Cash Flow Statement

Cash is a valuable resource for every organization. The movement of funds accompanies and supports almost all aspects of the economic activity of the enterprise. To effectively manage cash flow, you need to know its amount, its structure, activities that form the corresponding elements of the cash flow and the mechanisms of their formation.

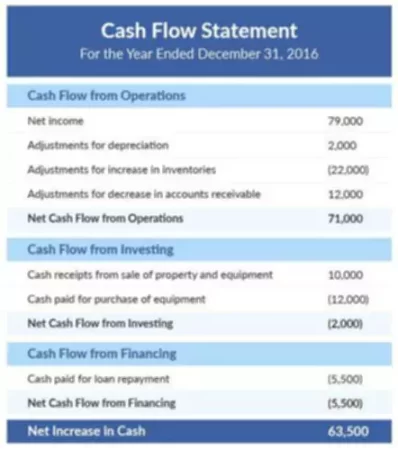

Analysis and management of cash flows include computing the time of circulation of cash, analyzing cash flow, forecasting it, determining the optimal level of cash, drawing up cash budgets, and so on. In this regard, the most important tool for achieving this is the Statement of cash flows. The users of the report can be both by internal accounting and management personnel and external, including tax authorities, banks, investors, and others.

There are two formats for compiling a Cash flow statement that businesses can use: indirect and direct. You will see that these two approaches are only different in one section of this report. Let’s consider the direct vs indirect cash flow method in detail.

Indirect Method

The indirect method of analyzing cash flow allows you to find the net cash flow and establish the relationship between the profit received and changes in the cash balance. This format is based on the recalculation of the financial result obtained by making certain adjustments to the net profit amount. What set this format apart is that a number of adjustments are made, which in general can be combined into three groups.

- Adjustments related to the mismatch in time of recognition of income and expenses in accounting with the inflow and outflow of funds from these transactions. The reason for the difference in the amount of net cash from the value of the obtained financial result is primarily due to the fact that the financial result is formed in accordance with the accrual principle, while the result of changes in cash is determined on a cash basis.

- Adjustments related to business transactions that do not directly affect the calculation of the net profit indicator, but cause cash flow. For example, changes in accounts receivable do not affect the financial result, but entail an inflow of funds.

- Adjustments related to transactions that have a direct impact on the calculation of profit, but do not generate cash flows. For example, the accrual of depreciation affects the profits, but does not entail an outflow of funds.

Direct Method

When considering direct vs indirect cash flow preparation ways, all you would report with the first one is cash receipts and cash payments from operating activities. There are at least a few advantages to it, including:

- ability to show the main sources of inflow and directions of cash outflow;

- ability to draw prompt conclusions regarding the availability of funds for payments on various current obligations;

- direct link to the budget for cash receipts and payments;

- establishes the relationship between sales and cash receipts, etc.

Obviously, the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods, but also more informative for analyzing cash flows, since it makes it possible to get a more complete picture of their amount and composition, allowing to determine not only the net cash flows by type of activity, but also total cash inflows and outflows for organization as a whole and for different branches of the organization.