Financial Analysis: What is it?

Analysis of financial ratios is an integral part of financial analysis, which is an extensive area of research and includes the following main areas: analysis of financial statements (including analysis of ratios), the formation of forecast statements, and assessment of the company’s investment attractiveness using a comparative approach based on financial indicators.

Financial analysis is a study of the main indicators of the financial condition and financial results of an organization’s activities in order to make management, investment, and other decisions by stakeholders. Financial ratio analysis is the art of linking two or more indicators of a company’s financial performance. Analysts can see a more complete picture of the performance results in dynamics over several years, and additionally comparing the company’s performance with the industry average.

Financial Analysis: Purpose

Currently, the importance of analyzing the financial condition of an enterprise has increased significantly. Almost all users of financial statements use financial ratio analysis methods to make decisions to optimize their interests. The published reports and accounts of companies contain many numbers, so an ability to read this information allows analysts to know how effectively and efficiently their company and competitors are performing. Ratios reveal the relationship between the profit from sales and expenses, between main assets and liabilities.

Analysis of financial indicators and ratios allows the manager to understand the competitive position of the company at the current time. The owners analyze reports to increase the return on capital, to ensure the stability of the enterprise. Lenders and individuals who consider investing in the company review financial statements to minimize their risks on loans and deposits. It can be argued that the quality of the decisions made depends entirely on the quality of the financial analysis of ratios and other indicators.

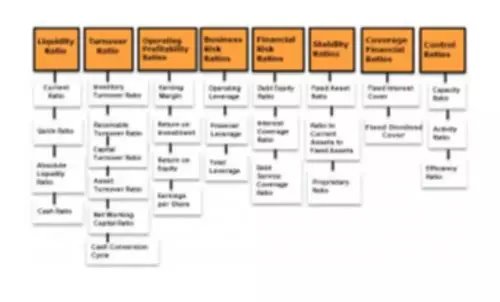

Financial Analysis: Ratio Types

There are many types of ratios. They are usually used to analyze the four main aspects of a company:

- liquidity – measure the short-term solvency which means the ability of the enterprise to meet its short-term obligation as and when they become due;

- solvency – measure the long-term financial solvency which means the enterprise’s ability to pay the interest regularly and to repay the principal on maturity or in pre-determined installments at due dates;

- activity – measure the effectiveness with which a firm uses its available resources and the efficiency of the enterprise in managing its assets.

- profitability – measure management’s overall effectiveness as shown by the returns generated on sales and investments.

Financial Analysis: Process

In the course of the analysis of financial and economic activities, both quantitative calculations of various indicators, ratios, coefficients, and their qualitative assessment and description, comparison with similar indicators of other enterprises are made. The success of the analysis is determined by various factors. Several basic principles can be distinguished.

- First, it is initially necessary to draw up a clear analysis system. The analysis is carried out on the basis of accounting information, so it should start with the selection of the necessary data. Certain user groups, such as management and auditors, have an opportunity to draw on additional sources. However, annual and quarterly reports are the main sources of financial analysis.

- Secondly, when carrying out analytical procedures, the performance indicators of the enterprise are always compared with something (with the plan, with the previous period, with the industry average indicators).

- Third, the integrity of any analysis is determined by the validity of the set of criteria used.

- Fourth, when performing analysis, there is no need to unreasonably chase the accuracy of estimates; as a rule, identifying trends and patterns is of greatest value.

Bottom Line

Analysis of ratios is a tool that provides an idea of the financial condition of the organization, its competitive advantages and development prospects.

- Performance analysis allows to analyze the change in productivity in terms of net profit, capital use and control the level of costs. Financial ratios allow you to analyze the financial liquidity and stability of the enterprise through the effective use of assets and liabilities.

- Assessment of market business trends via analysis of the dynamics of financial ratios over a period of several years makes it possible to study the effectiveness of trends in the context of the existing business strategy.

- Analysis of alternative corporate strategies enables to find alternative options for the development of the company.

- Having chosen the optimal business strategy, company managers can see a deviation from the planned indicators of the implemented development strategy by studying the main current ratios.