If you are a small business owner and you sell a product, you likely have instances of returns/refunds on items or you may provide reductions for items that are defective or damaged. If you provide either a product or a service, you may also offer discounts from time to time, whether it be a sale or by personal choice to discount a client’s service fee. In these instances, it’s useful to record these situations in a contra revenue account.

Contra, from the Latin contra means ‘opposite’ or ‘against’ and is a prefix used to describe a revenue account that sits in opposition to a normal account for the purpose of ascertaining net revenue. Your contra revenue account helps you to understand the difference between your gross revenue and net revenue, and the reason for the difference. Your contra revenue transactions are often recorded in one or more contra revenue accounts. The balance is usually a debit, (whereas the balance in your normal sales account is a credit). So, what does the contra revenue account look like on your balance sheet?

Contra accounts never appear on their own, by their very nature (being in ‘opposition to’), they always appear linked to a particular account. For example, your Accounts Receivable account may have a contra account entitled ‘Allowance for Bad Debt’. Since Accounts Receivable has a debit balance, its opposing contra account will have a credit balance. You may have an ‘Allowance for Bad Debt’ account set up in the instance that you’re aware that specific accounts receivable may be uncollectible, or you are uncertain as to whether the outstanding account will be settled. Having a contra account for ‘Allowance for Bad Debt’ protects your business by preventing unexpected losses and helps to maintain accuracy in your bookkeeping records.

It’s important to utilize contra revenue accounts and contra accounts in your small business bookkeeping because it provides transparency in your business. It also allows you to understand how your business practices are affecting net revenue and your overall profit margin. Your BooksTime Bookkeeper can help you to understand how one or more contra revenue accounts will improve the accuracy of your financial records and help you to be able to easily generate clear and useful reports in your automated accounting software.

What do contra accounts look like on my business financial statements?

Different sections of your financial statements may display different contra accounts. Your asset account will normally be in a credit balance because the cost principle means that when you acquire an asset, it’s recorded in your asset account at the cash amount or equivalent. In the instance of depreciation, a contra asset account can be used to display the debit balance. This contra asset account may be entitled ‘Accumulated Depreciation’ and will record the cumulative depreciation of your plant assets, (property, plant and equipment).

Your contra liabilities account will generally have a debit balance, mirroring and in opposition to the credit balance of your liabilities account. An example of a contra liabilities account is an account entitled ‘Discount on Bonds Payable’ and may refer to an instance when the bonds decreed interest rate is less than its market interest rate. Finally, the contra equity account is a shareholders’ equity account that has a net debit balance and reduces the overall equity held by a business. An example of a contra equity account may be ‘Owner Drawings’ which will show the funds withdrawn by the business owner in opposition to the equity account that displays the credit balance of shareholders’ equity.

Contra accounts are useful concepts in demonstrating the net effect of two accounts in binary opposition on your financial statement. The effect will generally create a pattern where the gross amount in the normal account, minus the contra account balance will equal the net amount. The purpose of these accounts is to provide the business owner, or reader of the financial statement, with important information such as asset depreciation, owner drawings, or – in the instance of the contra revenue accounts – the effect of marketing utilising sales and discounts on overall revenue.

GET A FREE REVIEW OF YOUR BOOKS TODAY

How are contra revenue accounts relevant to my small business?

If you are in the retail, hospitality or service industry, the contra revenue account may be particularly important to you, however, the contra revenue account can be used in all sorts of industries to the benefit of the business owner. The purpose of the account is to offset the revenue account on the income statement, for the sake of transparency and owner protection. As mentioned above, there are three common contra revenue accounts: sales returns, sales allowances and sale discounts.

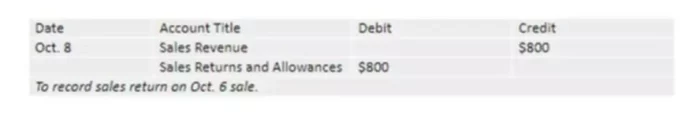

- Sale Returns contra revenue accounts are useful in demonstrating the impact on net revenue of returns and refunds. Instances of this may occur in the retail sector, where a product does not meet customer expectations, or in the hospitality sector, where the product is not up to standard. The Sales Returns contra revenue account provides the business owner with vital feedback in regard to not only financial data but also his/her business processes.

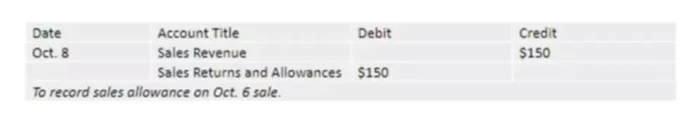

- The Sales Allowances contra revenue account may be utilised for products that are sold to a customer at a reduced price due to the product being defective or damaged. As in the instance of the sales returns contra revenue account, the sales allowances contra revenue account provides the business owner with important information and feedback, in this instance, regarding the business’s manufacturing, storage and packaging processes.

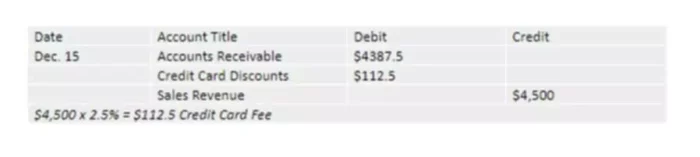

- The Sales Discounts contra revenue account contains cash, trade, quantity or seasonal discounts provided to customers for marketing purposes, or for the motive of moving stock at a faster pace than generally expected. It may also be used in the hospitality sector for instances such as a catering discount, or for staff discounts provided as a motive for staff loyalty and commitment to the brand.

These three instances of contra revenue accounts provide valuable information to the business owner, and also to lenders and investors, regarding the overall business mission as well as the internal practices of the business itself. Rather than debiting the sales revenue account, the effect of utilising an opposing contra revenue account with an opposing balance provides insight into net revenue, percentage of full-price sales and the effect of seasonal discounts on overall sales.

Is unearned revenue a contra asset account?

In short, no. Accounting is generally completed on a cash basis or accrual basis; with cash basis accounting, costs and revenue is recorded at the time of payment whereas with accrual basis accounting, costs and revenue is recorded at the time of generation. With cash basis accounting, when cash is received for products or services not yet provided to the client/customer, it is considered revenue. With accrual basis accounting, it’s entitled unearned revenue.

Unearned revenue occurs when a client/customer pre-pays for a product or service, for example, in the instance of a contract. This revenue is listed as a current liability, not as an asset, therefore, it does not appear in the contra asset account.

Can BooksTime help me to understand my contra revenue accounts and the contra accounts on my Financial Statements?

Accounting terminology can be baffling at the best of times, but when you are busy running a business, your focus is on business growth and providing a high standard of product / services. Taking the time to decipher your financial statements can be burdensome and tiring. If you’re currently utilizing a manual bookkeeping system, we’d like to take the time to show you how an automated accounting system can save you valuable time, and help you to grow your business by providing you with accurate financial figures, easy to read metrics and dazzling reports.

It’s important to us that you never need to worry about your bookkeeping again. That’s why we provide you with a dedicated bookkeeper, who is specialized in your industry, and available whenever you need to answer all of your bookkeeping questions. We understand that bookkeeping these days isn’t just about number crunching, it’s about providing you with great business advice to help you grow your business. That’s why we have dedicated business advisory specialists who can analyze your business financial statements and provide you with excellent advice, unparalleled to traditional business advisory services.

If you’re finding that you’re spending more time on the books than you’d like, and you would like to spend more time driving your passion, developing your business and continuing to move forwards, contact us today for a free quote. If you’re already a BooksTime client, and you have any questions about your contra accounts, please feel free to contact your Bookkeeper directly at any time, or you can request a call from us here.

Remember, contra revenue accounts aren’t financial jargon created to add complexity to your financial statements, they are a form of account transparency and a vehicle to assist you to understand and grow your business. Once you wrap your head around how they work, you can use these accounts to improve your internal business processes, decipher how your sales and discounts are benefiting or hindering your business and make an effective plan going forwards.