Accounting in non-profit

Accounting information is used by users for decision-making and control. The company’s management, having analyzed the accounting information for the year, will make decisions regarding the further activities of the non-profit organization. After studying the accounting information, the donors decide whether or not to give funds to the organization and if they are appropriately used. The governmental bodies will check whether the organization correctly maintains its bookkeeping records and if it meets the conditions for holding the non-profit status.

By the way, accounting information provided to users is called reporting or you might see it referred to as financial statements. It turns out that the accounting function of the organization should:

- collect complete and reliable information about the activities of the entity

- process collected information

- periodically present the results of its processing for users in the form of financial statements.

All this would be happening continuously since the beginning of the organization’s activities. Accounting is the key to the success of every organization, whether for-profit or non-profit. Besides helping the entity avoid any penalties and fees due to inappropriate fund allocations, late payments, and so on, it also helps the organization know what it has and how it can better use these resources for the goals of the organization.

Without proper accounting, it will be hard for a non-profit to attract donations and do fundraisers. This systematization of financial resources helps the management to identify which department/project has sufficient funds and which did not attract enough resources in order to achieve better results. It would be difficult to do this without accounting.

Fund accounting

Fund accounting is an integral part of financial recordkeeping at a non-profit organization. It might seem that a non-profit does not set profit making as its main goal, so accounting should be simpler. With regular accounting you would do in a for-profit business, you would need to keep track of assets, liabilities, equity, as well as accounts that go on the Income Statement.

With a non-profit, you would still need to account for similar items, but each section would be further subdivided into fund categories. For example, you can have different funds set up for each of the projects your organization has going on as well as a general fund for paying your rent, utilities, and other expenses and recording revenues and expenses associated with donation, grants, tax payments (for government organizations), and other private or public sources of funds.

Fund characteristics

In fund accounting, it is important to know three main characteristics of the funds you will be accounting for.

- Restricted fund. Funds with limited spending cannot be spent on current activities. They are, firstly, intended to reflect the funds received from the donor, that are intended to be used for certain non-profit activities and/or within a specific time frame. These restrictions are well known at the time the donation is made and should be strictly adhered to. Secondly, at the expense of these funds, often non-current assets (buildings, structures, equipment, etc.) are created or acquired. This allows donors to ensure that the funds they give to the organization are spent exactly as they wish they would be spent.

- Temporarily restricted fund. Funds temporarily restricted for spending can also not be spent on random activities or whenever the organization wants to spend them. They are intended to be used within a period specified during the donation. Once the organization completes the activity these funds are intended for or the time frame for their use is over, the temporarily restricted resource becomes unrestricted or stopped.

- Unrestricted fund. Only funds in no way limited for spending can be used freely. An example of such money can be membership fees in nonprofits in which membership is provided, as well as any receipts of donations, grants, and other funds without the donor specifying a specific purpose of use or time. This allows the management to use these resources as they see fit with no strings attached.

Fund accounting reports

As a result of fund accounting, you will have a self-balancing set of accounts per fund. Each fund can include the following elements: assets, liabilities, net assets, revenues, expenses, gains, and losses. In simple words, fund accounting can be thought of as the accounting segregation of resources. Note that you do not necessarily have to have a physical separation of these funds. In other words, you can have one bank account for all the funds that come in and out of your non-profit or public organization, but keep separate records for each category or project. Each such fund would be created by legal, contractual, or voluntary actions of the organization.

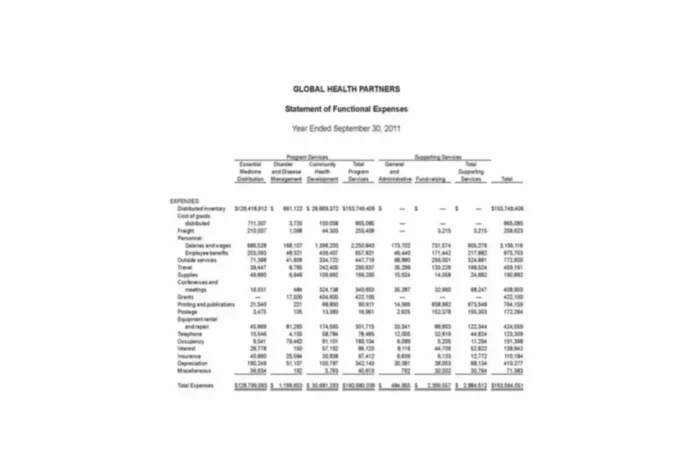

Accordingly, you would have separate financial statements prepared for each fund set up at the organization. Alternatively, you can have separate columns for each fund (project) and then create subtotals for each fund, which will be added together to present the overall numbers for the entity. The funds are typically divided based on the function or type of resource or spending, such as a general fund or capital fund. You can see an example of such a report below.

Thanks to fund accounting, you will be able to prepare all the standard financial reports for non-profit or public organizations. These include the Statement of financial position, Statement of revenue and expenses, and others. The first one shows the excess assets over the liabilities of the entity, which is also known as the fund balance and can be thought of as the for-profit’s equity account. The second report presents the revenue and expense items and totals to the excess of revenues over expenses. You can prepare financial statements for each fund, but it is not required to have fund accounting for each report.