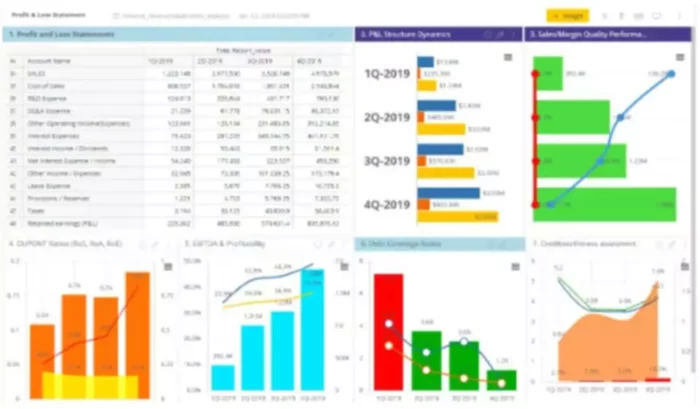

Each business is committed to financial success. Accounting profit is one of the critical indicators. A profit and loss report is based on the calculation of profit (loss). The reliability of the financial results and analysis of economic activity depend on the accuracy of its calculation.

Accounting Profit: How to Calculate

Accounting profit (loss) is the final financial result identified during the reporting period based on the accounting of all business operations of the organization and the assessment of balance sheet items under the rules adopted by the regulatory accounting acts.

To calculate accounting profit and see whether your company made money or lost money, you will use a special formula: Total Revenues–Total Expenses = Accounting Profit/Loss. Thus, to calculate this number, you will take the following steps:

- Find a total amount of revenue for the period (sales, service provision income, etc.)

- Find a total amount of expenses for the period (business expenses that are related to revenue)

- Subtract expenses from the revenue.

What kinds of accounting profits are there?

It might seem that a profit is just that–profit. However, there are three main types of profit every business owner should be aware of:

- Gross profit – in simple words, this is the total amount of profit the business makes.

- Net profit – in simple words, this is the remaining amount you get to keep. Employee salaries, tax expenses, and various other expenses are the money that is taken out of the gross profit to arrive at a net profit.

- Operating profit is the difference between sales revenues, COGS, and other operating costs.In other words, it is gross profit minus other operating expenses.

Income and Expenses

So, what items would you include in the profit/loss report (income statement)? Let’s review some examples of revenue sources and expenses:

Income:

- Sale of services or goods

- Profit on sale of non-current assets

- Commission or/and interest receivable

Expenses:

- Cost of goods sold

- Salaries

- Rent

- Utilities

- Insurance

- Interest payable

Note that not all business expenses are deductible expenses, so check with the tax department if you are not sure about something. This means that you will not include them when preparing the income statement and instead will record them on the balance sheet.

How often to calculate the accounting profit

Now that you know how to calculate the accounting profit, you might wonder how often you should do this. Company management and external parties regularly turn to the financial statement to evaluate its state and improve its results, namely, increasing revenues and reducing costs.

This is also one of the indicators of the effectiveness of previous decisions and how they impacted the performance. The income statement also serves as stimulation for continuous progress in all areas of the enterprise. So, the answer to the question above will depend on many factors, such as the size of the business, current profitability, and economic state.

The business will need to do this at least once every year to be able to file its taxes. Considering the importance of this financial indicator, we recommend calculating it regularly, for example, at least every month. With modern accounting software, this can be done in just a couple of clicks.