Definition of General Ledger Account

The general ledger (GL) is the main consolidated accounting register, which reflects data on the company’s entire financial transaction history for all bookkeeping accounts used by the company. Businesses can maintain the general ledger on paper or in electronic form. When reviewing the general ledger, you must compare the totals of debit (left side) and credit entries (right side). If the journal entries in the document are added correctly, the results of the debit and credit books will be equal.

Examples of General Ledger Accounts

Businesses have to record the accounts in the general ledger in a specific order, where Balance Sheet accounts come first, followed by the Profit and Loss Statement accounts. The Chart of Accounts has a list of all the accounts and their respective numbers. Examples of the GL accounts include:

- Asset—Currents Assets (Cash, Bank, Inventory, Accounts Receivable, etc.) and Fixed Assets (Buildings, Machinery, Motor Vehicle)

- Liability—Current Liabilities (Accounts Payable, Credit Card) and Long-Term Liabilities (Bank Loan, Vehicle Loan)

- Stockholder’s Equity—Capital, Drawings, Retained Earnings

- Income—Sales, Labor, Materials, Bank Interest

- Expenses—Purchases, Advertising, Subscriptions, COGS, General Expenses, Bank Fees

General Ledger Control Accounts

Control accounts are a simple way to keep information about each sub-ledger (e.g., nominal ledger, accounts payable ledger, accounts receivable ledger, cashbook) in one place. They provide an independent control check on the accuracy of individual accounts in the GL. Businesses prepare control accounts from the books of the first entry.

Examples of General Ledger Control Accounts

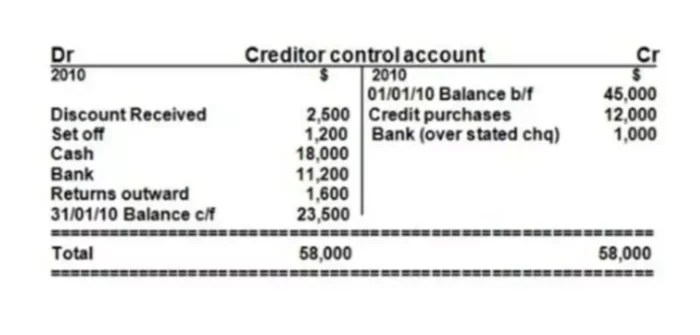

Some control account examples include Accounts Payable, Sales, Cash, and Inventory. Another good example would be Accounts Receivable. In the picture below, you can see an example Creditor Control Account.