Tax day is April 15th in the US, but the sooner you file, the sooner you will be able to get your tax returns. Yet, tax filing is a process that many Americans find scary and intimidating. In this TurboTax review, we will determine whether TurboTax will make it easier and what features this software has to achieve this.

What is TurboTax?

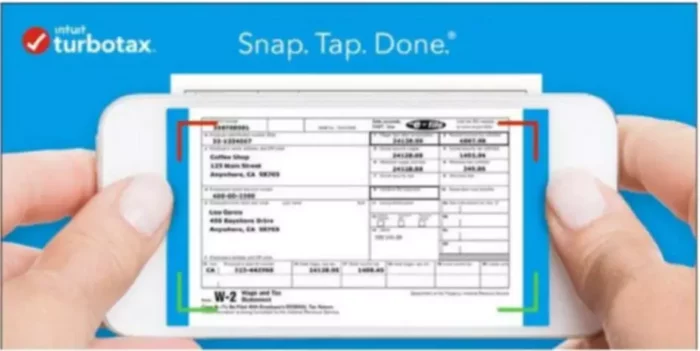

TurboTax is perhaps the most popular tax program on the market. The program offers excellent features, for example, importing your W-2 and live expert to answer your questions. Also, if you have an audit, TurboTax offers one free consultation. TurboTax is a user-friendly, interview-style simple question and answer (such as “Did you make money in any other state? and “Did you receive unemployment or paid family leave benefits in 202x?) tax filing software. The whole process is very streamlined and straightforward to follow.

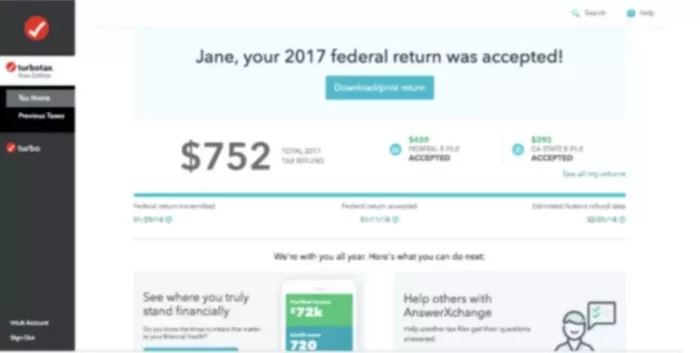

Users can seamlessly switch between phone, tablet, and computer, and returns will be saved automatically, so you can pick up where you started at any time. Moreover, it allows skipping back and forth between stages of the process, which is excellent if you have multiple sources of income.

The best part is that you can download the software and not have to wait for it to ship to you or opt for TurboTax online and do the whole process online. Android and iOS apps have extensive functionality.

TurboTax customer service specialists will help customers with general questions and issues and offer support using the TurboTax product free of charge. You can find the TurboTax phone number on the official webpage, where you will also see a FAQ page and an AnswerXchange community.

Users also have an option to live communication with a certified public accountant or enrolled agent. The enrolled agent will not only help you to prepare and file your taxes but also review your tax returns to confirm that everything is done correctly, and you get all the possible deductions. Just like the several plans offered by the TurboTax, users can choose between four TurboTax Live options depending on their needs (respective fees apply).

To start using TurboTax for free or with another plan, you will need to create an account. Your email, phone number, or TurboTax ID will serve as your TurboTax login. Once you have an account, to use TurboTax – sign in and proceed from where you left of. To make filing easier, you can use data in TurboTax from previous years or import a PDF file.

Overview of TurboTax Features

Completing your taxes will be a breeze because this program has amazing features to offer its users:

- File on smartphone, tablet or computer

- Live, on-screen TurboTax customer support

- Data security and encryption

- Import your W-2

- Electronic tax filing

- Guarantee of maximum refund

- Up to date on latest tax laws

- 350+ deductions and credits

- Withholding calculator

- Returns automatically saved (pick up where you left of)

- Guaranteed accurate calculations

- Max Assist and Defend add-on for audit protection

- Integrations

- In-depth tax articles

TurboTax — Plans and Pricing

There are several plans users can choose from. Although some might find TurboTax a little pricier, the features and live TurboTax help make this software worth a few extra bucks. Here is a list of TurboTax plans:

- TurboTax Free at $0 Fed, $0 State, $0 to File – for those who use Form 1040, allows claiming EIC.

- Deluxe at $40 – intended for those whose taxes include a mortgage or property tax and deductibles, searches over 350 credits, and deductions.

- Premier at $70 – has all features of cheaper versions and is intended for applicants with investment and rental property. It will automatically import income from investments and will allow accounting for cryptocurrency transactions.

- Home and Business at $90 – upgraded Premier version for small business owners and freelancers/independent contractors who use Schedule C.

Note: The Deluxe, Premier, and Home and Business plans do not include the additional charge ($39.99) for state filing. Also, prices might change, so check the official TurboTax website for current list prices.

User reviews

“The software walked me through everything in no time. At every point it is very easy to amend anything you have done wrong and good access to explain what the tax laws are on different issues. I was worried about using it on my Mac. TurboTax had instructions for Mac on their web site and they were perfect. It loaded in minutes. In fact the time I had set aside to get the software installed completed my returns. I highly recommend.”

-Jimmy R. Neal

“I’ve been using TurboTax for more than 20 years, and I am always pleased with how easy it makes an unpleasant task. I especially like the ability to import fund transactions as I had a lot of those this year. TurboTax asks the right questions to make sure that you file accurately and don’t miss any deductions you’re entitled to.”

-S. Lionel

“I’ve been filing my own federal and state tax returns with Turbo Tax since 1992. The laws and processes is updated constantly, so there is never a worry if the forms you are using are current. Easy to follow instructions and suggestions. IRS has gone to a telephone tree that is difficult to climb. With a home business and personal filings this is the BEST!”

-Numbercruncher

“TurboTax’s process was extremely easy and helpful. The fact that they let you try going through the entire process (even chatting with great, friendly CPAs) before you actually purchase the software/service is amazing. It shows you just how confident they are in their streamlined, simple process, and I’m so glad I went through. All the CPAs were so nice! And extremely responsive.”

-WowSoHelpful