Every enterprise needs an accounting system that would be able to continuously monitor changes in assets, capital, and liabilities status. Also, this system should provide the ability to draw up a Balance Sheet and other reports at the right time.

After looking at the Balance Sheet, we know that it displays the value of all assets, equity, and liabilities of the enterprise. This is carried out by combining assets and liabilities into separate groups – fixed assets, current assets, long-term and current liabilities, etc. However, this information is too generalized.

To ensure proper accounting, enterprises need to record each separate type of assets and liabilities at their value and only then combine them into separate subgroups, and subgroups, in turn, into main groups for their subsequent presentation in the company’s Balance Sheet. To account for such individual types, subgroups, and groups, accounts are created and used in the double-entry accounting system. Each company decides independently how far it wants to break down each group and how much detail it needs taking into account its own specific conditions.

Definition and Explanation

In accounting, there is an account for office supplies, equipment, rent expense, salary payable, etc. Each account has a debit and a credit. The account can be conveniently represented in the form of the letter “T”. Therefore, they are often called T-accounts and their definition, accordingly, is a visual representation of individual accounting accounts and the effect of transactions on these accounts.

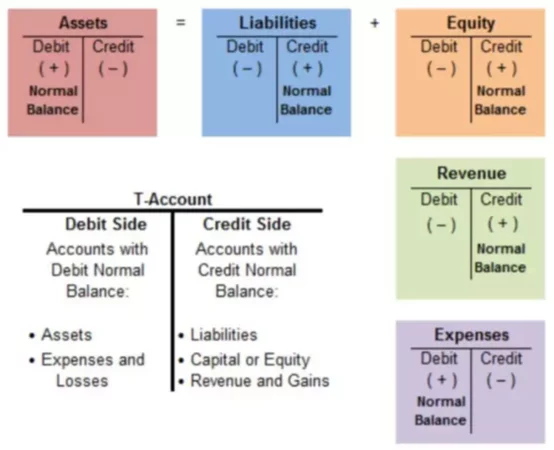

The left side of the T-account is called debit, the right side is credit. The amount of debit minus credit is called the balance. If the amount is positive, then they say that the account has a debit balance, if negative, a credit balance.

Any financial transaction affects the debits and credits of at least two company’s bookkeeping accounts. How would you know if you need to record a transaction as a debit or credit? For this, you would refer to the normal balances of each account (see illustration below). As you can see, some categories of accounts would be increased on the debit side, while others on the credit side.

To maintain the equality of the Balance Sheet, the debit amount of all the accounts involved in the transaction must be equal to the credit of the accounts involved in the transaction.

Example

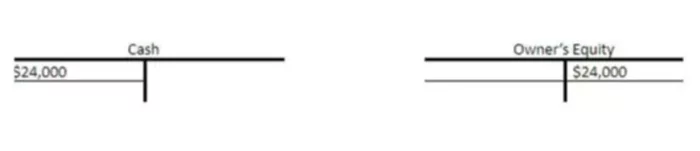

vTo illustrate, we will guide you through the first couple of financial transactions of ABC company in T-account form. The owners invested $24,000 of cash into the company. In our bookkeeping records, we would debit the Cash account and credit the Owner’s Equity account. With T-accounts, we would also use the normal balances of each account to know which side to use to increase or decrease the account’s balance. It would look like this:

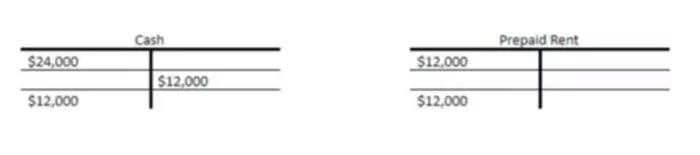

Let’s record another financial transaction. At the beginning of the year, the owners rented a warehouse for one year ahead, paying $12,000 in advance for the entire period. A bookkeeping entry for this would reflect a debit to the Prepaid Rent and a credit to Cash. Using T-accounts, we would record this transaction as follows:

Note that now the balance on the Cash account has decreased because it reflects all the transactions recorded under this account for the whole period. This is known as closing balance and is calculated for each account at the end of the accounting period. To do so, you would calculate the totals for both the debits and credits. Then, you will calculate a difference between the two and record it on the side where you had a larger number. This balance will then be known as an opening balance at the beginning of the next period.