501 c3 Definition

There are many kinds of tax-exempt organizations, however, the 501c3 is the most common. It is the United States legal code number that creates space for federally tax-exempt charities. Charities are typically nonprofits that have fundraising events and largely depend on donations to fulfill their mission. They might include:

- Hospitals

- Religious organizations

- Scientific, literary or educational charities

- Charities for amateur sports

- Testing for public safety (e.g. crash dummies)

- Charities involving cruelty to children, women, and animals

Nonprofit vs. Tax Exempt

First of all, we would like to point out that an organization would not be considered a tax-exempt charity no matter how much good work it does until it is registered as one with the IRS. A nonprofit organization or a nonprofit entity is a type of entity on the state level. It is an entity that is set up by filing documents with their particular state. All it means is that the particular entity does not pay revenue distributions or dividends to the stakeholders of the entity or the people in control of the entity. This status does not necessarily mean that the organization is exempt from government taxation.

A tax-exempt organization, however, is a federal tax status. Generally, the only way the entity can become tax-exempt (some exceptions exist) is by filing certain documents with the IRS. So, tax-exempt is determined on a federal level and will only exempt the organization certain taxes. It does not exempt the organization from all taxes. Usually, it would just eliminate the federal and state taxes, but the entity would still need to pay employment and other taxes.

Maintaining tax-exempt status

There are several reasons why an entity would want to keep its tax-exempt status.

- The entity does not have to pay federal and state income taxes and sales taxes.

- This type of nonprofit is able to receive tax-deductible charitable contributions.

- The organization is eligible to receive private foundation grant money.

- It is eligible for lower postage rates.

- There are many funding sources that are limited to 501c3 entities.

- The 501c3 organizations are eligible to receive gifts of real estate and other valuable properties.

Many nonprofits do not realize that it is easier to get the tax-exempt status than to keep it. The organization needs to stay compliant with the year-to-year requirement because if it loses its tax-exempt status, the nonprofit might have taxes to pay and donors will be hit with tax liabilities that they were not expecting because they will not be able to deduct the donations.

Nearly every 501c3 has some version of IRS Form 990 to file each year. Which form (e.g. Form 990, Form 990 EZ, Form 990 N, or Form 990 PF) it will need to file will depend on several things that we are not going to dive into in this article. Along with the form itself, the organization will need to provide other information that might include a complete statement of revenue and expenses, information on policies and disclosures, details of governing body and management, etc.

How Can Donors Receive Tax Deductions?

If a 501c3 is compliant with the many strict rules to maintain its nonprofit status, then donors giving money to it get to deduct that money right off the top when they are doing their taxes. The U.S. government essentially underwrites charitable donations, at least to some point.

How to determine if a charity is qualified to receive tax-deductible donations? Donors cannot just give money to a kid on the corner with a lemonade stand and expect to receive tax deductions. The key to actually being able to deduct that money is to determine whether the charity has been qualified as a 501c3.

These organizations need to go through a specific process with the IRS in order to be considered able to solicit these donations. They should be able to provide donors with the letter that this is the case. Typically, if the donation is over $100, the organization is required to provide a receipt and the donor is required to keep that documentation to deduct taxes in case the tax authorities want to take a closer look.

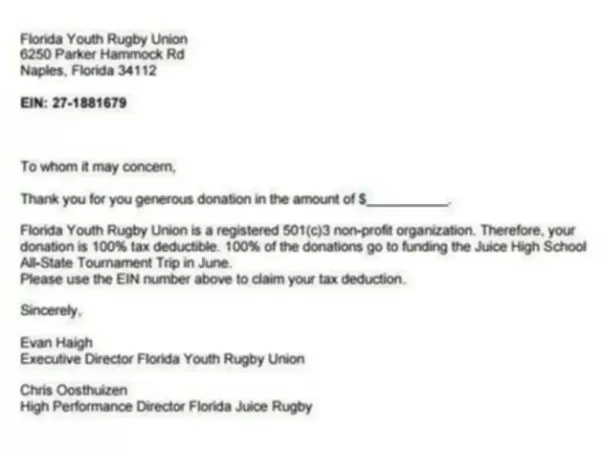

This receipt would need to be correctly written or it might not be accepted by the IRS. It is best if the non-profit organization has a standard template for their receipts that it can easily fill out for each donor. This receipt would have the nonprofit organization’s name, address, and, most importantly, EIN, which is charity’s own unique federal employer identification number that it obtains by applying to the IRS.

The receipt would also include the amount of the donation and date, and state that the organization is a registered 501c3 organization. Finally, it would have a signature, name, and title of the person signing the receipt. There are many free templates available online for the organization to use.