Definition

The definition of Notes payable is a formal debt in which a note is signed for the repayment of any obligations due to the creditor. In other words, we are owning money or something to a creditor (someone else). This promissory note is usually written and involves signatures and other aspects, such as interest, that make it more formal than just an accounts payable.

Comparing Notes Payable and Accounts Payable

Although both are liabilities, they all arise due to different types of transactions. The first one is usually due to financial and credit institutions. The company would generally pay the Accounts payable amount to its vendors and suppliers. While Notes payable can be both short and long term obligations, the same cannot be said about Accounts payable, which can only be short-term.

Notes payable comes with a promissory note (hence the name) that states that the individual or business promises to repay the debt. There is no such written promise with the Accounts payable. This promissory note usually bears interest, although there are no-interest bearing notes. The Account payable, on the other hand, are normally repaid without interest charges. It should be noted that management can always agree to convert Accounts payable to Notes payable. To know more about notes payable vs accounts payable, check our new article.

Journal Entries Example

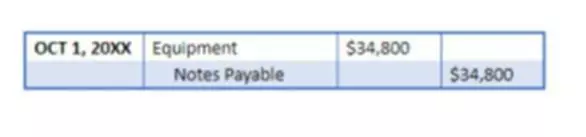

Decker & Smith Co. purchased equipment costing $34,800 by issuing a one-year, 8% note payable on October 1st, 20XX. Since no cash was paid, we are going to credit Notes Payable.

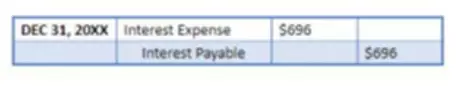

On December 31st, 20XX the company needs to records the accrued interest on the note payable. The total amount will equal to $34,800 X 8% X 3/12 (months) or $696.

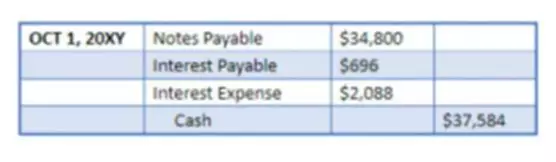

Finally, we need to record the payment of the note payable at maturity. To get rid of the note payable, we would need to debit the Notes Payable account. We also want to get rid of the liability from December 31st. We will also have to account for the interest liability between December and October. We have 9 more months worth of interest, which equals to $34,800 X 8% X 9/12 (months) or $2,088. To pay it all off, we will credit Cash. The total amount we will pay is our note face value ($34,800) plus the interest for all 12 months ($696 + $2,088). The journal entry to record is shown below.