Inventory is often the largest portion of working capital. Inventories are those things the business holds in order to enable it to produce as well as to trade. If the inventory is not used up by business operations at a reasonable rate, the company will find itself in a situation where a significant portion of its cash will be invested in an asset that is difficult to liquidate in a short time. Accordingly, keeping track of the inventory turnover rate is an important management function.

Stock (inventory) turnover ratio is used to measure how quickly the stock is converted into sales. In other words, this ratio is used to find out how many times a business replaces its inventory over a specific period. The ratio does not have a specific standard value. It can be analyzed using the following methods:

- Dynamic analysis. Calculate the values of the ratio for your enterprise for several periods and build a time series of its changes. This will allow you to determine the trend of its change.

- Comparative analysis. Calculate the value of the ratio for the industry on average, as well as highlight a leading company by the ratio. This will make it possible to determine your place in comparison with the enterprises of the industry as a whole.

The analysis of inventory turnover will allow to:

- eliminate interruptions in the supply of materials required for production;

- optimize goods and raw materials sitting in warehouses;

- reduce the number of expired inventory items written off;

- reduce the cost of maintaining storage facilities to ensure the safety of surplus goods;

- reduce the amount of ineffective and unused goods and materials;

- optimize spendings on payment for labor resources engaged in the processing, delivery, and storage of inventory.

Inventory Turnover Calculation

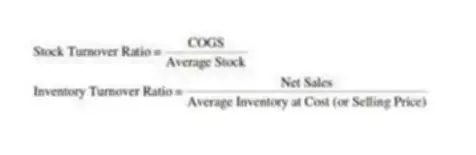

There are two options for calculating this ratio:

In the first option, when determining the inventory turnover, the numerator used the cost of goods sold, while the average value of the inventory for the analyzed period serves as a denominator. In another variation of this ratio calculation, the numerator does not reflect the cost of goods sold but uses the sales value instead.

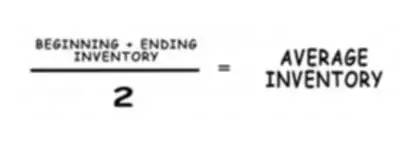

The Cost of Goods Sold and Sales values can be taken from the Profit and Loss Statement, while the values for the average inventory can be found on the Balance Sheet. The average inventory is determined by the arithmetic mean:

In practice, the second calculation method is used more often, since it allows obtaining the most reliable results. Everything is explained by the fact that with the first method of calculation, the cost is included in the calculation. However, the procedure for forming the cost of goods for each company is individual. For example, a firm may account for management costs in different ways in the cost of goods or separate them as a separate line in the financial result.

Consequently, the second formula for the turnover calculation reflects the clearest picture of the inventory turnover because it does not depend on the peculiarities of the business accounting policy in terms of the formation of the cost of production.

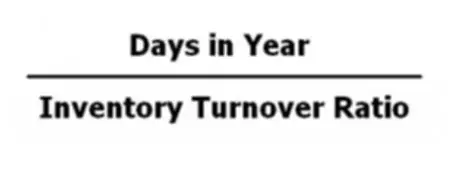

In addition to the rate of the inventory (stock) turnover, companies calculate the duration of inventory turnover in days. That is, for how many days of the company’s activity the existing stock will last.

Inventory Management

An effective inventory management policy means that the current level of inventory, work in progress, finished goods, and others ensures the smooth production and distribution of goods and services, but at the same time a minimum amount of financial resources is diverted to fund inventory.

Speeding up inventory turnover is believed to be a good thing. It characterizes the mobility of funds that an enterprise invests in creating inventories: the faster the money invested in inventories returns to the enterprise in the form of proceeds from the sale, the better. Yet, the turnover in itself does not say anything – you need to track the dynamics of the ratio changes, taking into account the following factors:

- if the ratio decreases – the warehouse is being overstocked;

- if the ratio is growing or very high (shelf life is less than one day) – this leads to failures in the shipment of goods to customers.

In conditions of a constant deficit, the average value of the inventory can be zero: for example, if demand is growing all the time, and the company does not have time to bring the goods. As a result, there is a shortage of goods and an unmet demand arise. If the order size decreases, the costs of ordering, transportation, and handling of goods increase.

There are options for a justifiable increase in stocks – in times of high inflation or expectations of sharp changes in exchange rates, as well as on the eve of seasonal peaks of buying activity. If a company is forced to store goods of irregular demand, goods with a pronounced seasonality, then achieving a high turnover is not an easy task. To ensure customer satisfaction, the company will have to have a wide range of seldom-sold items, which will slow down the overall inventory turnover.

Also, the terms of delivery of goods play an important role: if the purchase of goods is made using the business own funds, then the turnover is very important and indicative. If for credit, then own funds are invested to a lesser extent or not invested at all – then the low turnover of goods is not critical.