Definition

Fixed assets are subject to gradual depreciation during their use, so they gradually transfer their value to finished products or rendered services. Depreciation is defined as the process of deterioration of fixed assets due to their use or obsolescence. Although it is not reflected in the accounting records, it is customary to distinguish between two types of wear:

- Physical deterioration is characterized by the loss of the original quality of the fixed assets and the properties of the materials from which the objects are made.

- Obsolescence refers to the gradual lag of assets behind the current level of technology.

Depreciation deductions are expenses of an enterprise that are associated with depreciation. The definition of accumulated depreciation is the total value of assets allocated during a period of its use as depreciation expense.

Accumulated depreciation reflects the portion of the depreciation expense that has been allocated over prior periods. The amount of accumulated depreciation is systematically increased and carried over to the next period. To properly track the depreciation expenses, financial analysts need to create a depreciation schedule using one of the depreciation methods.

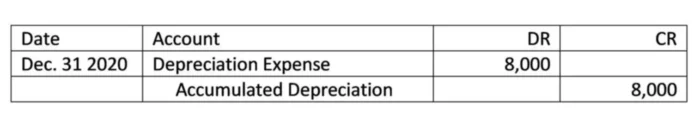

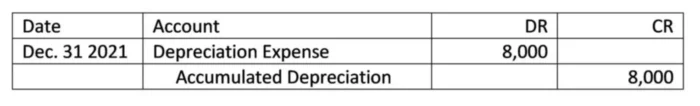

A cumulative depreciation account in finance is considered a contra asset account that brings the balance for the asset account it is connected to down. For this reason, it normally holds a credit balance. Whenever a depreciation expense entry is made in the accounting records of an organization, the same amount is credited to the accumulated depreciation account. This allows us to show the net book value of the asset on the Balance sheet.

It should be noted that the concept of accumulated depreciation is closely related to the concept of residual value, which is defined as the initial cost of an object less accumulated depreciation. You will see how it works in the example we are going to share next.

Example

Jeffrey and Co. purchased equipment on January 1st, 2020 for $60,000. The equipment has a residual value of $12,000 and an expected useful life of 6 years. If the company is using straight-line depreciation, what will the accumulated depreciation account show on December 31st, 2021?

To calculate the depreciation expense, we will take the value of the equipment Jeffrey and Co. bought and subtract the residual value. Then, we will divide the result by the useful life. This comes to $8,000 in depreciation expense per year.

The amount on December 31st, 2021 is two years’ worth of depreciation. Thus, we will multiply the $8,000 by two and get $16,000 of accumulated depreciation as of the date asked. We can also calculate the equipment’s net asset value on that date by subtracting the accumulated depreciation from the original value. This will give us a net asset value of $44,000.