Whether you are a bookkeeper or a business owner who wants to know the purpose of each document in the business operation and be able to correctly prepare it, you are in the right place. Today, we are going to answer the question “What is an invoice?” and guide you through all the elements of one.

An invoice is a document that regulates the goods and services exchange relations between the seller and the buyer. It consists of a written agreement of the parties to the transaction, which helps to avoid further complaints or fraud on both sides. You can, obviously, enter into an exchange without an invoice, but then it is impossible to prove any offenses on both sides, if any, at the legislative level.

Key points to remember

Novice entrepreneurs and bookkeepers need to remember the following regarding the invoice:

- An invoice is a document with a list of goods sent or services provided that includes an amount due for these among other important information;

- It is issued by the seller and handed over to the buyer, often simultaneously with the goods or right after;

- In this document, the main characteristics of the quality, quantity of goods, and other formal features of the products are described;

- The invoice must indicate the final cost of the exchange;

- This document must indicate the owner of the goods.

Usage in business

Drawing up an invoice requires attention and foresight, regardless of which market: internal or external, sales are focused on. The two parties decide for themselves which points should be included in the document, adhering, of course, to legislative norms. Usually, the invoice should contain the following data:

- invoice number (optional);

- date of issuance (required)

- name and details of the seller and the buyer (required)

- payment details (recommended);

- delivery terms (recommended);

- payment terms (recommended);

- name of goods, their price (required)

- total invoice amount (required)

- currency (required)

- tax rates and amount (optional);

- delivery location (optional)

- the amount and grounds for granting discounts (subject to provision).

An invoice statement indicates that (except for cases when delivery is made on a prepayment basis) the receiver is obliged to give the money for the goods or services delivered in accordance with the specified conditions, as well as that the goods have been shipped in accordance with the terms of delivery. In fact, an invoice is a settlement and payment document, it only provides for the issuance of certain amounts to be paid by the buyers for the supplied items or services.

There are instances when it makes sense to create a pro forma invoice first. It is an optional, but very useful document in a case when it is impossible to foresee and plan the volume of supplies, money, and other conditions in advance. Then, the pro forma serves as a rough draft with the possibility of making changes in the future. One way or another, when drawing up the invoice, you need to start from basic templates and information, which we will go over in this article in just a moment.

Example of template

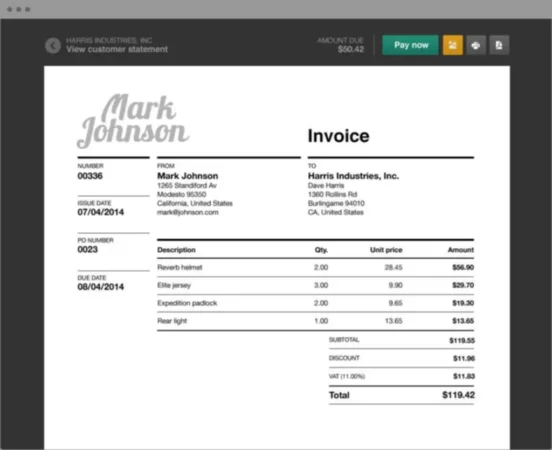

Here is an example of an invoice, which contains all necessary data, but your template design may be different.

“Invoice preview” by recreahq is licensed under CC BY-NC-SA 2.0

Invoice Elements

What basic fields should an invoice contain? For the invoice to perform all its functions as expected, it is necessary to know how to make an invoice by studying its structure, and then adding all the main components to your document. Check out the list of items to help you get a quality invoice.

- Business/seller’s name

If you are a business owner, then the presence of its name on the document is necessary both for internal reporting and for the buyer. Moreover, the name of the company on the invoice demonstrates the image and status of your business. Thus, the client will find cooperation with you more reliable than with those competitors that do not have this element on their invoice.

- Your logo

When designing your invoice form, add your logo. This will keep the documentation more presentable and official, and your clients will understand that they are dealing with a business that does things with responsibility. If you still don’t have a logo, then this is not at all a reason to abandon the branding of documents. There are numerous services that allow you to create one in a very short time. Most invoicing apps and software have a place for your logo in their templates.

- Your (seller) contact info

Phone, address, email, and other means to get in touch with the seller are mandatory elements of the invoice. This is primarily a way to provide the payer with the opportunity to contact you in case of additional questions. Secondly, if the deal goes well and the buyer wants to become your regular customer, then this section will be useful for continuing cooperation.

- Buyer’s contact info

Since the invoice is intended, among other things, to form a fair legal transaction, then here you need to indicate information about the buyer, so in case of failure to comply with the purchase agreements, all the info would be on the invoice. Your customer’s contact information is a necessary part of invoicing. Indicate the full name of a person responsible for the purchase/payment, company name, and other details about the buyer.

- Invoice number

Although optional, this element helps you to keep track of your invoices and makes bookkeeping simplified and more organized. Please note that the invoice number must be unique for each invoice. To avoid duplication, keep track of the sequence of numbers already in use or add alphabetic characters such as, for example, an abbreviation for a buyer, the name of a company, etc. An invoice number will also help track the current status of payment. Including a purchase order (PO) number, which would reference the buyer’s initial request sent to the seller for goods or services, might be a good idea.

- Payment methods and deadline

Just because a request for the payment was sent to the buyer does not mean that you already have cash in your pocket. After all, in order to receive payment on time, it is necessary to determine the payment deadlines. Of course, the customer should know these conditions before the purchase of goods or services. You also need to indicate payment methods are allowed because this takes out the guesswork and speeds up the receival of your money from the client. Nowadays, direct deposits are considered to be the best option for both parties. It is also great if you are able to set up an online reminder for the buyer closer to the deadline.

- Discounts

This element deserves a separate mentioning and explanation. If there is a discount for your product or service, indicate this in the invoice. It will also help you with correct accounting calculations. This can be either a percentage of the price or the actual discount amount. When it comes to discounts, the invoice might have something like 5/10 Net 45. What does it mean? This is a short way of saying that the buyer will get a 5% discount if the invoice is paid in 10 days. Otherwise, they have 45 days to send the payment for the goods or services they received.

- Details on goods/services

Describe what you are selling as thoroughly as possible. This will help protect you from any misunderstandings. After all, otherwise, you will have to spend time revising the purchase order and/or other documents or the deal may fail altogether. Moreover, by specifying all the details of the product or service, you will make it clear to the buyer what they are paying for, so they can make appropriate recordings in their books.

- Sales tax

If the sales tax is applicable, do not forget to include the sales tax amount on your invoice. Depending on what you do as a business, whether you sell goods that are taxable, as well as the location of your business, the tax requirements may differ significantly.

- Totals

Besides the price for each item on the invoice, you would want to have subtotals and the final amount the client would need to pay. For subtotals, it is helpful to know the total for each item if there is more than one. In addition, you would have a subtotal for all the items. Then, you would typically list the taxes and discounts, if applicable. Finally, you should list the total for the whole invoice, which would be the amount the buyer would be actually paying you.

Pro forma invoice

A pro forma invoice is a document that contains preliminary data about the supplied goods, such as the quantity or price, and is the basis for issuing a final invoice, which we just discussed. If according to the conditions specified in the contract the buyer needs to make a prepayment, the seller also issues the pro forma invoice. Sometimes, the pro forma invoice replaces a contract. It indicates the key points of the transaction, but not much is specified — for example, it does not contain information about the responsibility of the parties if either one does not fulfill their obligations.

The pro forma invoice is usually issued if the goods are delivered on partial prepayment or free of charge (donations, participation in exhibitions, promotions, auctions, etc.) The pro forma invoice can be issued for a shipped but not yet sold product, and vice versa.

Pro forma invoice vs invoice

Just like in a typical invoice, the pro forma invoice contains data on the price, number of units, and other info about the items. But, unlike the first, the pro forma invoice is not a settlement document. No payment is made based on it.

We can point out that some of the data in the pro forma document is not final and may still be changed before the final approval of the delivery. This is what sets it apart from the typical invoice. For example, this may concern the number of products or varieties of its models. After clarifying all the data, a final invoice is created and sent to the customer/buyer.

We can conclude that the invoice issued by the seller indicates the buyer’s obligation to pay for the goods following the conditions specified in the contract (does not apply to prepaid deliveries). The pro forma invoice, though, does not contain a requirement to pay the amount specified in it.

To understand the difference between estimate vs invoice, read our latest article.