Definition

A reversing entry is simply an entry that reverses the month-end adjusting entry from the period before. In other words, you just flip the debits and credits you made before to set up an accrual and post an entry on the first day of the next month. What you are trying to do is offset what you did at the end of the last month. One thing to keep in mind is that reversing entries are completely optional.

Accounting systems have the ability to automatically reverse accruals. In fact, you can set up the accounting system to reverse an entry whenever you want it to and not on the first day of the next month. Usually, you would check a box when making an adjusting entry to tell the system that it is a reversing entry, so it would automatically reverse it.

Why would one want to use reversing entries if they are optional? This method simplifies the recording process of subsequent transactions by eliminating the need for certain compound entries. If we skip reversing entries, easy entries next year get really complicated.

You would usually come across reversing entries with expense or revenue accruals and deferrals. Only the deferrals that are recorded on the Balance sheet do not get reversed. The entries that we can reverse share one common feature: our simple computer program wants to make an entry that affects an Income Statement account every time it debits or credits Cash in normal situations.

Example

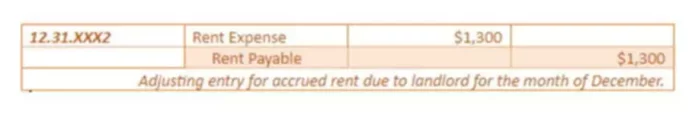

Let’s say Flower Shop pays its rent on the 15th of every month. At the end of the financial period, the company makes closing entries. Since the rent in the amount of $1,300 for the last two weeks of that has not been paid yet, it will record an accrued rent expense.

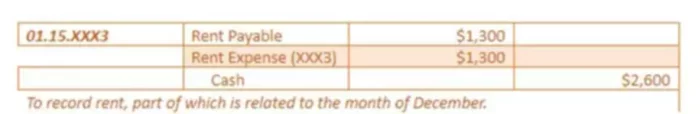

If the company decides not to use the reversing entries in its financial accounting, the entry for rent payment next year will look as follows.

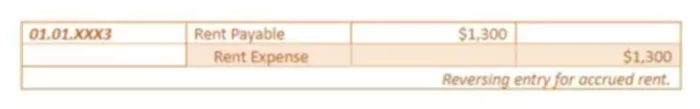

The same events could be recording using reversing entries. First, we would use the same account we used in the adjusting entry with contra debits and credits.

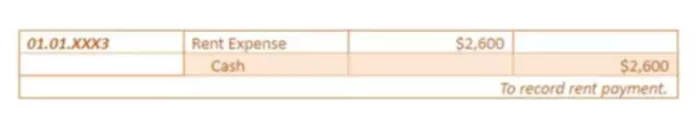

When the company makes a payment on January 15th, the journal entry would now look as follows:

As you can see the net effect on a Rent Expense account is the same. No matter which method is used, the Cash account has the same amount credited to it, while Rent Payable has a zero balance in the end.