Sometimes, people, including business owners, get gross and net income confused. Thus, being able to tell the difference allows one to properly evaluate accounting reports, make financial plans, know what to provide when asked for one or the other, and much more.

Gross Income

In business, one of the most significant financial concepts is gross profit. It is one of the main indicators characterizing the results of the company’s business activities. Gross profit is one of the intermediate types of profit shown in the Income Statement. Calculation of gross profit allows to focus on promising business areas and reallocate financial flows to use them in a more effective way.

It is determined according to the accounting data and represents the proceeds from the main type/s of activity less the cost of sales. The price of the goods (works, services) sold is inextricably linked with investments in their cost. The prime cost consists of a set of different types costs (material, human and other resources). The cost of the manufactured (or purchased) product includes all costs incurred for its production (purchase). If a firm provides services (performs work), then when calculating their cost (and subsequently gross profit), all costs associated with their provision are accounted for.

Gross profit reflects the fact of profitability of sales (both all and categorized by type of activity) and allows you to determine how rationally each of the firm’s resources is used. The gross profit of a business is used to calculate the gross profit margin and for its analysis. The higher the gross profit, the better it is for a business. A higher gross salary for workers also means that you will be able to take more after taxes are deducted.

Net Income

Net income, in comparison, is the funds that you actually receive after your deductions, for example, for insurance, income tax, and Social Security. So, it is whatever number your actual check reads. In the business world, you will see it referred to as the bottom line. This figure is the most valuable indicator of financial analysis and represents the final rate of return that remains after deducting all costs.

The total business expenses cover the cost of sales amount used in the gross income calculation as well as the operating expenses, overhead that are incurred by the business, such as rent and interest on loans, and all other expenses. Therefore, net profit will always be lower than the gross income.

It is necessary to bring it to your attention that a business’s net profit does not include any tax payments because these are paid based on the net profit figure. Therefore, you may also see this called net profit before tax. Net profit has a great influence on the future development of the enterprise, on its competitiveness, investment attractiveness, solvency and financial reliability. It is something that internal and external stakeholders will be interested in for various reasons.

Example

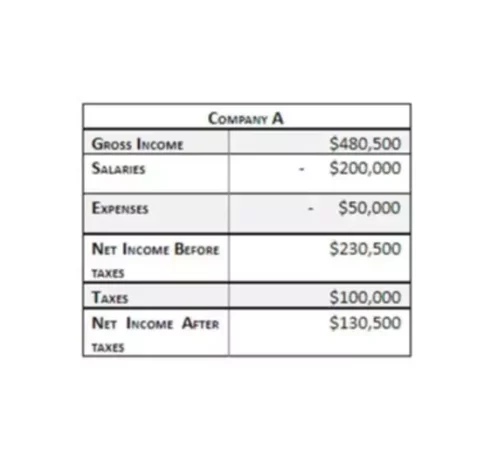

Let’s say Company A offers website design services and has five employees. Last year, its customers made payments to it totaling $480,500, which is a gross income. Unfortunately, Company A does not get to keep all that money because it has to spend $200,000 on salaries, $100,000 in taxes, and $50,000 on various other spendings and expenses.

After subtracting these amounts from the gross income of $480,500, we are left with Company A’s net income before taxes of $230,500. As you can see, the gross income and net income are drastically different. The same principles are valid when it comes to your paycheck, which leaves many to a sad realization that the job wage advertised was quite a bit higher than the actual amount received in the bank account.