When dealing with merchandise inventory, you might hear the term credit memo. What is the definition of a credit memo? What are these memos for? Let’s get to the bottom of it.

Definition and meaning

The definition of the term credit memo is very simple. The credit memo is just a note the seller of goods (or services) sends to the buyer when they credit their account. For this reason, you might also see the credit memorandum simply referred to as a credit note. It serves as a source document and is one of the methods of communication with the buyer.

Format

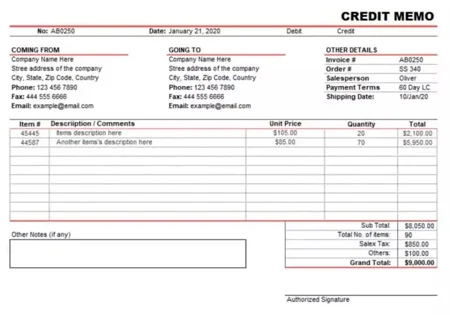

Now that you know the definition of the credit memo, how does the credit memo look like and what information does it contain?

Just like with invoices, you will find numerous templates for credit memos. However, they all contain the same basic information, such as:

- Memo number and date

- Seller’s contact information

- Buyer’s contact information

- List of items for which credit was issued

- Credit amount

- Seller’s signature.

The memo might also include other details like a reference to the invoice number, purchase date, payment terms, and reason for issuing the credit. If the business using accounting software, a credit memo can be automatically created with the same line items as the original invoice.

Example

Whether we provide goods or services, we have to look at the financial transaction from both sides of it. For the seller, if they have an Accounts receivable for $800, then there will be a buyer who also has an Accounts payable with the same amount of $800. You have to maintain this balance not only within your debits and credits but also between yourself and your customer.

From the seller’s perspective, when the customer calls the seller and wants to return defective merchandise inventory that was purchased. When the merchandise is returned, the seller will credit the buyer’s Accounts receivable. The seller will also send the customer a credit memo (short for memorandum) to let the buyer know that they have credited their account.

When the buyer receives the seller’s credit memo, they are going to debit the Accounts payable to reflect in their financial records that they no longer have to owe the money for that merchandise they returned. To acknowledge the receipt of the credit memo, the buyer will issue a debit memo to the seller.