The main goal of any business is to maximize profits, and how well a business thrives depends on what economic resources are available to it. A simple equation can be used to represent these resources (assets) and show where they came from. It is imperative for any business owner to understand the basics of the accounting equation and to learn how to apply it to their business. So what is the accounting equation and what is it used for?

The accounting equation is used primarily to create a balance sheet:

Assets = Liabilities + Owner’s Equity

⮚ Assets are resources owned or controlled by an enterprise from which the company expects future economic benefits. Some examples of assets are:

- Something the company owns – money, land, buildings, goods, trademarks, shares in other companies, equipment, transport;

- Something owed to the company – these are things that belong to the enterprise but are currently in someone else’s possession. These are referred to as receivables, with money being the most common example.

⮚ Liabilities everything the company owes to others and has an obligation to return within a specified period. This is the enterprise’s debt accumulated over time.

⮚ Equity is a portion of an enterprise’s assets that remains after liabilities are deducted. Equity includes equity (contributed) capital and retained earnings.

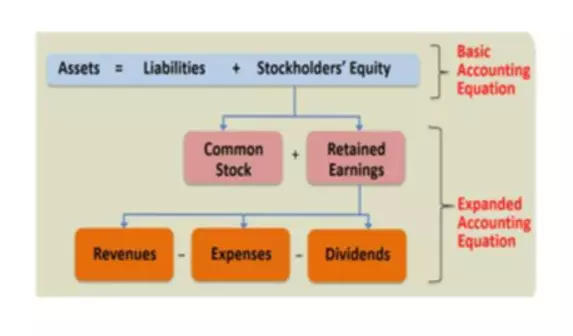

The Extended Accounting Equation

The basic accounting equation expresses the relationship between assets, liabilities, and equity at a specific point in time. The company can also see the impact of transactions and how net income affects equity. But the accounting equation can be expressed in more than just a basic form.

We begin with:

Assets = Liabilities + Owner’s Equity

Then, we bring in the profit element:

Assets = Liabilities + Owner’s Equity + Profit

Note: Profit = Revenue – Expenses

The expanded accounting equation may be expressed as:

Assets = Liabilities + Owner’s Equity + Revenue – Expenses

This type of accounting equation reflects the relationship between the balance sheet and income statement. The income statement shows the company’s net profit, which is the difference between revenues and expenses for a specified reporting period. Net profit is the biggest reason for a change in equity.

The amount of equity during the reporting period may change depending on revenues, costs, investments, and dividends related to the current reporting period. Transactions associated with changes in accounting policies and the way certain aspects of bookkeeping and accounting are reflected in the financial statements may impact the owner’s equity directly (such as fixed assets revaluation).

Accounting equation and balance

Everything in business, as in life, should be balanced. This balance is achieved with the help of a basic accounting question. Even if you are not an accountant or finance expert, you probably have some idea of what the balance sheet is and how important it is to the financial health of a business

What does the balance represented in the balance sheet mean in terms of business? It shows the company’s assets and the sources of their formation. That is why the sum of assets is always equal to the sum of the sources of their structure, that is, liabilities and owner’s equity. So, the accounting equation may be expressed as.

Assets = Liabilities + Owner’s equity

This equation is also known as the balance sheet equation. This name refers to how both parts must be equal to each other. Balance reflects the company’s financial position at a specific date, for example, at the end of the reporting period. According to this equation, a business is an asset holder and is equal to its sources (that is, liabilities and equity).

Accounting Equation Role in Double-Entry Method

Double-entry bookkeeping is a method in which every account entry has a corresponding but opposite entry in a different account. These entries are referred to as debit and credit. Double-entry bookkeeping is one of the main elements in gaining reliable information on an enterprise’s economic operations. The double-entry method provides a timely and accurate reflection of transactions in a company’s accounts.

Using a double-entry record for all of your business transactions allows you to maintain a balance as well as identify any errors in the company accounts. In this context, maintaining a balance means that all business transactions are reflected in the interrelated accounts, and an interconnection between accounts is provided as well. The connection between accounts is called correspondence of accounts, and the accounts themselves are referred to as corresponding. Monitoring all of this correctly leads to:

- The creation of a unified accounting system;

- Control over available resources and sources of funding;

- Proper reporting.

In simple terms, the double-entry method allows the organization to illustrate any transaction simultaneously on debit and credit accounts. This, in turn, lets one follow the path of receipt and outflow of funds, providing a necessary first step to anyone seeking to improve the company’s financial health. The simultaneous reflection of operations on debit and credit accounts ensures the balance equality of all the organization’s accounts in the balance sheet at the reporting date. Therefore, it guarantees the balance reflected in the equation as: Assets = Liabilities + Owner’s Equity.

The double-entry method shows the receipt and distribution of individual funds, the types of operations that impacted these funds, the sources of these funds, and the financial results of business activities.

The Accounting Equation in Action

The example below answers the question of what is accounting equation and shows it in action:

- Above, you can see business transactions entered into an accounting equation. To begin with, the owner invested $10,000 into the business, which increased assets and the owner’s equity.

- The owner then withdrew $100 for their own personal needs, which decreased the company assets and the owner’s equity.

- Then, the owner purchased equipment for the company with $5,000 cash, which increased one asset account (equipment) and decreased another (cash) by the same amount.

- After totaling up the numbers, you will see that the equation is balanced, meaning that all transactions were entered correctly.

After totaling up the numbers, you will see that the equation is balanced, meaning that all transactions were entered correctly.