Uncovered loss or retained earnings in the balance sheet or statement of retained earnings are an indicator showing the company’s performance over the entire period of its existence. It is calculated cumulatively at the end of each defined reporting period. Here, we will tell you how to prepare retained earnings statement and how the retained earnings statement is formed, where they are reflected in the balance sheet and what is involved in its calculation. A statement of retained earnings example will help you to grasp all the information better.

What are Retained Earnings?

Retained earnings – net income, which (as the name implies) was not distributed among the participants/shareholders of the company. It is also often referred to as retained income, accumulated profits, or undistributed revenue. In other words, retained earnings are cumulative net income minus cumulative dividends paid to shareholders. Net income is considered a part of the income from the sale and non-sales operations, which remained after payment of taxes.

The main difference between retained earnings from net profit is that it is always calculated not only for a specific period but also for the total period of the existence of the enterprise whereas net profit is determined only for the reporting period. But for the year, which is logical, both indicators can be the same.

Retained earnings serve to show investors and market how the company is doing and how much it can reinvest into any part of its operations. It is usually higher for new, rapidly growing companies who choose to spend the profits on company growth and/or covering the debts instead of paying a portion to the shareholders. This, in turn, often increases their price per share. However, if the company believes that the reinvestment of the money will not give good returns, then they will distribute these funds among company shareholders.

What determines the size of retained earnings?

The number in the retained earnings account may differ in different reporting periods. Such factors as the influence it

- the amount of dividends paid to the owners of the company;

- net profit change;

- increase or decrease in the value of commodity assets;

- overhead change;

- tax review;

- change in the business strategy of the company.

The decision on how to distribute this income is made solely by the owners. Traditionally, the question of retained earnings is put on the agenda of the annual meeting of the company’s owners. The decision is written down based on the results of the general meeting of participants/shareholders. The main ways of spending retained earnings include the following:

- to pay dividends to participants/shareholders;

- repayment of past losses;

- replenishment (creation) of reserve capital;

- other goals formulated by owners.

What is Retained Earnings Formula?

Retained earnings for the reporting period can be calculated by simply subtracting the dividends paid to shareholders of the company from its net income. Usually, such calculations are performed by an accountant (this is an essential part of their work). But you can determine the amount yourself using the following retained earnings formula:

+ Beginning retained earnings

+ Net income during the period

– Cash/Stock dividends paid

= Ending retained earnings

For example, Smart Home has $600,000 of net profits in its current year, pays out$100,000 for dividends, and has a beginning retained earnings balance of $1,400,000.Its retained earnings calculation is:

+ $1,400,000 Beginning retained earnings

+ $600,000 Net income

– $100,000 Dividends paid

= $1,900,000 Ending retained earnings

How are retained earnings calculated?

Retained earnings increase the liabilities side of the balance sheet and, consequently, the equity capital of the enterprise. If you do not have the retained earnings value, you can perform the calculation (use a simple calculating retained earnings) according to the following process:

- First, the company needs to find a gross profit. It is reflected in the income statement, and it can be determined by taking away the cost of the goods or services that are sold from the income from these sales.

- Now, calculate the operating income – what remained after covering the costs of sales and current expenses (for example, wages). Right from the gross profit in addition to the cost of goods sold, you also need to deduct operating expenses.

- Next, you will subtract taxes and add the retained earnings amount from the last year to a total sum.

- Now, you need to deduct dividends. The net profit is already cleared from the expenses of the company, and you deduct dividends that are paid to shareholders.

You can calculate the current retained earnings balance in the account, which reflects the retained earnings. Do not forget that this is a cumulative account, and all changes in retained earnings are accumulated in it from the very moment when the company was formed to the present. Thus, the amount that was at the end of the previous reporting year is being added to the retained earnings for the current period. As a result, a new retained earnings balance will be created.

This calculation is necessary when calculating the exact amount of dividends for the owners or in the redistribution of the company’s income for its own needs. Therefore, awareness of how it is carried out is necessary not only for the accountant but also for the entrepreneur.

The Purpose of Retained Earnings Statement

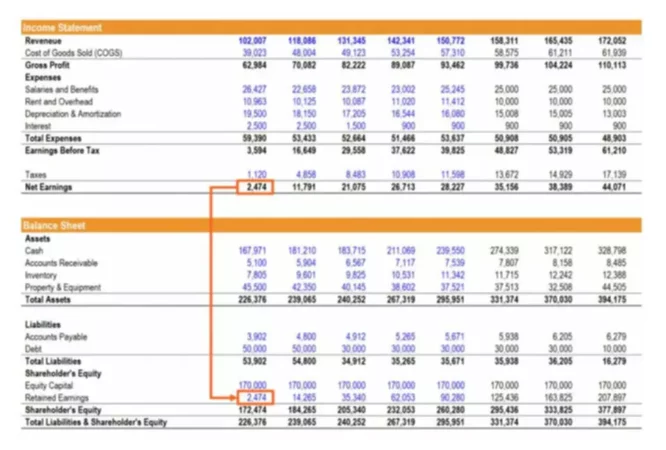

Statement of retained earnings is one of the most important financial statements. It links the income statement to the balance sheet, showing how the period’s income statement profits either transfer to the balance sheet as retained earnings or shareholders as dividends. The statement of retained earnings reflects all changes that occurred in retained earnings during the reporting period. This financial statement must necessarily take into account the retained earnings of the previous reporting period. Typically, an account “Retained earnings” has a credit balance. If this is a debit balance, the company has a loss, which is also indicated in the equity capital section of the balance sheet, reducing its value. This report may be submitted separately or as part of an income statement and retained earnings. Generally accepted accounting principles require that this type of report be compiled whenever a balance sheet and income statement are presented.

Statement of retained earnings helps shareholders and investors to evaluate the operations of the firm and predict future growth. This is important in decision making, whether to hold, buy, or sell company shares. They can also see the percentage of net income that is paid in dividends, which helps them to decide whether the company will be a good source of dividend income or if the prices of its shares will grow in the future.

Statement of Retained Earnings Example

A balance sheet includes a retained earnings account. However, you can also present retained earnings as a separate Statement of Retained Earnings. Public companies must publish their statement of retained earnings along with other financial statements quarterly and the end of each year to allow shareholders to make informed decisions. Itis prepared following generally accepted accounting principles (GAAP).

Below, you can see an official statement of retained earnings example. This financial statement includes a heading which consists of the company’s name, name of the financial statement and the period for which the statement is created. Next, you will and net income for the fiscal year to the previous retained earnings balance.

You will subtract the dividends paid (both on preferred stocks and common stocks) from the total amount. This will give you a new value for retained earnings balance, which will also be indicated in the balance sheet statement, increasing the shareholder’s equity account.

Retained Earnings on Financial Statements

Aside from having its statement of retained earnings, you might wonder where else this figure is included in other financial statements. Some believe that it should be included in the cash flow statement; however, this is not correct. This is because retained earnings, just like profits, do not represent cash. The cash flow statement only shows cash items – cash flows coming in and cash flows going out.

On the other hand, the two are intimately connected because a company can spend retained earnings on operating, investing, and financing activities just like it would do with cash. The final figure in the income statement – net profit, is included in the calculation of retained earnings and the statement of retained earnings itself and the balance sheet. As it was mentioned earlier, retained earnings are shown on the balance sheet under the owner’s equity section at the end of each accounting period.