When you start a business or even try some freelance work, there are many terms and concepts you would need to know. It is likely that you will come across two seemingly familiar terms: purchase order and invoice.

To help you better understand how purchase order and invoice play together and at the same time differ, it is best if we describe a life situation you are likely well aware of. Let’s say you go to a restaurant and order yourself dinner. Although you typically do not do it in writing, whatever you ask the waiter to bring to you is considered to be a purchase order.

Once the food is prepared, the waiter brings the food you asked for to your table, thereby fulfilling your purchase order. Then, you finish your meal and ask for the check. The waiter brings you a bill for the food and drinks served to you, which is equivalent to an invoice a company would send to the buyer once the items requested are delivered. Finally, you transfer the money for these items. This is how the purchase process works in a nutshell.

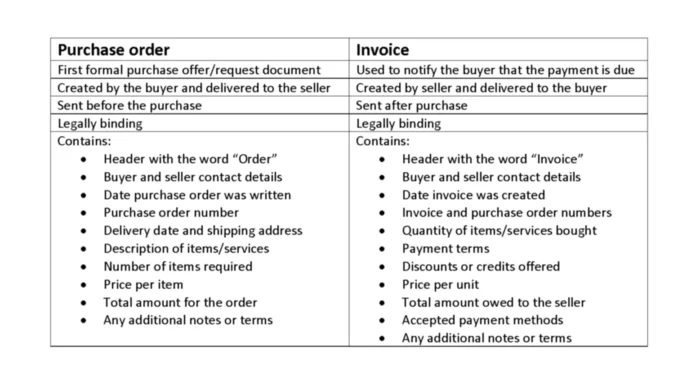

Quick Comparison

What differentiates a purchase order and an invoice is that the first one is only for ordering goods from a supplier or another party and thus defines the terms of such a sale. The invoice is then used to confirm a sale, it is a supporting document. Now, let’s look a little closer at elements of the whole process (the purchase order and invoice) to offer a more comprehensive comparison.

What is a Purchase Order

A purchase order is an agreement between two parties where the buyer declares a desire to purchase a specific amount and type of goods. After this agreement is made, the seller has time to prepare the goods ordered and send them to the buyer. This brings us to one of the differences between the two documents. The purchase order usually specifies the expected or guaranteed delivery times.

Business owners, especially startups and small businesses, often overlook the fact that this is a contract between you and the vendor. So, if there is a dispute, or a disagreement about payment, shipment, and even about performance, you will have something to reference. It also serves as a legal defense for whoever sold the goods in case they are not able to retrieve money for their goods or the buyer rejects the order. Thus, a formal purchase order is a necessity that should not be ignored.

It should be noted that the purchase order is not a fixed document and, initially, the specific details of a purchase order may be revised if they are not suitable for the seller or there are any errors in the document, which will then be reissued until agreed to by both parties.

If purchase orders are well documented, then if you need the information of the vendor in case of any issue, you will be able to reference all the necessary data. Automated solutions that keep track of all the purchases allow businesses to protect themselves in case any issues arise and also help to search for the necessary purchase order, which can save a ton of time if you have multiple vendors and years of purchase orders, based on any piece of information from that purchase order (e.g. vendor name, date, item description).

Example of Purchase Order

The purchase order is a way of telling the seller what you want in an official kind of way. To illustrate this concept, let’s look at an example. Company A desires to purchase 400 coats from its supplier Clothing Inc. the following month. To let the supplier know about its plans to make the purchase and place the order to ensure that Clothing Inc. has a sufficient number of coats, it sends the purchase order. Clothing Inc. receives the purchase order and adjusts its manufacturing as necessary.

The next month, Clothing Inc. sends the 400 coats Company A ordered. Company A looks at the purchase order it sent to Clothing Inc. to make sure that the right number and the right model of coats it ordered earlier is delivered. The next step will involve an invoice, which we will discuss later in our article.

A purchase order can help keep track of your business processes. For instance, when you order 400 coats of product and only 380 coats arrive, you can contact the supplier and ask for the additional 20 coats that you need to properly replenish your inventory. Otherwise, you might realize you are short on something at the most inconvenient time. It also allows you to ensure that the price charged on the invoice matches the one you agreed to when you originally requested the order.

What is an Invoice

After the order is ready to be shipped or has already been sent, the seller can start preparing an invoice. Although both documents may contain the same information, they are provided at completely different stages of a business transaction. The invoice is an indicator of the buyer’s debt to whoever they made a purchase from, that is, the payment for these is still to be made. This creates a debtor-creditor relationship between the buyer and the seller.

The invoice is often generated on the basis of a corresponding purchase order. However, it can be created without any purchase order, for example, when a customer simply made a purchase but will pay later. While creating an invoice might not sound like a big branding opportunity, having a well-designed and professional-looking invoice can make a big difference.

As seen from the comparison table above, the invoice has a lot of similar information that a purchase order does, which is why the purchase order and invoice might look similar to some. Their similarities, actually, allow invoicing tools and software to copy data from one document to another.

The invoices should be with consistent branding to ensure the company issuing them looks trustworthy. It should be clear what the invoice is for with a clear itemized list of goods or services, which is likely to be the same as specified on the purchase order. The PO number is added for easy reference for both parties. So, you want everything that a person or company paying would want to know and be able to actually pay you to be there.

Payment Terms for Invoice

Also, what sets the invoice apart from the other accounting document we discussed earlier is that it also has a due date and other terms for the payment. Besides the due date, there might be a note that a late payment fee will be charged if the customer does not make a payment within the agreed time period.

When it comes to terms, you should be familiar with abbreviations used on the invoice. An abbreviation Net 10, for instance, means that the buyers have 10 days to pay the bill. A slightly different abbreviation that might look something like 4/14, Net 30 translates as please pay within 14 days to save 4%, otherwise, you have 30 days to make the whole payment. The count typically starts from the invoice date. The seller can specify other payment conditions, such as upon receipt.

Although it might seem that the seller is losing money, discounts push buyers to pay earlier which means the seller has actual cash running in the business that can bring even more profits than what has been lost. Actually, it is typical to see the invoice simply list a discount amount right under the subtotals, lowering the final amount to be paid or the seller might choose to simply lower the price per item at the request of the buyer. The discount part is what you would not usually see on the purchase order, but it is relatively common for invoices.