Definition

Selling, general, and administrative expenses is an accounting term that you will see on the Profit and Loss report. What exactly are these expenditures? It is actually very close to its name. The definition of SG&A is the sum of all expenses that are directly or indirectly related to sales and all costs incurred to manage the overall company. SG&A expenses, also known as operating, are usually recurring costs and do not include one-time costs in most cases.

Selling expenses comprise all the costs associated with or tied to the company’s sales. They are a result of the company’s effort to create sales and fill customer orders. These spending items typically rise and fall with sales and are mainly related to distributing, marketing, and selling.

Direct selling expenses are can be easily traced to the sale of specific merchandise. Indirect selling expenses cannot be directly allocated to a specific unit but are proportionally distributed between all products or services sold during that period, such as phone, electricity, shipping costs.

Expenses that arise in the course of everyday activities of a business and incurred independently from sales are usually classified as G&A costs. They are incurred for the benefit of the enterprise as a whole and are not related wholly to a specific function. Typically, the company will still have to pay for these expenditures even if nothing is sold. Moreover, most of them are dollar amounts that do not vary based on business activity volume.

SG&A in Accounting Records

The selling expenses usually include salaries of sales personnel and executives, advertising or promotional costs, and travel expenses. They can also include selling commissions, shipping expenses, sales supplies used, credit and collection costs.

The general and administrative portion of the SG&A, on the other hand, includes salaries and benefits of non-sales personnel, such as management and legal staff, building rent, office equipment depreciation, supplies, utilities, travel costs, consultant fees, subscriptions, bad debt expense, insurance and other related spendings.

Optimizing SG&A Expenses

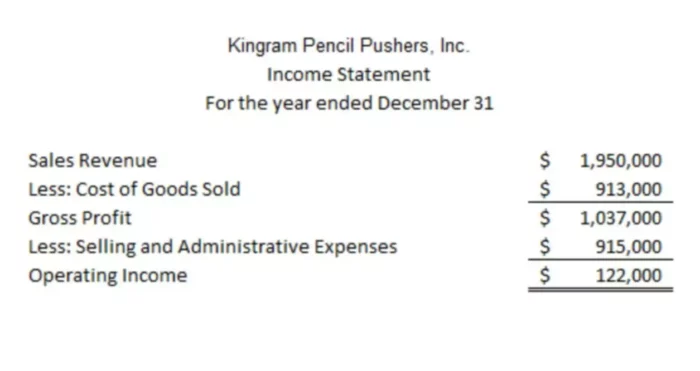

SG&A is a major non-production cost reported on the financial reports. This figure is used in the calculation of different margins and when looking at the profitability of a company. When looking at the SG&A expenses, you will be examining them as a percentage of revenue/net income. By doing so, you will know how much you will be spending besides your cost of goods sold.

During the economic downturn caused by the coronavirus pandemic, every company thinks about how to optimize its business. Often, decisions are made at the highest level based on a limited set of data, such as revenue forecasts or a comparison with competitors.

In the meantime, leaders should approach business optimization with data from the most valuable source they have – their employees. By empowering them to participate in collecting data and making recommendations, leaders can gain a more complete picture of what actions and initiatives are already taking place in the company.

They will also be able to better understand which activities are strategically important, and which can be automated, outsourced (or abandoned altogether). This way business leaders can not only significantly reduce SG&A costs, but also use their resources more effectively to achieve goals much faster, since both lower-level managers and employees tend to provide support, and the changes made have a longer-lasting effect.