The main indicators of modern accounting reports on financial results of an organization are income, expenses, results by type of activity, and the final financial result for the reporting period in the form of profit (loss).

Profit is the source of the organization’s activities, capital gains. Therefore, a correct and timely accounting of all financial activities of the company is important for the timely calculation of tax amounts and payments and the search for profit growth opportunities. The final financial result is income minus the costs incurred to carry out the activities of the organization.

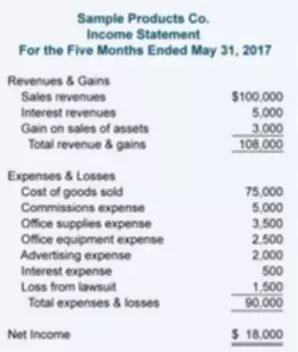

Single-Step Statement

It is called a one-step statement because net income is computed in one step. All income sources are grouped by their types in one part of the report, expenses – in another. Net income is defined as the difference between total income and total expenses. Although using this method, the user can tell whether the company made a profit or not, it does not clearly indicate the other key operational results of the business the users want to know, such as:

- sell its product for more than its cost

- generate positive income from its core operations

- generate income before taxes.

This sample Income Statement covers a period of five months ending May 31st, 2017, but depending on what the statement users need, management can prepare a report for any period users want.

When preparing a single-step report, make sure to title it correctly and include all the required info. Then, list all revenue account and total them up. Next, list all the expense accounts and total them up. Finally, take the first total less total expenses and losses to arrive at net income (net loss).

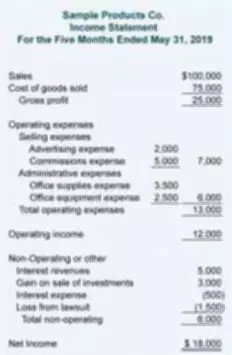

Multiple-Step Statement

Income and expenses are grouped separately according to their types, and the final financial result is determined by sequential calculations and subtotals. There are other differences. This method provides an ability to conduct margin analysis and resolve the shortcomings and deficiencies of the single-step Income Statement. This is its main advantage in the finance and business world.

When looking at the profit and loss report of the same company, but prepared using the multiple-step method, the users can now tell that it has a positive gross margin of $25,000. The amount of operating income (income from its core operations) is $12,000, which is also positive. This is a clear indication that the gross profit was more than enough to cover its basic operating expenses.

Please note that the revenue from sales is part of the company’s core operations and is used to compute gross profit. On the other hand, interest revenue and rent revenue are considered to be below the line items because they are not usually part of a company’s core operations.

However, for a bank, interest revenue would be considered its core operations activity and included in the calculation of the operating income. If this company, for example, was renting properties and other assets, then rent revenue would be their main operations activity and would appear at the top of the statement.

When revenues are not considered to be part of a business core operations, they will under other revenues and expenses. In the end, all these revenues will be included in the calculation to arrive at the net income amount.

Conclusion

As you can see, there are differences not only in the way these two formats of the Profit and Loss Statements are prepared but also in the information they present. The one-step method assumes that all of its elements are grouped into two categories: income on one hand and expenses on the other. Based on a difference between all types of income with all expenses, the net profit (net loss) of the organization for the period is determined.

A multi step income statement assumes that the income and expenses of an organization are grouped by the types of activities of the organization, types of individual revenues and expenses. With the multi-step method, the income and expense indicators, which characterize similar groups or categories, are reflected in the Income Statement separately. With this method, in order to obtain an indicator of the final financial result for the organization as a whole, you need to take several preliminary steps, namely, to calculate the intermediate totals for each subcategory.