Running a successful business means keeping track of profit and cost. Of course, this is more easily said than done. Business owners rely on different types of reports to capture different aspects of their financial structure. One example is the Income Statement, which is well known for its usefulness in communicating a business’s strengths and weaknesses and informing corporate strategy. Despite its ubiquity in accounting, it can be an incomplete, and even misleading, summary of a company’s performance. Fortunately, there is another type of report that fills in the gaps and provides a more holistic overview. This report is called the Statement of Comprehensive Income (SCI).

Definition

The Statement of Comprehensive Income (SCI) is a robust financial document that summarizes two kinds of income.

- Standard net income, which encompasses revenue earned and expenses incurred, including taxes and interest charges.

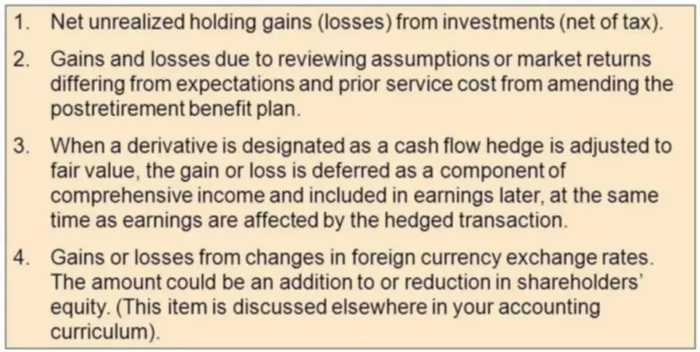

- Other comprehensive income (OCI), which describes unrealized gains and losses that result from fluctuation in value of certain assets. These items are excluded from the Profit and Loss and instead recorded as equity (see illustration below).

A company can accumulate other comprehensive income in several ways. It may have a bond portfolio that is fluctuating in value, or realize gains and losses from cash flow hedges. It may also see fluctuations in other holdings, like pension plans and currency holdings for international transactions. Companies with gains and losses that qualify as OCI tend to be larger and have international holdings.

The SCI offers a thorough overview of an enterprise and provides key information to owners and potential investors. Every business owner should learn about the Statement of Comprehensive Income, especially if they are wondering which accounting procedures and financial reports are best for their company.

Statement of Comprehensive Income Structure

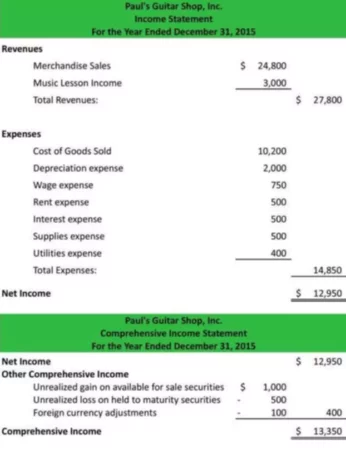

The Statement of Comprehensive Income has two components. The first component is the Income Statement, and the second is for OCI. To generate the SCI, accountants simply add the two components together.

Comprehensive Income = Net Income + OCI

The company can decide the presentation format for the report and present one or more reports. They have the option between submitting a single SCI or a combination of two documents: a Statement of Comprehensive Income and an Income Statement. The report must follow all applicable GAAP and/or IFRS standards for accounting for OCI.

Accountants calculate a Statement of Comprehensive Income in accordance with the accrual accounting basis, in which earnings are recognized when they are earned, not when cash is received. Likewise, expenses are recognized at the point that they are incurred, even if they were paid in the previous or subsequent reporting periods.

Example

The above figure shows an example of a Statement of Comprehensive Income. The first section of the document conveys basic information about the business and the report. As you can see, the first component, net income, is followed by several terms that fall under OCI. These sections both combine to calculate the total comprehensive income and complete the SCI.

How to distinguish other comprehensive income from profit/loss and changes in equity?

There are two questions that will help a company’s accounting department determine whether an item is OCI, or whether it should be considered part of the Income Statement or as changes in equity. Consider the first question:

1. Is this change a result of operations or is it a change in equity related to shareholders?

The Statement of Comprehensive Income must clearly show why net assets increase or decrease. If change occurs through transactions with shareholders, then it is reflected in equity. If the change is due to activities within the enterprise, such as the transfer of property, then it is instead included in the SCI.

After determining that these changes are related to the company’s activities, consider the second question:

2. Does GAAP allow these changes to be reflected in OCI?

To be considered OCI, balance sheet items must be unrealized gains and losses that are excluded from the Income Statement. GAAP standards require that items included in other comprehensive income and those included in net income be mutually exclusive.

With so many types of financial reports and accounting methods in existence, you may be wondering which ones would benefit your business. Learning the broad strokes is one thing; doing your own bookkeeping while running a complex business, on the other hand, is much more daunting. Fortunately, there is a way to avoid the stress and potentially costly mistakes: hire a bookkeeper to meet your accounting needs with confidence and precision. Contact BooksTime to find out more about how we can help you to grow your business while saving you precious time!