The accounting equation can have many forms and a variety of uses in bookkeeping. You should not ignore any accounting equation if you want your business to be successful, as this equation is the foundation of your company’s balance sheet, which includes your assets, liabilities, and owner’s equity. So what is the accounting equation? To help you understand its significance and application, we have prepared a short overview.

The Accounting Equation: Role in Business

What is the practical use of the accounting equation, and why is it so important? It provides the basis for calculating various financial ratios (liquidity, return on investment, profitability, etc.). It also makes it possible to prepare financial statements and evaluate the enterprise’s operations, as well as how effective it is in developing new products/services.

Every accounting equation discussed below is essential knowledge for the manager, investors, or the owner of any business. An accounting equation makes it easier to evaluate your business operations and make the right decisions as a result. Although they seem relatively simple to work out on your own, when you have multiple accounts that need to be factored into the equation, help from professional accountants may be necessary.

The Accounting Equation – A Basic Equation

The accounting equation in the illustration above (Assets = Liabilities + Stockholders’ / Owner’s Equity) represents an equation which will be used to form a balance sheet and other financial statements. This helps owners, managers, and investors to effectively evaluate the company’s operations and make informed decisions.

The accounting equation consists of assets, liabilities, and owner’s or shareholders’ equity. The assets portion represents how much the company owns, while the liabilities and stockholders’/owner’s equity show where these assets came from. Liabilities mean that the funds came from an outside source, while the owners’ or stockholders’ equity portion came from the money that they invested in the company. We will answer the question of what is accounting equation for different types of calculations of profitability of an enterprise. But first, some basics.

Net Income

To calculate the company’s net income, the following accounting equation is used: Net Income = Revenues – Expenses. In other words, net income is the difference between the following two items:

- Revenue – the income from sales or additional positive cash inflow, such as service fees and commissions.

- Expenses – the number of costs related to business operations, depreciation, interest, taxes, and other expenses.

Net profit is the company’s profit before the payment of dividends. This figure can be found in the company’s income statement. It is an essential indicator of how profitable a company is over a specified period. If the expenses exceed the revenues, a net loss appears instead of net profit. The amount of net profit is also used to calculate earnings per share.

Profitability Ratios

Profitability is the primary indicator of any company’s success. You can evaluate financial success using the following three ratios:

⮚ The accounting equation for profit margin is calculated using this formula: Profit Margin = Net Income ÷ Sales. This value over five or even ten years can show a trend in the company’s profitability.

⮚ The accounting equation for return on assets (ROA) is considered as the ratio of profit (net income) to the average value of the assets: Return on Assets = Net Income / Total Assets. The accounting equation result will show how well a company utilizes its assets and controls costs.

⮚ The return on equity (ROE) is calculated using this formula: Return on Equity = Net Profit / Average Stockholders’ Equity. Unlike the ROA ratio above, ROE shows the return on investors’ funds without including all the other assets.

Retained Earnings Equation

The goal of each enterprise is to make a profit. A portion of this profit may go towards the company’s development, other needs, or be used as reserves.

The accounting equation for calculating what is left after owners have taken their portion of the profits (dividends) is as follows: Retained Earnings = Beginning Retained Earnings + Net Income or Net Loss – Cash Dividends. Retained earnings reflect the earnings left after payment of dividends for the company’s whole operation period. If the company has just started operating or has spent all of the funds in this account, it might have $0 for its beginning retained earnings.

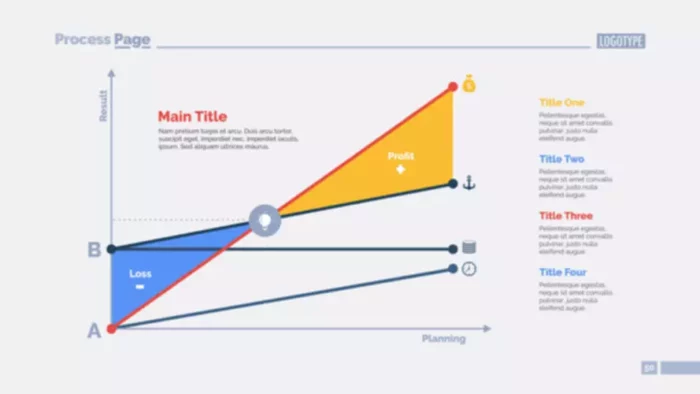

Break-Even Point

The break-even point is the sales volume at which the company covers all its costs before making a profit. Its total plays a vital role in the company’s sustainability and solvency. If the break-even point is exceeded, the company makes a profit; if the break-even point is not reached, the company incurs a loss.

The break-even point is calculated for the company as a whole or for certain goods or services. It demonstrates the effectiveness of a commercial project, helping investors know the financial scope of a project, the estimated financial timeline, and what the level of risk is. To calculate the break-even point, use the following formula: Break-Even Point = (Sales – Fixed Costs – Variable Costs = $0 Profit).

Debt-to-Equity Ratio

The debt-to-equity ratio is calculated as: Debt-to-Equity Ratio = Total Liabilities ÷ Total Equity. This calculation demonstrates the company’s financial stability and shows the amount of borrowed funds accumulated from issuing stock to shareholders, as opposed to loans and other debts.

Both the numerator and the denominator are taken from the organization’s balance sheet. Liabilities include both long-term and short-term liabilities. This ratio also shows the extent to which shareholders’ equity can fulfill a company’s obligations to creditors in the event of a liquidation.

Cost of Goods Sold

Another accounting equation we want to address deals with calculating the cost of goods sold (COGS). Cost of goods sold is generally included in the income statement. The price of products sold represents the total amount of the company’s direct costs at all stages of the production process at the time of sale. It is calculated using the following formula: Cost of Goods Sold = Beginning Inventory + Cost of Purchasing New Inventory – Ending Inventory.

Understanding cost dynamics for specific periods, as well as assessing a product’s value after each sale, allows us to understand if the acquisition of new or different inventory is feasible or advisable. By paying attention to cost indicators, the company can also develop new marketing strategies, pricing models or other ways of improving the profitability of the enterprise.