Company managers, investors, and other parties are interested in financial security and business stability, which is largely determined by the generated cash flow. Cash flow is the sum of cash receipts and payments for a certain period of time, which is divided into separate intervals.

The term cash flow, however, is really vague and does not really tell anything about whether we mean money spent or received. We can make it a little bit clearer if we say cash inflow or cash outflow. Cash inflow is some amount of money that is received, while cash outflow is the money that was spent.

Cash flows are used to ensure the functioning of the company in virtually all aspects. In order to achieve the required business goals, to ensure stable growth, the financial manager needs to optimally organize the management of cash flows. For this purpose, it is convenient to classify cash flows into types. Today, we are going to review cash flow from assets.

Definition

Cash flow from assets represents all cash flows that are recorded by the company that relate to assets. It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders, which shows how you can draw a line between this and the balance represented by the accounting equation.

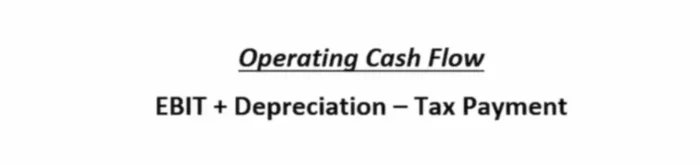

One of the ways to generate cash flow from assets would be operating activities. The operating cash flow basically shows the cash flow a business generates without taking into consideration the financing, without looking at interest expense. Whether a business had to borrow or not is disregarded when calculating this type of cash flow because we are simply looking at how a company generates cash from its regular activities. To find out this amount, we are going to use the following formula.

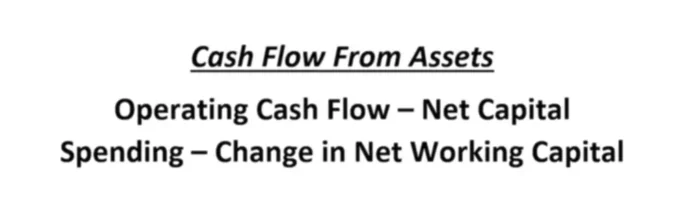

There are ways to generate cash from assets besides using them for regular operations. One of the simplest ways would be selling the assets, which would obviously generate some cash for your business. Similarly, buying assets will lead to a cash outflow. Just like the cash flow from assets that was generating via operating activities, we can use a formula to calculate all the cash flows from assets.

Calculation

The first step in calculating the cash flow from assets would be a separation of assets into two types: long-term and short-term. If you are going to buy more short-term assets, it is going to change your net working capital This is going to be a cash outflow, so you are going to subtract it from the operating cash flow value.

If you are buying more of the long-term assets, you would refer to it as net capital spending, which we are also going to subtract. Similarly, if you are selling some fixed assets, you would need to add that amount. An easy way to calculate this change in long-term assets would be subtracting the beginning balance for fixed assets from the ending balance and adding the depreciation. All these calculation steps are represented by the equation below.

When calculating the operating cash flow portion of the total cash flow, an important detail you should remember is that you may have non-cash items in your financial statement, the most common item being depreciation. Although depreciation, for instance, looks like a cash outflow, you do not actually spend any money. You only need to use it as if it is a cash expenditure so that you can calculate your taxes correctly.

Example

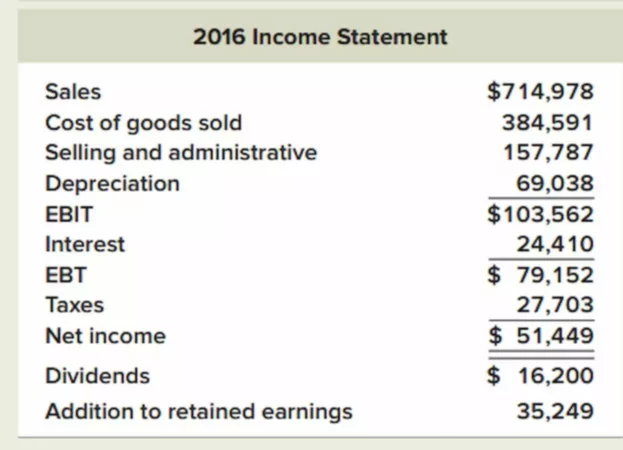

Below, you can see an Income statement. We are going to use it to find the operating cash flow.

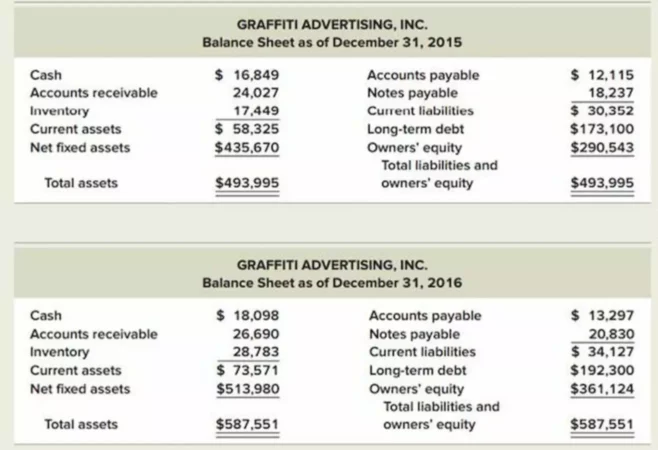

First, you will take EBIT ($103,562) and add back the depreciation amount ($69,038) because it is a non-cash transaction. Another cash flow that we need to take account of is the tax payment ($27,703), which we are going to subtract from the EBIT value. Thus, we get $103,562 + $69,038 – $27,703 = $144,897. Now, we will need the Balance sheet to get the other elements of the equation.

As mentioned before, the NCS value would be $513,980 – $435,670 + $69,038 = $147,348. The change in NWC is calculated as follows: ($73,571 – $34,127) – ($58,325 – $30,352) = $11,471. Now, let’s just input all these numbers into a formula: $144,897 – $147,348 + $11,471 = $9,020. This is the amount of cash flow from assets for Graffiti Advertising, INC. for the year 2016.