Retained earnings (uncovered loss) is an organization’s final accumulated financial result for the whole time a company has been operating. They’re a significant part of the financial statements, particularly the balance sheet. This article will cover retained earnings, how to calculate them, and why they’re important. You’ll also find out why owners and investors need to keep an eye on changes in retained earnings.

What are Retained Earnings?

The retained earnings (loss) of the reporting year allows you to assess your company’s financial viability. What are retained earnings? They’re the undistributed part of the income in the company’s balance after payments have been made except for dividends and business development. In other words, it is the amount of money earned through the regular course of business after all expenses have been deducted that the company decides to keep.

Retained earnings are part of the shareholder’s equity in your company. Board members have the privilege of deciding how and when to distribute these retained, which is formally recorded in the company’s minutes.

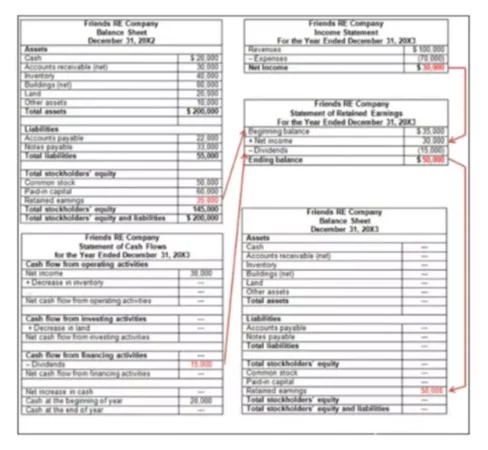

You’ll find retained earnings in the shareholder’s equity section on the balance sheet. As you know, accounts are broken up into three major categories: Assets, Liabilities, Owner’s Equity. Stockholder’s Equity is broken into subcategories which are Common Stock and Retained Earnings. Owner’s (Stockholder’s) equity account has a normal credit balance. Thus, the normal balance of the Retained Earnings account is also a credit. Normal balance is defined as the side of the account that increases that individual account. Some factors may lead to a debit balance under Retained Earnings, so it would be referred to as Accumulated Deficit. Note that Dividends, an equity account, have a normal debit balance.

Retained earnings could in some cases be the same as net profit. This happens if the company didn’t accrue dividends in the reporting year and lacks deferred tax liabilities. An important distinction, though, is that retained earnings are a company’s accumulated result for the whole time of its existence and the reporting year. Net profit, however, is just what the company received in the current reporting period.

Retained earnings serve as an internal source of long-term financing. You can think of retained earnings as a savings account for your company. Instead of spending that money and giving it out to shareholders, you are saving it so the management can use it in whatever way they and investors see fit. Your goal as a company owner is to ensure you accumulate these funds. Company owners use retained earnings to establish a reserve fund for future business development, future dividends payments, and debt coverage.

Thus, ensure you place some of your company’s revenue in a reserve, you’ll need it to:

- Pay cash or stock dividends

- Cover unexpected expenses

- Fund R&D

- Invest in better equipment or

- Train or hire skilled employees, etc.

Without retained earnings, your company will struggle to grow or attract investors. At the same time, you need to balance this with a need to pay dividends, whether it is stocks or any other form. Shareholders and investors will lose interest in your company if you only use the money for the company’s internal needs.

How to calculate retained earnings

Here’s what you take into account when calculating your retained earnings (uncovered loss):

- Its value at the start of the fiscal year

- The net income (or loss) for the year, and

- The dividends paid to owners (for Joint Stock Companies (JSCs), which are payments to shareholders; for LLCs, payments to founders).

If you can gather all the necessary data from the company’s standard financial statements. Companies are required to officially document their financial history, including dividend payments. If you can manage, it is usually easiest to calculate current retained earnings by using these official values for a company’s retained earnings to date, net income, and dividends rather than calculating these by hand.

An amount company’s retained earnings up to the most recent reporting period and its owner’s equity should appear on the current Balance Sheet, while its net income should appear on a current Income Statement. If you can find all this information for your company, essentially all you need to do to calculate the retained earnings value is follow the formula which is net income or loss minus dividends.

Depending on the final result of the work, the cumulative retained earnings formula will slightly vary:

- If the company has a positive result, use this retained earnings formula RE = RE 0 + NI – D. The ‘RE’ and ‘RE 0’ show the retained earnings at the start and end of the period. NI is net income, and D is the payment to owners.

- If there’s a loss, you’ll adjust the formula for the retained earnings to this: RE = RE 0 – L – D. ‘L’ is the loss for the reporting year.

The result of your calculation is the value that will be recorded in the equity section of the balance sheet as well as in the statement of retained earnings. Retained Earnings is a permanent account that appears on a business’s balance sheet under the Stockholder’s Equity heading, so you will always know where this number will go on this financial statement.

As said earlier, this account represents the company’s cumulative earnings since the formation that have not been distributed to the shareholders in the form of dividends. If the Retained Earnings account has a negative balance, it is called “accumulated deficit.” To find the company’s retained earnings at the end of the accounting period, you would need the data for this year and also know what the total amount of retained earnings has accumulated since its formation.

Let’s say the total amount of retained earnings at the end of last year for your company was $265,000. During this reporting period, you have kept $135,000. Thus, you can easily calculate the cumulative retained earnings value at the end of this year, which would equal to $265,000 plus $135,000 or $400,000 total. In the following year, your company had a decrease in retained earnings by $210,000 in total because the management invested some money into new equipment and also paid dividends. As a result, your retained earnings balance at the end of the next year will equal to $190,000. We can come to a conclusion that during the whole existence of your company, it has earned enough to “keep” $190,000 after covering day-to-day expenses, dividends paid to stockholders, wages and other needs.

If you do not yet have the net income value for this year, you can still manually calculate the retained earnings for your business. Be prepared that it will take some time. You would start by calculating the company’s gross margin value. To do this, you need to subtract the company’s cost of goods sold from the money generated from the sales and other operating activities.

As an illustration, let’s say a business made $365,000 in sales this year and spent $128,000 to make the products it sold. The gross margin, thus, would equal to $237,000. The next step is to find out the operating income by deducting the sales expenses and operating expenses (except for cost of goods sold because we already subtracted that). Let’s assume the total for these expenses makes up $27,000. The operating income would be $210,000.

Next, you will calculate the pre-tax net income by accounting for all expenses due to interest, depreciation, and amortization from the operating income. Let’s assume the company had $800 in interest expenses and $2,900 in depreciation expenses. The pre-tax net income will equal $206,300. If the tax rate is 25%, then the taxes will equal $51,575. The after-tax net income would be $154,725.

Now that we have found our company’s net income, we have a value we can use to find retained earnings for the current reporting period. In our example, let’s assume we paid out $33,500 to our investors this quarter. The current period’s retained earnings would be $154,725 – $33,500 = $121,225. Do not forget that the retained earnings is a cumulative account that accounts for the net change in this value for the whole time a business has operated. To arrive at the total retained earnings, add the current retained earnings to the account’s balance as of the end of the last reporting period.

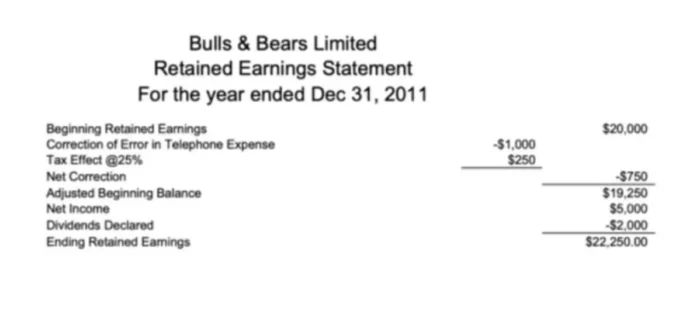

If you look at the Retained Earnings Statement above, you can see that it is the most simple and there is not a whole lot that goes into this statement. All the information was taken from other financial reports. The beginning balance is taken from the previous year’s Balance Sheet, while the ending balance will go on the current on. The Statement of Profit and Loss gives the net income value, while the Statement of Cash Flows will tell you how much money was paid in dividends to shareholders.

All you need to do is just plug these numbers into the formula or fill out the financial report format to present it to the management. This report will have a heading that is similar to what other reports have. Note that it is done for a period of time, such as year, but you have to account for what you had at the end of last year as you go into a new year.

The other items will follow the equation for calculating the accumulated (total) retained earnings at the time the report is prepared. One of the items that are not included in the equation, but you might see on this report is the Adjustments, which may lead to an increase or a decrease in the beginning balance. As you can see from an example below, this organization had to adjust the beginning balance (the ending balance from the previous year) to reflect an error in phone expenses and changes to taxes. Once the new, correct beginning balance is determined, the format is not different from the standard one.

What affects retained earnings?

Management should also know the factors that affect retained earnings, which may lead to the fluctuation of the retained earnings from one reporting period to the next. However, this is not always the result of a change in a company’s revenue flow. Below are factors that might lead to either an increase or a decrease in the total retained earnings:

- Cash, scrip, property or stock dividends paid to the owners and investors

- A change in the net revenue

- Adjustments to the beginning balance for any errors, oversight of some kind, etc.

- The value of commodity assets increasing or decreasing

- A change in overhead costs and GOGS

- Tax rates changes

- Changes in the business strategy

- Certain changes in accounting principles, such as going from LIFO to FIFO

- Quasi-reorganization to eliminate the deficit

- Selling treasury stock for a lower price than its cost

Wise Distribution of Profits

A profitable company’s investors will expect a return on their investment paid in the form of dividends. Only an organization’s owners or shareholders can decide how to distribute the accumulated money. Shareholders’ decisions and the respective instructions about accounting are recorded in the minutes of the shareholders meeting.

What companies usually do for dividend obligation is pay dividends in the form of cash. This leads to a cash outflow from the organization, which means when you pay dividends with cash instead of stock, the company’s asset value is being reduced.

When the business decides to do it in the form of stock instead of cash, the respective proportion of retained earnings is transferred to common stock. For example, if a business to issue two shares for every share owned by the shareholders for a dividend payment, the share price will decrease because the total number of shares will increase. Since announcing a stock dividend would not create any real value, the market price for each share will be adjusted according to the stock dividend proportion.

Although when the number of shares changes it does not impact the balance sheet as in the case when dividends are paid with cash because there is an adjustment to the market price, the per-share valuation will be impacted. This decrease is reflected in the capital accounts, affecting the retained earnings account.

At the same time, investors also want the company to grow and become more profitable so that its share/stock price will rise, earning the investors more money in the long run. For a company to effectively grow, it needs to invest the total retained earnings back into itself. Usually, this means using retained earnings to improve efficiency and/or expand the business.

If the organization is young, a start-up, or in a rapidly expanding industry, then it is more likely to keep the net income inside the organization, then pay it out in a dividend. Many internet start-ups are not going to make a dividend payment to shareholders because rapid growth requires new infusions of money to be kept inside the organization. If successful, this money re-investment leads to the company’s growth and increase in its value, raising its revenue and share price and earning the investors more money than if they had initially demanded greater dividends.

If the company is generating revenue and retaining a significant portion of its profit but is not growing, the investors usually demand greater dividends because the money they are allowing the company to “keep” is not effectively used to make them more money. If the company is not retaining earnings or paying dividends, it unlikely to win any investors.

What else are retained earnings used for?

- Reserve funds. The law requires some businesses to create a reserve fund with net profit, while others have a choice. Reserve funds are used to cover losses and buybacks of public shares as well as to cover liabilities. Think of the reserve fund as a financial security ‘blanket’ of the organization.

- Use these funds for essential, unforeseen expenses such as to replace failed equipment or components. Set aside part of the reserve for the scheduled update of assets as well as to launch new activities.

Retained earnings analysis

When analyzing your retained earnings, you should assess the change in its share of the equity amount. Decreased retained earnings show a decline in the business activity and revenue. However, before coming to that conclusion, consider the fact that this might be a mature organization where management and shareholders do not see any opportunities in their market that will give high returns. Thus, they decide to cash or stock dividend payments instead.

However, if retained earnings increased, it suggests:

- Accumulation. Note that if they’re not invested in projects or used to stimulate investors’ interest, this may lead to negative consequences down the road. Company’s revenue could decrease due to manufacturing goods not being able to compete in the market (whether it is a lower price or better quality), management not having an opportunity to replace or update equipment, etc.;

- Errors in reports that increase the total money coming in;

- Favorable market conditions, effective management and other factors that improved money inflow from the main activities;

- Stock or cash dividends unclaimed for more than six years.

Investors have a keen eye for companies that invest funds that remain after paying dividends into their development. That’s a sure sign the company’s management knows the market and effective way of handling the available resources, so the company will improve, expand over time, and deliver larger shareholder dividends in the future. Shareholders are betting on this when they reinvest shareholder’s dividend money back into the organization with expectation to receive more substantial returns.