According to fundamental accounting principles, the definition of a purchases journal is a special journal normally used by a business to record all purchases on credit. The ones that are done on account will impact accounts payable.

Thinking of the purchases journal, we are considering a system that may be set up by hand. In this case, we don’t want to put all the transactions in a general journal. Here we have to record the debits and credits. We might set up special journals where we can record common transactions in a more simplified way.

We can record all the purchases for a certain period, that period being a day, a week or a month, and then take that purchases journal and record it into an accounting system all in one lump sum.

Information Listed in the Purchases Journal

What information is listed in the purchases journal? It is usually shown in the form of a table with one or more columns depending on the needs of a business. We would take the information from a purchase invoice provided by a goods supplier. In the purchases journal, we are going to have:

- Invoice date;

- Order number;

- Vendor name;

- Reference number;

- Amount on the invoice.

Information like the description of goods, quantity, and credit terms might also be entered in the purchases journal.

Purchases Journal Example

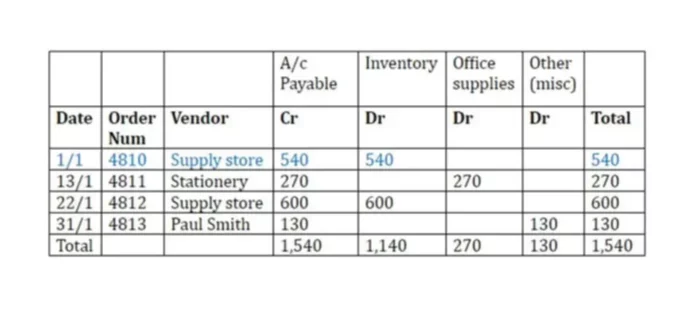

For instance, we may have a purchases journal that looks something like one below.

We’re going to have the date. We might have the vendor who we purchased it from. Accounts payable is going to be credited. That will always be the case if it’s going into the purchases journal.

The other question is, “What did we purchase?”. Let’s say, as an example, we always purchase the same items, such as inventory. If that’s the case, then we can only have one column, we can say accounts payable and inventory highlighted in blue).

However, if we have other items that we purchase on account, there will be some other columns for the common purchases to be recorded on the debit side.

So, we might have the stationery store where we have an amount of 270. Again, accounts payable are the constant for the purchases journal, but this one is not going to inventory for the debit side. It will go to the supplies account with a total of 270.

We could have a similar thing for the supplies store again, with the amount of 600 for inventory. Then, we may have a purchase of $130 from a vendor (Paul Smith) who is not on our list, meaning we might have to put it into the ‘other’ column and figure out what account in the system this will be posted to.

So, if we total all the columns up, whatever period the purchases journal is run for, we can make the lump sum ($1,540) journal entry into the accounting software. That being a credit to the accounts payable, a debit of $1,140 to inventory, a $270 debit to office supplies, and a debit of $130 to some other amount, possibly the so-called miscellaneous expenses.

It is important to note, even though the name is purchased doesn’t mean that every purchase will go in that purchase journal. It’s only those purchases that are on account for accounts payable. It would be better named ‘the accounts payable’ purchases journal because if we purchase something for cash, anything that is cash related, is not going to go in the purchase journal, it’s going in the cash payment journal.

Purchases Journal Proof of Postings

At the end of an accounting period, the purchases journal should be checked to make sure all the information has been correctly entered and posted to the accounts payable ledgers. The checking procedure involves updates of both the accounts payable ledger and the general ledger accounts.

We would update each supplier account in the accounts payable ledger daily using the invoices’ information in the purchases journal. The amounts are posted as credits to suppliers’ accounts in the accounts payable ledger. The balances between the totals of all supplier accounts and the totals of the accounts payable subsidiary account in the general ledger should be equal.

At the end of each month, the purchases journal totals are used to update the general ledger accounts. These totals are posted as debits to purchases account, whereas the accounts payable account in the general ledger is credited. The postings are part of the double-entry bookkeeping as they represent purchases made on credit terms from suppliers.