Definition

Every once in awhile, a company may decide to distribute some of its earnings to its stockholders/shareholders. In financial accounting, they are referred to as dividends. They can happen frequently, such as every quarter, or a corporation may decide to never distribute a dividend. It really depends on the company.

The decision to distribute these dividends in any form and actual distribution are recorded in the Dividends account and any other affected accounts. Cash Dividends is a contra capital account that is created on a temporary basis for recording the declaration of dividends. This Stockholder’s Equity account is closed at the end of the accounting period by transferring its balance to Retained Earnings.

Journal Entries – Example

Let’s review a cash dividends payment and how it would be recorded in the accounting records of a business. On September 10th, 2020, Toys Corporation announced that it would be paying a $0.45 per share dividend on its 180,000 outstanding shares. The actual payments are to occur on December 10, 2020.

When you think about dividends, keep in mind that there are three important dates:

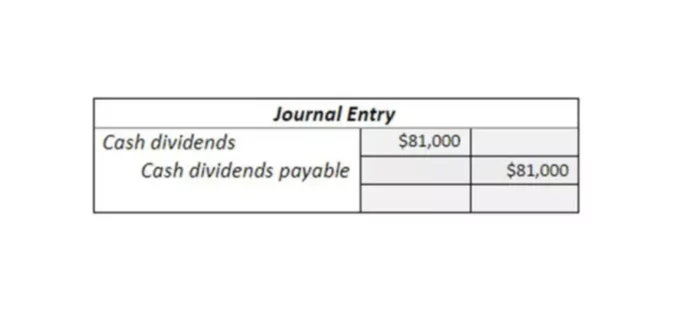

- Date of declaration – a day the company announces that they will be giving out a dividend, which in our case, will be on September 10, 2020. Since we know that we are giving out cash dividends, so that will be the first account that will be affected. On the date of declaration, we do not actually pay the dividends – we owe them, so we will have a Cash Dividends Payable account affected as well. The amount will equal $0.45 x 180,000 or $81,000.

- Date of record – usually, about a halfway point between the first date and the third date, and anyone who owns the shares as of that date will be getting the dividend. On this date, the data on who is going to be getting the dividend payment is collected. Remember, shares of stock are constantly being traded amongst different shareholders, so if somebody sold their shares after the date of declaration, the new owner who owns them as of the date of records will be entitled to that dividend. Accordingly, there is no change to any accounts, so no journal entries.

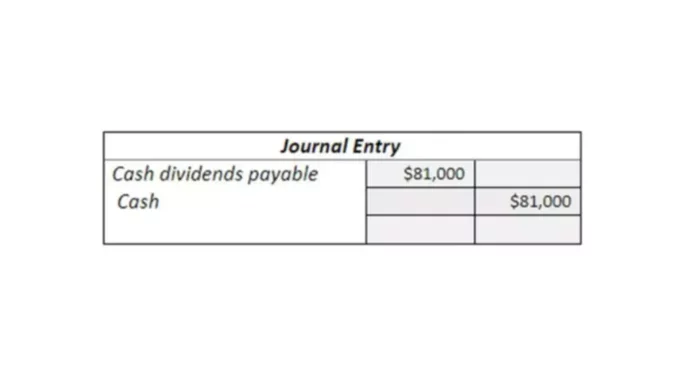

- Date of payment – as the name suggests, it is the day the dividend will actually be paid, which in our case, is December 10, 2020. Now that we are finally paying off dividends, our Cash Dividends Payable account will go down. Since the liability account is reversed, there will be no accounts associated with dividends on the Balance Sheet. The Balance Sheet total balance, though, will be reduced by $81,000 because the Cash Dividends (Retained Earnings) account is part of the Stockholder’s Equity, so the business’ Assets (Cash account) and its Stockholder’s Equity are reduced with the payment of dividends.