In the process of analysis and planning, the management usually wants to calculate indicators that characterize the efficiency of an enterprise. These indicators are crucial for being able to steer the business in the right direction and towards success. In today’s article, we will discuss one of such indicators, why it matters for a business and how to calculate it.

Meaning

In a general sense, the cost of goods sold is everything a company spends on during the production and sale of its products. For a retailer, the cost of goods sold would be all the costs related to acquiring the product for future resale.

The cost of goods sold to some extent depends on the policy chosen by the enterprise for accounting for the cost of inventory. Also, its value will depend on the selected inventory accounting system: system of continuous or periodic inventory accounting.

Importance

The financial reports of the enterprise cannot be correctly prepared without the cost of goods sold amount. It is an integral part of the Profit and loss statement and is involved in the calculation of the net profit. On the Balance sheet, its affect on the net income is reflected in the Retained earnings. The same net income value is reported on the Statement of cash flow. Otherwise, you will not see the COGS figure directly shown on the company’s Balance sheet or the Cash flow report.

In addition to these reports, the cost of goods sold is important for payers of income tax because it affects the indicator of the company’s financial result before tax. Accordingly, the higher the cost of goods sold, the lower the amount of accrued income tax. Also, the cost of goods sold can be used for management purposes. It is very useful for analysis and forecasting.

Calculation

What does the cost of goods sold constitute of? Business entities incur costs, such as:

- the raw materials;

- salaries of workers who are directly involved in the production;

- depreciation expenses;

- preparation for the production of new types of products.

For a retailer company, these are costs of purchasing items for resale. It should be noted that the cost of purchasing goods also includes all costs associated with the purchase of these items, such as shipping costs, insurance, etc. Collectively, these costs are known as direct costs.

When determining the amount of cost of goods sold, only net purchases are taken into account, that is, the value of returned goods is not taken into account. Operating expenses, such as office supplies, utilities, and rent, are not included because they are not directly related to the making of an item being sold. These specific expenses do not increase with the increase in sales by the ratio of one-to-one.

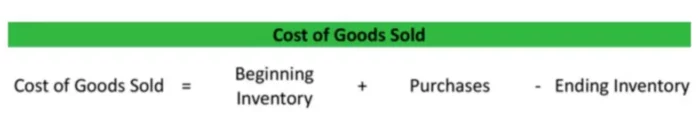

There are couple ways to find the COGS. However, there is a simple method to calculate this value.

Example

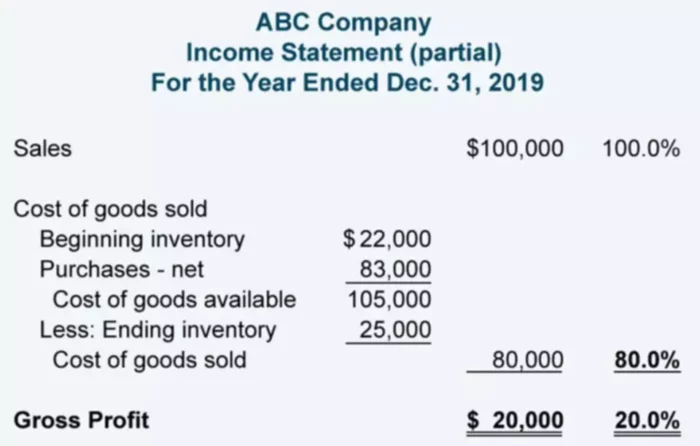

We are given the following information about ABC Company:

- Beginning inventory was $22,000.

- Net purchases made $83,000.

- Ending inventory added up to $25,000.

Our first step in finding the cost of goods value would be adding the net purchases of $83K to the beginning inventory of $22K. This would give as the total amount of goods that were available for sale during this period, which is $105K.

To be able to tell how much the company sold during this year, we would need to subtract what is left from the goods available for sale. So, $105K minus $25K would give us $80K This is how much the goods the ABC Company sold during the period cost to make. We can see how the elements of this calculation make up part of the Income statement presented below.

Looking at this Income statement, we can come up with another method of calculating the cost of goods sold. As you know, gross profit equals sales minus COGS. If we know the values for the first two elements, we can find the unknown by doing simple math. We would have something like this:

$20,000 = $100,000 – COGS

GOGS = $100,000 – $20,000

COGS = $80,000.

As you can see, there is a lot that goes into the calculation of the COGS, but calculating it is still very much possible if you have good accounting records.