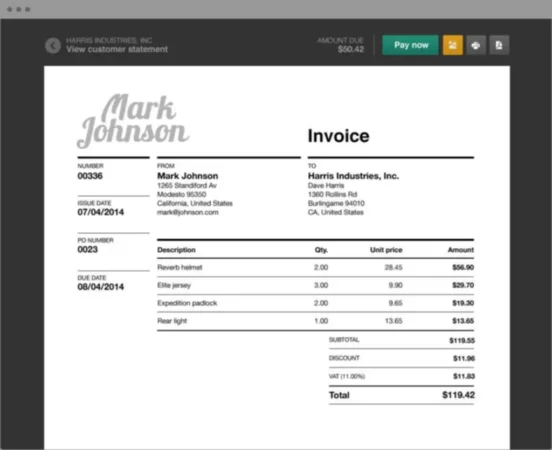

Today, retail and wholesale trade actively uses various schemes to attract customers: providing various types of discounts, selling goods on credit, etc. Many sellers offer customers to purchase goods on credit. The buyer pays only a fraction of the cost of the goods and receives the purchase. Yet, this convenient and uncomplicated way of purchasing goods for buyers is not so simple for sellers because accounting procedure for such transactions often causes certain difficulties and takes more time.

The sale of goods on credit is possible with or without the participation of the bank. In the first case, a loan for the purchase amount is provided to the buyer by the bank, which fully or partially pays for the goods to the seller. In the second case, the seller independently carries out commercial lending to the buyer. Today, we will consider the recording of transactions related to the sale of goods on credit without the participation of a bank.

Recording Credit Sales

Now, let’s get to actual bookkeeping records associated with credit sales.

Example 1

In our example, a business sells coffee for $4 a cup. The cost of the inventory (cup, coffee beans, etc.) is $2 per cup of coffee made. The business sold 6 cups of coffee on credit. What is the correct journal entry to record this sale? Note that the sale of goods on credit is carried out at prices in effect on the day of sale, and the subsequent change in prices for goods does not entail recalculation. This greatly simplifies accounting and the buyers are not afraid that they will have to pay more than they initially planned.

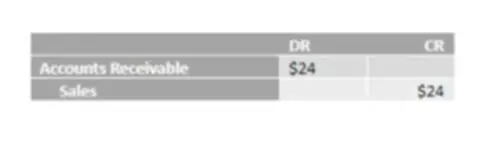

First, we will calculate how much we are going to receive from customers. This would be 6 cups X $4 per cup or $24. This amount will be reflected in our Accounts Receivable (as opposed to Cash account with cash sales) and a corresponding entry will be made under Sales.

Another entry you would need to make is to keep your inventory up to date. Under the perpetual inventory system, it would look as shown below. The inventory will be decreased by $2 X 6 cups or $12.

To collect the Accounts Receivable and to journalize that collection you have to debit Cash to reflect a receival of money and credit Accounts Receivable to note that the debt has been paid and these customers do not owe you anything and bring its balance to zero.

Example 2

The first example was a simple credit sale. What if your business offers credit terms? We will use the same example, only now your business offers customers to pay for coffee within 7 days to get a 15% discount, otherwise, they have 30 days to pay. These terms can be recorded as 15/7 net 30.

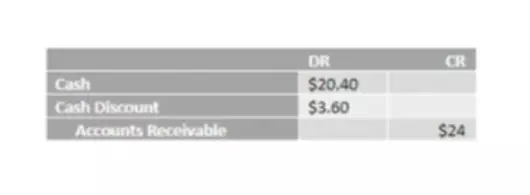

The original entries for sale and inventory financial accounting will be the same. What will be different is the way you will journalize the collection of money. If the customer takes more than 7 days to make the payment for the coffee purchased on credit, the journal entry will be the same as in the first example. However, if the customer decides to make the payment early and receive the discount, then the record will look as follows:

To calculate the discount amount, you would just multiple $24 by 15% or 0.15. The cash received will be $24 less the discount.