Single-Entry Accounting

The single-entry method is a traditional way of bookkeeping and does not follow a fixed set of accounting rules. Its feature is that only one entry is made for each transaction either in the form of revenue or expense, just like in your checkbook. Depending on your preferences, you can record everything in just one column or keep a two-column ledger, separating your income and expenses. It would still be considered a single-entry method because there is only one entry made for each financial event. Since it is not self-balancing, mathematical errors are common and fraud is more likely.

Double-Entry Accounting

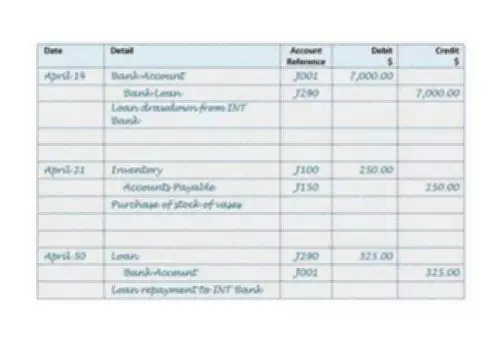

Double-entry is a way of maintaining accounting records in such a way that the two-sided effect of a transaction is recorded in the appropriate accounts, providing an overall balance. Thus, for every debit there should be a corresponding and equivalent credit entry/s. Depending on the type of account, the debit or credit of the account may reflect an increase or decrease in one or another accounting object according to the “debit-credit” rules.

Double-entry ensures the connection/correspondence between different accounts. It allows see at a glance the paths of cash inflow and outflow, giving advantages for specialists seeking to evaluate and improve the entity’s financial position. This accounting method is one of the main elements of the formation of reliable information on the business operations of an enterprise. As a result, the business has the following advantages:

- creation of a unified accounting system;

- control over the use of available resources and funding sources;

- correct reporting.

Which Bookkeeping System to Choose?

To help you decide which system will be best for your business, we summarized the advantages and disadvantages of each. Let’s first look at the single-entry bookkeeping system.

Advantages:

- It is a good choice for small business firms, freelancers, etc.

- There is no need for specialized knowledge to maintain books.

- It also does not require extra spendings on expensive bookkeeping software/tools.

Disadvantages:

- Arithmetic accuracy cannot be guaranteed.

- It provides incomplete and unrealistic result of trading.

- It is difficult to detect errors and fraud.

- It delivers improper valuation of assets and liabilities.

- Business and personal transactions of owners can be mixed.

- This financial information is of no value to external parties.

As you can see, there are many disadvantages to this system. However, if you are a freelancer or a startup and want to have at least some kind of record of your finances without needing to hire a bookkeeper, this might be a good option for you. Now, let’s see what the double-entry method can offer you.

Advantages:

- This is a modern, complete, and scientific method of maintaining books.

- Since both aspects of the transactions are recorded, a Trial balance can be created.

- Mistakes and fraud can be easily and often instantly detected.

- This system can be used by every business, no matter its size or sphere of activity.

- Ability to prepare reports enables the business owners to plan, control and take necessary actions.

Disadvantages:

- The person who is responsible for bookkeeping should possess specialized knowledge and skills.

- It might require purchase of special, often expensive, bookkeeping software/systems.

As you can see, this method has only two disadvantages, but they can be a huge roadblock for those who are not familiar with bookkeeping but cannot afford to hire a bookkeeper. However, there are online bookkeeping services that can do your bookkeeping using this system for a fraction of the price that you would pay an in-house bookkeeper. This can be a great option for those who want to benefit from the numerous advantages of the double-entry accounting system.