accounting equality provides a visual representation of the economic interrelation of the main accounts: the difference between income and expenses, which is a net profit (net loss) calculated in the income statement that increases or decreases the business’ owner’s equity amount.

In addition to income and expenses, two more operations affect the amount of equity reflecting the interrelation of the business with the “outside” world:

- investments

- owner withdrawals (dividends)

These operations can also be entered into the basic balance equation:

Assets = Liabilities + Capital + Revenues – Expenses + Investments – Dividends

In this form, the equation is rarely used. At the same time, this form of the equation demonstrates not only the process of increasing capital as a result of the organization’s activities but also the possibilities for its change introduced from outside.

Accounting Equation Example

Accounting Equation Formula and Calculation

The formula is very simple: Assets = Liabilities + Owner’s equity. You will need to keep this balance at all times, no matter how many transactions you have recorded. If you have a Balance sheet on hand, calculating whether this balance has been maintained is quite easy.

- Add all the Assets, such as cash and cars, together.

- Now, look for Liabilities (what your business owes to third parties) and total them as well.

- Next, add Shareholder’s equity to the total Liabilities.

- Finally, check if the amount you have for Assets equals the amount you got in step 3.

Limits of the Accounting Equation

The accounting equation helps to keep an accurate record of all the accounting transactions. However, even if it is balanced, there is no guarantee that mistakes or fraud are eliminated. In addition, it is not able to give much insight into the company’s financials. Business owners and investors will have to do analysis separately.

Frequently Asked Questions

Why is the accounting equation important? The accounting equation plays an important role as the basis of the double-entry bookkeeping system. It provides a global standard for financial reporting.

What are the basic elements of the accounting equation?

There are three main elements:

- Assets – all the things that you own;

- Liabilities – all the things that you owe;

- Shareholder’s equity – owners’ residual claim on assets after debts have been paid.

Why is the accounting equation always in balance?

Every financial transaction involves at least two accounts. It reflects what a business received and what it gave in return. For example, it can pay cash (Assets decreased) to acquire inventory (Assets increased) or take a loan from a bank, simultaneously increasing Assets and Liabilities.

Takeaways

By using an accounting equation, you can tell whether a company’s total assets equal its total liabilities and its shareholders’ total equity. It maintains a clear relationship between a company’s assets, liability, cash flow, and total equity.

The accounting equation is used to maintain a balance sheet. However, it’s critical to ensure that each entry in debit has an entry in credit. The accounting equation maintains the balance between debits and credits.

The accounting equation is critical to maintaining a business. Thanks to the accounting equation, the balance sheet offers the following data:

- the number of assets, resources, etc., the company owns;

- proof that the company can cover its liabilities and obligations;

- cash flow volume;

The accounting equation enables companies to evaluate their progress and attract investors.