The goal of any company is to generate profit. All income minus all expenses – this is how most business owners calculate their success. However, this approach will help determine only one of the types of income – net income, and only if you took everything into account in your calculations.

The bottom line, though, does not give a complete picture of the business. It shows only the final result of your work but does not reflect how successfully you worked throughout the entire production process. There are many other concepts such as revenue, net profit, gross income, and so on. Gross income is one of such key indicators of the company’s performance. It allows analyzing the production efficiency of the organization.

Definition

Gross income or profit is the difference between income and cost. No taxes are deducted from these funds. By cost, we mean the following items:

- product manufacturing costs: equipment maintenance and material costs;

- cost of acquisition of finished products from suppliers;

- payment for electricity;

- payment of salaries.

Thus, gross business income is how much an organization earns from selling goods or services before you subtract taxes and other expenses. We can draw the line between the two types of income using the fact that gross is what was received even before the mandatory deductions. That is, the cost of paying taxes and other necessary deductions is not accounted for. It can also be thought of as the price the client pays for services provided or goods received less the cost of these goods (services) for the business.

Why calculate it?

The gross profit does not reflect the real income of the enterprise. This indicator includes a lot of expenses: advertising, salaries, rent. This type of income is required for other purposes. The purpose of the calculation of this value is to find out the profitability of a production (company) or a specific department. If, when calculating the gross income, a small amount is obtained, then it can mean inefficiency of business activities, a department that is close to bankruptcy, or a project that is not successful.

It is used to analyze the production resources of an enterprise. Correctly calculated indicators ensure the achievement of the following goals:

- analysis of the difference between the cost of the product and the income from its sale;

- determination of the optimal price for a product or service;

- identification of problems and weaknesses of the enterprise.

Based on the analysis of the annual indicators, it is possible to track the economic growth of the organization, the results from the optimization of activities. Using the gross income, you can determine a gross margin. The higher the margin, the better for the business.

What affects gross income?

Gross income changes due to external circumstances, such as the cost of transportation, natural and environmental factors, the socio-economic environment in which the company operates, cost of production resources, and so on. It is also influenced by internal factors:

- income from product sales

- other sources of income: investments, provision of services

- demand for manufactured products

- the cost of the manufactured product.

The gross profit is also influenced by negative factors that can arise during the operation of the business. These include overestimated or underestimated cost of products sold, poor quality of goods, employee errors, and other actions that lead to losses, fines, and sanctions. These factors can affect the amount of gross profit directly and indirectly.

Calculation

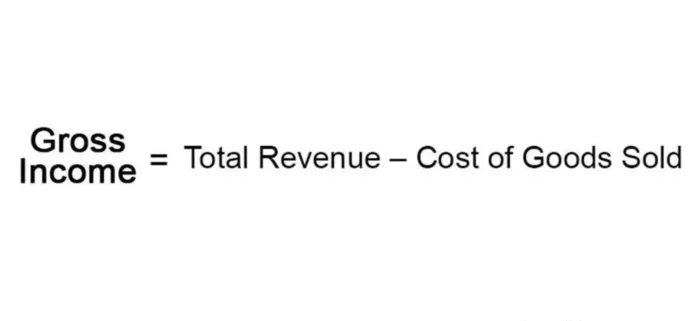

There is a simple formula that businesses can use to calculate their gross income. It can be seen below.

At the same time, the calculation process is determined by the type of activity of the enterprise:

- If the company specializes in the sale of products, it is required to deduct all expenses from the sales proceeds, including discounts and returns. The cost of production is deducted from the amount received. The result of the calculations is the gross profit.

- If the business focuses mainly on the provision of services, usually the calculations are carried out according to a simplified formula. Discounts and other expenses are deducted from the revenue. The cost for a retailer is the cost of purchased goods, the cost of delivery of the goods upon purchase, salaries of personnel responsible for these processes, as well as the costs of storing the goods and preparing them for sale.

Nonetheless, the basics of the calculation are standard.

Example

The Balloon Inc. is manufacturing a variety of balloons. The materials that go into making 100 balloons cost Balloon Inc. $5. It pays the workers $10 to make these balloons and spends another $5 on electricity and other direct expenses to make the production possible. It also has selling, general and administrative expenses that add up to $1,000. Balloon Inc. sells its goods for $40 per 100 piece pack.

We know that the sales revenue is $40. From this value, we need to subtract all the costs that directly relate to the making of the balloons and therefore are part of the COGS. So, we subtract $5 it paid for the materials, $10 it paid the workers, and $5 for other direct expenses. This gives us a gross income of $20.

How to improve gross income?

Gross income is a dynamic measure. It constantly changes depending on the activities of the company. The following activities help to improve this value:

- optimization of production processes aimed at reducing costs;

- effective pricing policy, taking into account the demand and the general market situation;

- improving the quality of equipment to accelerate the production and improve quality of goods;

- creating reasonable standards to ensure control over intangible assets.

Gross income is the indicator on the basis of which the planning of an enterprise’s activities in the production area can be carried out.

You can also read the article “Gross vs Net” in our blog.