Definition

By definition, a Trial Balance is not a formal financial statement. It is merely the ledger accounts listed along with their respective closing debit or credit (normal) balances on a certain date. Other financial statements are usually prepared after this statement. In an automated accounting system, the Trial Balance may not even be necessary, although one could be printed off.

Purpose

A sign of healthy bookkeeping is accuracy and consistency. Yet, in any bookkeeping system, there is always a possibility of an error. There are numerous ways to avoid errors and reveal them sooner. These include:

- separation of personal and business funds

- division of the accounting function between a number of people

- preparation of bank reconciliation statement

- use of a computer accounting program

- checking cash balances against cash held

- extraction of a trial balance at regular intervals.

The Trial Balance is primarily used to determine that debits equal credits at any particular point in time. This, though, is not the same as total assets or total revenues or total expenses. This is just all the debits and all the credits summarized.

It is a very useful tool to determine if mistakes and errors have occurred. If this statement fails to balance, then certainly something has gone wrong in the bookkeeping records. This can be manipulation in accounting, a result of carelessness on part of a bookkeeper or a simple human error. The error must be found by checking that no mistakes were made during the preparation process, reviewing the bookkeeping records, and how transactions were posted to the ledger accounts. The Trial Balance discloses errors in:

- posting from the Book of Original Entry

- posting of an incorrect amount

- debiting the correct amount instead of crediting and vice versa

- the ledger accounts balancing

- extracting the Trial Balance

Even if this financial statement is in balance, there is still a possibility that there might be some particular error. Errors not disclosed by the Trial Balance:

- Errors of principle: i.e. recording not in accordance with accounting principles

- Omission or duplication: the complete omission or duplication of a business transaction

- Mistakes of original entry: if the amount of a transaction is originally entered incorrectly

- Errors of commission: an entry is made to the wrong account

- Compensating errors: an accounting error that offsets another accounting error.

Preparation Example

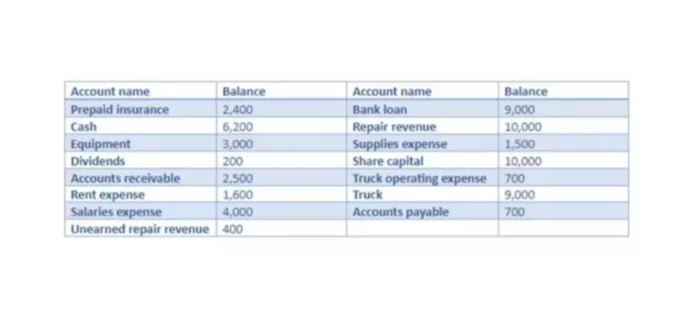

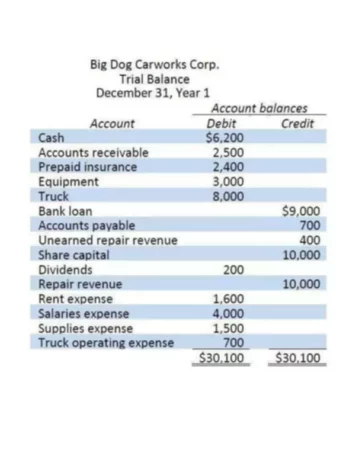

Closing entries should be made to all ledger accounts to prepare a Trial Balance. Ledger balances are posted in the Trial Balance depending on the nature of the accounts. In other words, adhering to normal balance of each account. For our example, we will use data from the ledger of Big Dog Waxworks Corp.

Using this information, we will prepare an Adjusted Trial Balance. After listing the organization’s name and statement title and date of preparation, we will list the account names and their balances in either debit or credit column. First, we will list the Assets in the debit column. Next, we list Liabilities and then Owner’s Equity in the credit column. Then, we list Owner’s Drawings (Dividends) in the debit column. Finally, we list all Revenue and Expense accounts. After listing all respective debits and credits, we will total each column of our statement.

What Does a Trial Balance Include?

A trial balance must include the list of the company’s general ledger account totals. Each mentioned account must consist of:

- number;

- description;

- final debit and credit balance.

Additionally, the trial balance must include the accounting period’s final date. It differs from the general ledger since the latter shows every transaction by account. The trial balance states the account’s totals instead of every operation’s total, for instance, credit transactions.

Main Requirements for Trial Balance

Trial balance is an essential document in the accounting process. To make it, you must follow several rules. First, put the company’s name, date, and the label of a Trial Balance in the header. Top amounts at the debit and credit column and totals at the end of the trial balance should contain a dollar sign.

Don’t forget to underscore the final figure in each column (debit and credit) when the sums are added. Totals at the end should be double-underscored. The companies prepare a trial balance at the end of the reporting period.

Learn more about the post closing trial balance in our blog.