At the end of the year, at a general meeting of shareholders of the company or thefounders of the business, a decision is made on the distribution of the company’s netprofit. Part of the financial income that has not been distributed among shareholders isrecognized as retained earnings of the current year.

Retained earnings are affected by financial transactions that increase or reduce netincome as well as dividends payment, which decreases retained earnings. Anyexpenses that a business has incurred during the reporting year will also reduceretained earnings. The more fees a company has the less net income will be, which willalso be reflected in the retained earnings statement. Higher revenues mean a possibleincrease in retained earnings.

How Much Do Retained Earnings Matter?

It is believed that business growth should be a priority in determining where profits willgo. Knowledgeable reinvestment can increase the overall profitability of the businessand the price of its shares. This, in turn, will be the main advantage for investors. Simple

dividend payments are useful only in the short term, while progressive developmentcreates the potential for stable long-term earnings. If the company does not grow,investors will not see this potential and will want to increase dividends here and now,which is undesirable from a financial point of view for the company itself.

On the other hand, even taking into account the logic of the aforesaid, debates oftenarise as to where to distribute profits. If management opposes allocating funds to paydividends but wants to use them exclusively for the implementation of new projects,shareholders may decide to sell the shares. As a result, the company’s stock quotes will decrease, as well as its market capitalization.

Therefore, it is vital for financial management to adhere to the so-called middle ground,providing investors with the profitability they are counting on, and at the same timedirecting funds to the development of the company. Here is a list of some uses for theprofits:

- production development;

- social development;

- formation of a financial reserve;

- environmental measures;

- financial incentives for employees;

- financial investments;

- acquisition of shares;

- charity goals;

- dividend payment;

- distributed among the founders and other purposes.

Retained earnings are often directed at the acquisition of new equipment, marketingresearch, technology improvement, and other items on which the continuedcompetitiveness and financial success of the business largely depend.

Financial Statements

The financial accounting department of the company is responsible for keeping track ofall financial transactions and cash flows. According to the accounting principles (GAAP),a company should prepare four financial reports at the end of each year. The basicfinancial statements include:

- Income statement — takes money earned by business and subtracts theexpenses to get net income. From this report, one can see whether a companyhas employees, rent space or equipment, or taking loans.

- Retained earnings statement — statement of retained earnings explains thechanges in retained earnings and includes dividends and net income. It shows allthe accumulated retained earnings for the whole time of the company’sexistence.

- Balance sheet — one of the most informative reports and represents theaccounting equation where Assets = Liabilities + Equity. This statement gives asnapshot of the business state on December 31, 20XX.

- Cash flow statement — gives a summary of sources and uses of cash and itsbalance. Cash flow statement is more complicated to understand because cashflow report does not usually reflect the money a company has on a bank account.

Retained Earnings Statement Explained

The retained earnings statement is a financial report that outlines the changes in theamount of retained earnings for a specified period. Investors can evaluate how well thebusiness is doing and whether it is worth investing in a company or even keep sharesthey already have based on several financial statements and retained earningsstatement is one of them.

What retained earnings statement can tell you? Retained earnings statement andincome statement are two items that can determine whether a company is growing andhow much it developed in the past year. It also further strengthens the income

statement and gives retained earnings amount that will be used in the balance sheet.Thus, the retained earnings statement interconnects several accounts.What sets retained earnings statement apart from other reports is that it takes intoaccount the retained earnings of all the previous years. As you will see in a retainedearnings statement example below, the first item after the heading in the retainedearnings statement is retained earnings for the previous year.

Next, the retained earnings statement shows how retained earnings changed during thereporting year. Since retained earnings are what is left from the net income afterpayment of dividends, you can see net income being added to the previous yearsretained earnings fewer dividends paid for the reporting year. The result will be the lastnumber on the retained earnings statement and will reflect the retained earnings normal balance at the time of the report preparation.

However, it should be noted that the retained earnings statement can also have otheritems included in it. The separate line you can see in retained earnings statement is anadjustment for the prior period. To make this section easier to understand, let’s reviewthis example.

For example, you were preparing a report for the year ending on December 31, 2015,and noticed an error in net tax in the financial accounting for $30,000. Due to thismistake, the cost of goods was lower and net income, in turn, was higher for 2014.This not taken into account cash flow, consequently, meant that retained earnings wereoverstated. An adjustment entry will reduce retained earnings from the previous year by$30,000, and the end retained earnings balance will reflect a correct amount of theretained earnings. The ending retained earnings balance will also go into the balancesheet under shareholder’s equity.

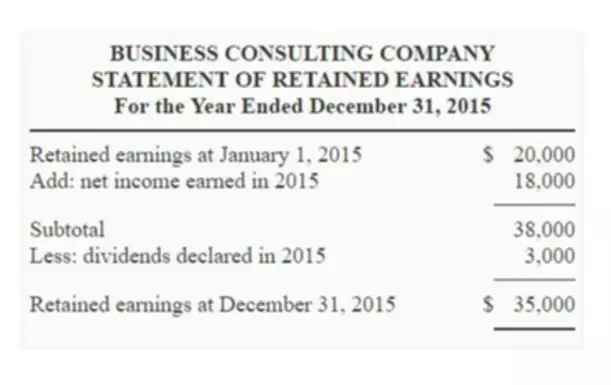

Let’s review statement of retained earning example. At the top of eachfinancial report, one can see the name of a business, name of report, and date. In ourcase this is Business Consulting Company, Statement of Retained Earnings and yearended December 31, 2015. Next are retained earnings for the previous year, which areequal to $20,000.

To this number, we would add the net income for the reporting year (2015), which canbe taken from the net income statement. The $3,000 amount shows that BusinessConsulting Company paid dividends to its shareholders, so we will subtract this amountfrom a subtotal we got earlier — $38,000. As a result, we get $35,000.

This the amount of retained earnings at the end of December 31, 2015. This number willbe included in the balance sheet for the year ending December 31, 2015. It will also beincluded in the retained earnings formula for the upcoming year (2016) asbeginning retained earnings.