Define Contra Asset Account

A contra account is a type of asset account that has a credit balance, as opposed to the debit balance of a normal asset account. A contra account will naturally have an associated account, and the two accounts will have an opposite but equal balance. Let’s take a look at the two main types of contra account:

- Accumulated Depreciation: this account type shows a reduction in value of a tangible asset (property, equipment) to reflect the asset’s wear and tear (the natural degradation of an asset through repeated use). Depreciation is a gradual transfer of certain asset costs into an expense. Each asset will have its own depreciation account. This will show the value the asset has lost since its purchase. The net balance of these two accounts will show the book value of the fixed asset.

- Allowance for Bad Debt (Doubtful Accounts): this type of contra account reduces the accounts receivable value on the balance sheet. Only what the company expects to receive will be shown in this account and the accounts receivable account.

Other Contra Asset Account Examples

Allowance for Doubtful Accounts

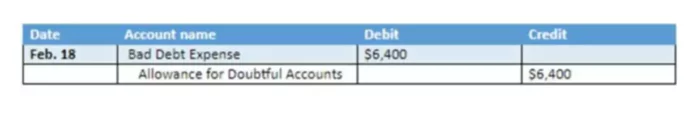

Let’s look at an example. A company has an accounts receivable total of $27,500. The credit balance in the allowance for doubtful accounts comes from the entry in which the bad debts expense is debited. The amount in this entry may be a percentage of sales or generated using the accounts receivable aging method. This method estimates expenses related to bad debts through classifying the debt owed to a company (based on length of time owed and likelihood of collection). In our example, the allowance for doubtful accounts is estimated at $6,400. The journal entry for this would appear as follows:

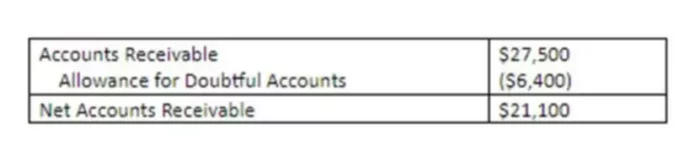

The contra account amount is subtracted from the total accounts receivable to get a net accounts receivable of $21,100. This is the net accounts receivable, or the amount owed to a company minus the money that it does not expect to receive. An excerpt from the balance sheet would look like this:

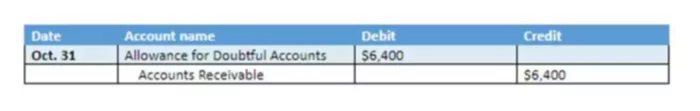

If the company is certain that they will not receive this money, they can reduce the value of the relevant asset. If this occurs, the company will debit the allowance for doubtful accounts and credit the corresponding receivables account.

By reading these financial statements, an individual will see the full financial picture of the company in question. It is critical that companies estimate their allowance for bad debt correctly; otherwise, the resulting expected future revenue will be incorrect.

Accumulated Depreciation

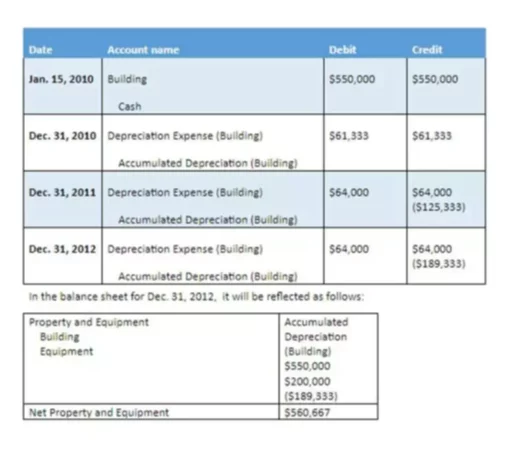

Accumulated depreciation frequently appears on the company’s balance sheet. Let’s assume that a company purchased a building for $550,000 on January 15, 2010. Every year, the company depreciates the building by $64,000. After three years, the net value (book value) of the building will equal $360,667 ($550,000 -$189,333). Depreciation journal entries would look as follows: