Regardless of how perfect and effective the solvency control system is, the company will find buyers who have not paid in time for goods and services sold on credit. Invoices that are not paid by the buyers within the due date in accordance with the contract are considered doubtful debts. The possible costs associated with it must be reflected in the reporting period when the sale was made.

Why is it necessary to write off debt?

An organization has to prepare financial reports at least on yearly basis for multiple reasons. Among them is identifying overdue obligations that must be demanded from the counterparty. If it is impossible to receive money, the debt is subject to write-off. If the doubtful debt is not accounted for, then a problem can arise when concluding a major deal.

For example, having studied the accounts of the business, a lender or an individual interested in investing in the company notices a large amount of receivables. Fearing that the company will not have enough funds to fulfill its obligations due to a large portion of debt turning out to be uncollectible, an investor or the bank may refuse to work with the business. Alternatively, if this factor is not paid attention to, and the company is unable to repay the loan, serious claims can be brought up, including charges of fraud and deliberate distortion of data.

In addition, it is not beneficial for the company itself to have financial data that does not reflect its real position accurately. Having a doubtful debt accounted for in the books will allow the management to make better decisions and not count on money it is not likely to receive.

Allowance for the doubtful debt – Definition and Explanation

Instead of writing off bad debt directly, if the amount of the unrecoverable debt is significant, a company might need to put in a reserve for doubtful debt because not all debtors may pay it back and all sales that a company makes are not going to be good sales. Thus, the business may have to make an estimation for uncollectibles because certain companies will have a certain amount of receivables that will not be collected.

Even if they do not have an easy credit policy or if they even have some kind of relatively conservative interest rate, there may still be defaults on some of the sales. A result of this will be a fact that the Accounts receivable and Net income will be overstated. Thus, the company needs both of these to be at its actual transparent value.

An account that is used to bring down the Net income (Profit and loss statement) to its real value is an account known as Bad debt expense. To adjust the Accounts receivable (Balance sheet), we will turn to the Allowance for doubtful debt. This will be a reserve account just for accounts that will not be paid. The company is making an allowance because bad debts are a regular thing if you have credit sales.

Examples

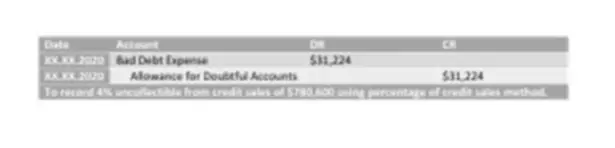

Our company uses a sales method to find the amount of reserve for the bad debt it needs to make. It estimates that 4% of its sales on credit will not be recovered. In the year of 2020, the company had a total of $780,600 in credit sales. Thus, it will need to make the following record:

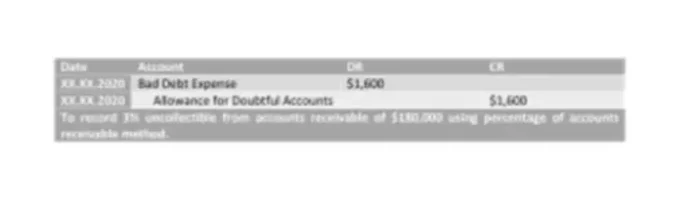

Let’s say another company prefers the percentage of receivables method for estimating allowance. It expects 3% of accounts receivable balance to go default. The ending balance at the end of the year was $180,000. The balance in Allowance for doubtful accounts should equal $180,000 X 3% or $5,400. Currently, it is $3,800. An adjustment of $1,600 ($5,400 – $3,800) needs to be made.