All enterprises, regardless of their type and forms of ownership, maintain accounting records in accordance with the current legislation. If you are in a position where you will be using the financial data to make management decisions, knowing at least the basics is crucial.

Basic Terms

Before we discuss anything else, let’s get familiar with an explanation of some basic accounting terms.

- Assets – resources (property) controlled by an enterprise, the use of which is expected to result in economic benefits in the future, in other words, this is what you own

- Financial statements – reports that are compiled on the basis of accounting data to meet the needs of certain users. They contain information about the financial condition, results of operations, and cash flows of the enterprise for the reporting period

- Accounting – a process of identifying, measuring, registering, accumulating, summarizing, storing, and transmitting information about the economic activity of an enterprise to external and internal users for decision-making

- Accounts receivable – what is owed by other individuals (e.g. customer) and legal entities to the enterprise. Accounts receivable arise from the sale of goods and the provision of services on credit. They are included in the composition of assets because this is our potential asset

- Accounts payable – a debt of the enterprise to other enterprises, organizations, and individuals. It is included in the company’s liabilities.

- Liabilities – sources of property (assets), i.e. how we finance assets. It is a debt of an enterprise the repayment of which in the future is expected to lead to a decrease in the enterprise’s resources embodying economic benefits

- Reporting period – a period for which the accounting (financial) statements are prepared

- Primary document – a written document that contains information about a business transaction and confirms its completion

- Equity – a portion of the entity’s assets that remains after deducting its liabilities. Equity = Assets – Liabilities

- Financial activity – a transaction, event, operation that has or is capable of influencing the financial position of an economic entity, the financial result of its activities, and (or) cash flow

- Economic activity – any activity that is related to the production, exchange, distribution, and consumption of material and intangible benefits

- Business transaction – an action or event that causes changes in the structure of assets, liabilities, and equity of the enterprise

- Accounting register – a written document that contains accumulated and grouped data of primary documents.

Accounting principles

There are two basic principles that govern all accountants.

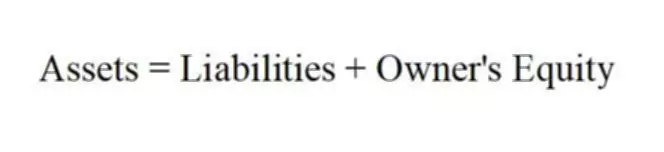

- The principle of accounting balance

This principle is based on accounting for the assets owned by an enterprise and accounting for its liabilities. Assets are all tangible items and intangible rights that an enterprise exploits for profit. Liabilities are the debts of an enterprise to other persons, organizations, or the state. The part that remains after the deduction of liabilities from assets is called equity. This rule is the basis of the accounting balance principle:

In this equation, liabilities come first because liabilities to external investors must be repaid in the first place to owners or shareholders.

- Double-entry system

The introduction of the double-entry system in 1494 is associated with the name of Fra Luca Pacioli, an Italian monk. He explained that there are two parties to any transaction. Therefore, each transaction must be recorded in at least two accounts. If the transaction is recorded in this way, no matter what operations are performed, the principle of accounting balance is preserved. For example, you decided to open a company for the rental of boats. You own $40,000, so the initial balance sheet equation shows that:

(40,000 = 0 + 40,000)

(ASSETS = LIABILITIES + EQUITY)

Basic rules of accounting

- The collection and processing of information at the enterprise are ongoing.

- A Chart of Accounts based on which the records will be maintained is created.

- For each business transaction, accounting entries are drawn up on the basis of double-entry.

- For each business transaction, a primary document is drawn up, which must be drawn up at the time of the transaction or immediately after its completion.

- Information from accounting documents is collected and systematized in accounting registers. Register forms have an approved form.

- A regular inventory of the company’s assets and liabilities is mandatory. The frequency is approved by the head of the organization.

- For effective and accurate recordkeeping, an accounting policy is required.