Almost every individual and business owner has come across purchase discounts sometime in their life. The financial benefit for the company providing the discount is extremely simple – it gets cash flow that it can use in its business activities. Yes, earnings may not be so big due to the discount provided. However, one can save time and not use loans. Let’s look at the definition of purchase discounts a little closer from the accounting point of view.

Purchase Discounts

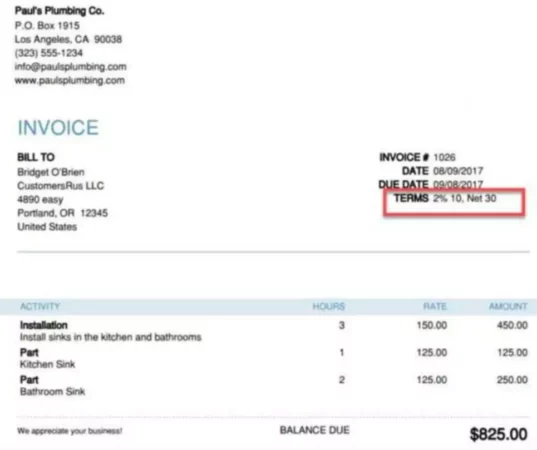

If a buyer is purchasing something from a company, sometimes, you can negotiate some terms if you pay cash upfront or if you pay within a certain time period. These discount terms can be found on the purchase invoice. For example, 1/15, n30 stands for a 1% discount if you pay within 15 days of the sale, but the whole net amount is due within 30 days. Every business decides on its own what purchase discounts it is going to offer the buyers.

Example

Suppose Dan & Co. purchased merchandise on account for $8,000. Credit terms are 4/10, n/45. Dan & Co. paid within the time specified to receive the discount. The first step would be to record the purchase. Since the company purchased the merchandise items on account, it owes money and will pay it later.

| Account | DR | CR |

| Inventory | $8,000 | |

| Accounts Payable | $8,000 | |

| To record merchandise purchase on account. | ||

Now, the company would journalize the payment on account. The company owes $8,000, but it is paying early enough to take advantage of the discount offered. This means that it will take the discount, which is 4% of the amount it owes. If we do the calculation, the discount will be $320. However, on the books, the company has accounts payable of $8,000, but it is only going to pay $7,680 for this merchandise because it is taking its 4% discount. So, what should the bookkeeper debit the accounts payable for?

The bookkeeper needs to take it completely off the books. The accounts payable shows that we owe $8,000, so we are going to debit it for this amount. As stated before, the business is going to pay only $7,680 in cash, so we are going to credit the cash account for $7,680. What is the other account that needs to get credited to keep the books in balance?

There is no such account call purchase discounts or purchase returns allowances because the company keeps the inventory on the books at what it paid for it. Thus, the bookkeeper is going to credit the inventory for $320.

| Account | DR | CR |

| Accounts Payable | $8,000 | |

| Cash | $7,680 | |

| Inventory | $320 | |

| To record payment of inventory on account within the discount period. | ||