Balance sheet, Income statement, and other financial reports is something that most individuals that deal with the business world are familiar with to some extent. As you might know, financial statements are usually prepared based on the accounting records for the past month, quarter, year, or any other period.

What if you want to look into the future and guess what the financial statements of your company will look like? Can you do that even if you do not have the financial data for that period yet? Do you even care what your business finances will look like next year? Today, we are going to talk about a definition of pro forma financial statements and how they are used in business.

Definition

Being able to accurately predict if investing in new equipment, rental property, or any other asset would bring the company the desired income is what managers, owners, and investors really want. Unfortunately, no one can tell exactly how much money such an investment would bring. However, there is a way to take certain data and information and put it together into something called a pro forma financial statement.

We can say that the definition pro forma financial statements are financial statements the reflect the best guess at how a particular investment is going to perform in the coming months and years. In other words, a pro forma is like a financial statement that projects and predicts what the investment’s future financial performance is going to look like based on certain actions that a business plans to take within the given time period.

Example

A pro forma is used in many different scenarios and industries. These reports are regularly used by business owners, bankers, and other financial professionals when they need to make important decisions, such as starting a new product line or service, investing in expensive assets, getting or providing a loan, and when merging two companies.

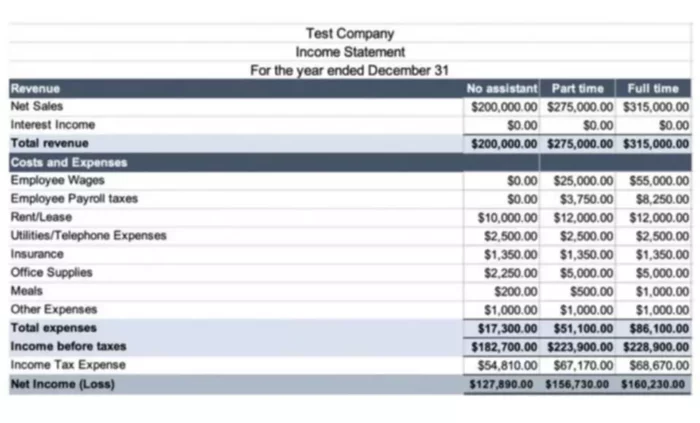

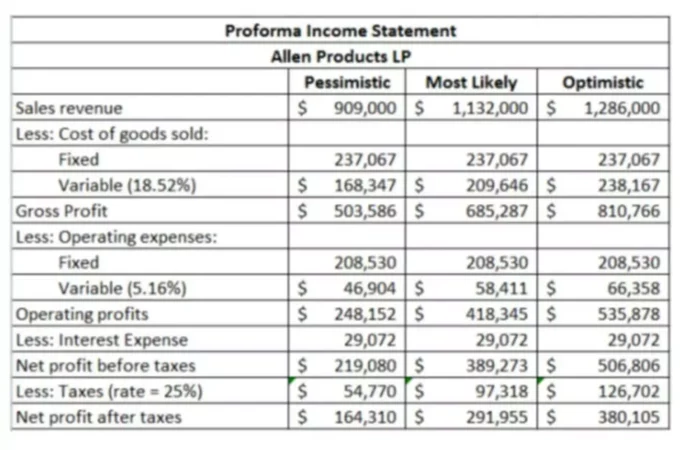

For example, with investment into a rental property, the investor might want to predict how things like making renovations to the property, filling vacancies, or possibly change the rental price might affect the future profits. Business owners would want to evaluate how the future performance will look like if they open a new service location, hire new employees, or invest in more modern equipment.

Businesses can prepare Pro Forma Balance Sheet, Cash Flow Statement, or Profit and Loss Statement. The calculations and steps for preparing each pro forma report will obviously differ, although they will all be intertwined just like in regular reports. Here are a few things to keep in mind when compiling these reports:

- Gather numbers that you know for sure, such as rent expense

- Do as much research as possible

- Use past data and expert opinions

- Make realistic assumptions and clearly define where these assumptions are made

- Do not exaggerate

- Account for all expenses

- Create best, likely, and worst-case scenarios.

Bottom line

Pro forma financial statements are a great tool that can assist anyone trying to predict the financial results of a certain action, make big business decisions, and plan corporate budgets. If done correctly by knowledgeable financial experts, these reports are a very accurate reflection of what is actually going to happen.

On the other hand, there are cases when they are completely off base, very inaccurate, and intentionally misleading when it is beneficial for some parties to convince others of a certain outcome that is not very realistic or accurate.