Financial statements, including the statement of retained earnings, are an essential part of financial accounting of business operations and many of them are required by law. They are created on a monthly, quarterly, and yearly basis according to generally accepted accounting principles (GAAP). These include the following three main reports:

- Income Statement

- Balance Sheet

- Cash Flow Statement

Statement of retained earnings as well as a statement of owner’s equity is also often included along with these financial statements, especially in larger companies. Financial statements show account balances and their changes, as well as aggregates of several accounts, such as net profit.

What are Retained Earnings?

Retained earnings shown in the balance sheet and statement of retained earnings for the reporting year are part of the net income that was not distributed by an organization in the reporting year. Retained earnings (loss) is the sum of:

- retained earnings (loss) of previous years and

- retained earnings (loss) of the reporting year

This indicator reflects the final financial result of the organization in the reporting year. The decision on the distribution of profits is taken by the owners of the organization in a general meeting of shareholders (in a company or a joint-stock company) or a gathering of participants (in an LLC).

The volume of retained earnings covers the costs of the company’s development (for example, the purchase of new production capacity), is saved in the form of cash (for example, cash balances) or securities. A business with debt obligations uses this financial flow to repay loans and other debts; stable companies form a reserve fund from retained earnings to cover unexpected expenses.

What is a Statement of Retained Earnings?

The statement of retained earnings is a report detailing the direction of profits movement during the reporting period. The story is formed as follows: first, it shows the beginning retained earnings (a number from previous period), then the beginning retained earnings are added to the net income for the current period and deduct dividends paid. The resulting amount at the bottom of the statement of retained earnings is retained earnings at the end of the period.

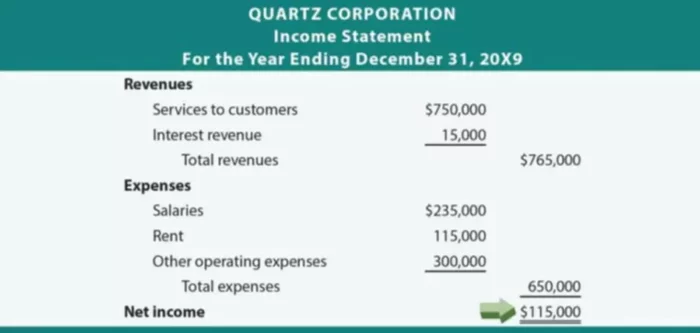

The statement is made separately from other financial statements. How to prepare retained earnings statement? – Please follow the manual. The title includes the company name (Quartz Corporation), a title of the report (Statement of RetainedEarnings) and reporting period (For the Year Ending December 31 20×9). Next, it has retained earnings from the previous period, which are equal to $400,000 plus net income for the current period – $115,000. The total number is the same at $515,000.

Then, dividends paid to shareholders, $35,000, are subtracted from the total sum. Bonuses are often indicated as a price per share, so it might be necessary to multiply the price per share by the number of shares. The final amount will be the retained earnings at the end of the current period, which is equal to $480,000 in our statement of retained earnings example.

This number represents retained earnings from the beginning of the company operations. You can also find retained earnings just for the current period. To do so, you would subtract dividends paid from the net income, excluding the beginning balance of retained earnings from the equation.

As you can see from an example above, not every statement of retained earnings looks the same. Companies are required to report any accounting error correction in the previous year. Thus, you might see an additional section in the Statement of Retained earnings – Prior period adjustments.

Who Needs Retained Earnings Statement?

Statement of retained earnings is essential not only for shareholders (owners) of the company but also for external users (investors, bank employees, regulatory bodies). Investors are interested in information where these funds are spent. They can be spent:

- To pay dividends to shareholders;

- To pay losses from the past periods of the company operation;

- For reinvesting into the development of the company (for example the acquisition of fixed assets, equipment, etc.);

- To increase the share capital;

- To create a reserve fund;

- For other purposes established by legislative acts.

If a loss is received, it can be repaid with the following sources:

- At the expense of shareholders own funds;

- At the expense of profits from the past periods of the company;

- Through the use (reduction) of the share capital;

- From the reserve fund.

For investors, more profit must be spent not on paying dividends, but on the company investment activities. But it is also essential for them that the benefits obtained before distribution increase every year, not decrease. If a company closes (liquidated), then the amount of retained earnings will be distributed among the owners (shareholders) of the company, so they are primarily interested in a positive result of this indicator.

What Statement of Retained Earnings Can Tell You?

Looking at this financial statement, you can see how retained earnings changed from the last period. It allows to evaluate the operations and condition of any business and business owners as well as investors, market, etc. examine it along with income statement and balance sheet. Statement of retained earnings gives a complete picture of the company’s profitability.

However, this financial statement can also reflect not only the profit but also the uncovered loss of the company, which is when the expenses exceed the income. Negative retained earnings appear as a debit balance in the retained earnings account. It can develop (accumulate) due to the results of the fiscal year or from previous years.

Retained Earnings Statement Connection to Other Financial Statements

The right to dispose of retained earnings belongs to the owner/s. Profit is a source of income payments to owners, and its presence helps to attract investment to the organization. Retained earnings remaining at the disposal of the organization after the payment of dividends to its shareholders is an increase in equity of the organization for the reporting period, invested in its development.

Although retained earnings are not noted on the Income Statement, a Statement of Retained Earnings cannot be created without the first one. As you can see in the statement of Retained Earnings showed earlier, the second figure in it is the net income. This number is taken from the Income Statement after all expenses and taxes are deducted from the revenues.

Statement of retained earnings takes information from the income statement and gives a different spin to it. Then, it transfers this information to the balance sheet. In the balance sheet, you will see retained earnings under stockholder’s equity.

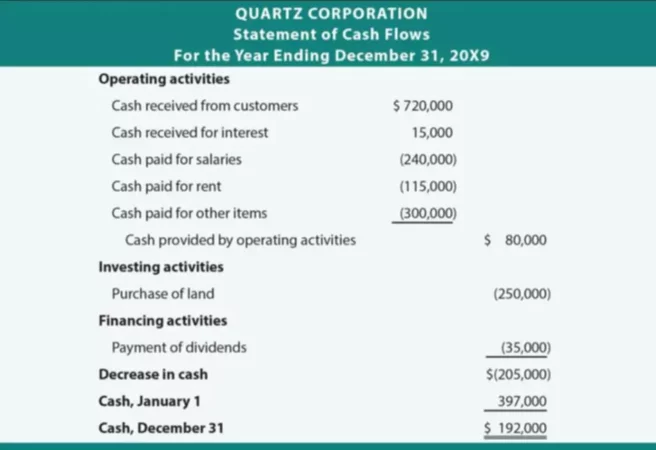

Another important report in financial accounting is the cash flow statement. If you look at the cash flow statement above, you will not see retained earnings anywhere on it. Nonetheless, many companies, in a way, treat retained earnings as cash because these are also money that is available for spending on any needs of a business.