Having business records up-to-date and accurate is vital for every company regardless of its size or its business sector. That is why one of the key duties of accountants is to keep track of all company financial transactions by recording them into the company’s accounting system or writing them down in the journal and then transferring the entries into the general ledger.

A transaction is any condition or event that must be recorded in the books of business because of its effect on the financial condition of the business. Based on all of these recorded transactions, financial and management reports are prepared for different stakeholders, from owners, bankers to government entities, like tax authorities.

The Process of Recording Transactions

Recording business transactions is the process of entering business events into the accounting system, which is more common and very automated now, or accounting books. By recording transactions, we translate business transactions into accounting records. Accountants follow a three steps methodology in recording transactions:

- Understand the business transaction;

- Identify the affected accounts;

- Meet the conditions of the double-entry accounting concept.

Understand the business transaction

The responsible person would need to collect the required information to understand the nature of the transactions (whether it is a purchase or a payment, and so on) and know the monetary value of the transaction and parties of the transaction. This understanding of the business transaction is achieved by examining source documents. There are several main financial transactions one would come across:

- Sales – sell goods and/or services; with a cash sale, a customer pays at the time of sale, while with on account sale, the business allows the customer time to pay;

- Purchases – purchase goods and/or services; with cash purchase, the business pays the supplier at the time of the purchase, while with on account purchase, the suppliers allows the buyer time to pay;

- Payments – receive customer payment either at the time of the sale (cash sales) or a payment from a sale made on account (credit sale);

- Payroll – pay employees’ salaries and wages;

- Loans – borrow money and repay money borrowed on loans;

- Pay owners – owner withdrawals.

For example, an accountant would know that an organization has made a purchase transaction from examining the invoice received from the supplier or there is an increase in the Inventory account by examining the goods received note.

Identify the affected accounts

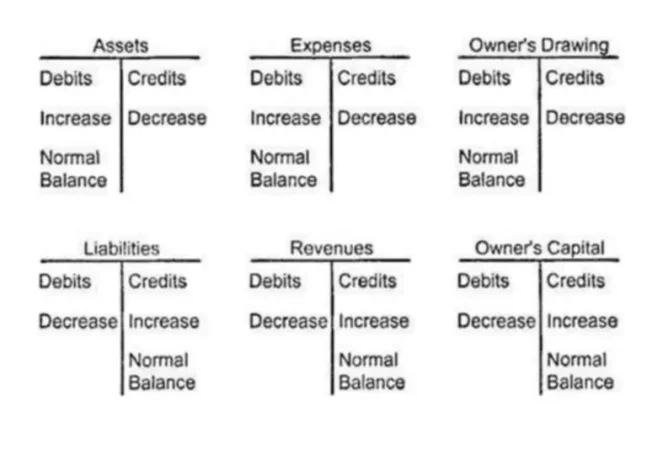

The second step is to identify the affected accounts and how they will be affected – debit or credit, depending on whether it is an Asset, Liability, or Equity account. For example, in a purchase transaction, at least one Asset account will be affected, whether we debit Inventory or Fixed Asset or credit Cash, if it is a cash transaction.

Always keep in mind that in a typical business transaction, we get something and we give up something, which is the basis of the double-entry accounting concept. This means that with every transaction an accountant records, there will be at least two accounts that will be involved in the process or creating journal entries for the transaction. After recording transactions in the journal, you need to transfer them to the general ledger.

Meet the conditions of double-entry accounting

The final step is to check whether the debits and the credits of the recorded event meet the conditions of the double-entry accounting and everything is still in balance. If you are still learning which account to credit and which to debit, refer to an illustration below.

Example

Let’s say you have a loan agreement that states that Company A obtains $8,500 of cash by receiving a loan on July 15th, 20XX from Bank Y. First, we understand that this is a borrowing money (loan) transaction. This transaction will affect the company’s Cash account because it received the cash. The other account affected by this transaction is Loans Payable because the company owes this money to the bank.

Since Cash is an Asset account and it increased, we will debit it. The Loans Payable is a Liabilities account. This account also increased because now the company owes more than it did before, so we will make a credit entry. When we depict this transaction in the accounting equation, it balances out.

$8,500 (Assets) = $8,500 (Liabilities) + $0 (Equity)

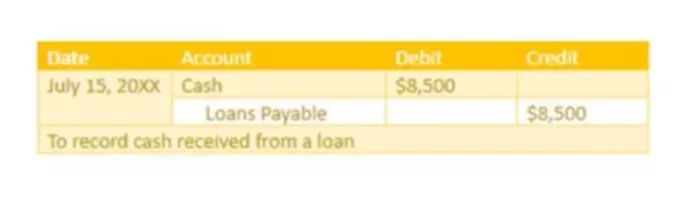

A journal entry to reflect this cash loan transaction starts by recording the date of the transaction on the left side. We will debit the Cash account. This is written first in the account description column and the amount is recorded in the debit column. Then, we will credit the Loans Payable account. The liability amount is included in the credit column. Optionally, a short description is provided underneath. Note that the accounts that are debit are written first, followed by accounts that are credited, which are slightly indented to make it easier to read the journal entry. It would look like this: