To estimate the prospects of your business and properly manage it, you need a fast,and at the same time, a reliable way to calculate expenses and profits. To do so, youneed to account for all your costs, including prepaid expenses properly. Prepaidexpenses are also a great way to secure a product or service and not worry aboutforgetting to pay for it. Find out other benefits of prepaid expense, how they arerecorded and amortized.

Definition of prepaid expenses

Prepaid expenses are a type of asset, a current asset to be specific, that appears on thebalance sheet as a result of the business making payments for goods and services thatwill be received soon. These are payments for expenses in the current period that willbring benefit for more than one period, for example, commercial lease rent or insuranceexpense, which is often paid as a single payment for annual coverage.

Examples of prepaid expenses

In particular, prepaid expenses include two areas of spendings. The first one is thecosts associated with the preparation of production for the season of active operations(in agriculture and seasonal industries), and the costs associated with the preparationfor the launch of new production facilities, the development of new technologies andenvironmental measures.

The second one is advance payments for work and services not related to the operatingactivities of the enterprise. For example, payment of an insurance policy, subscription toperiodicals, preliminary (several months in advance) rental payments, trainingpayments. Quarterly estimated taxes that businesses pay throughout the year are alsoanother example of prepaid expenses.

How are they recorded?

Expenses incurred by the organization in the reporting period but related to the followingreporting periods are reflected in the balance sheet following the conditions forrecognition of assets established by accounting rules and principles. Let’s review tounderstand example of prepaid insurance and how this expense is recorded.

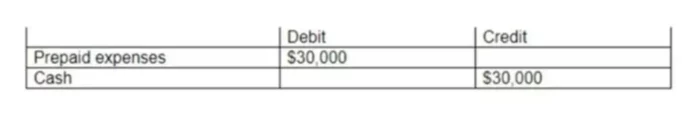

For example, a company made a payment of $30,000 for the insurance for the 12months of the upcoming year. Journal entry for this payment would look like this:

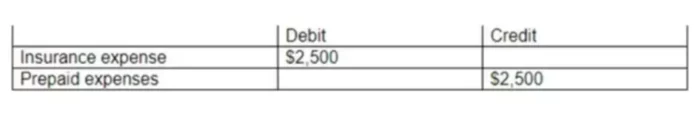

At the end of each month, an accountant will make an adjusting entry reflecting theamortization of the prepaid service (more about amortization later in this article). Anadjusting entry at the end of each month will look as follows:

By the end of the year, the Prepaid expenses will be reduced by the amount respectiveto the amount it was initially debited – $30,000.

What are their advantages?

There are several advantages to paying for product and services in advance for anycompany and even individuals. The first benefit is that a company will get payments thatit will have to make anyways out of the way, and nothing will surely be forgotten.

The second benefit of prepaid advantages is that a company can save a significantamount of money. The reason for this is that paying in advance. They ensure that they

secure an advantageous price, and no matter how much it rises, they already boughtthe product or service. It just has not been used yet. Moreover, bundle prices usuallyend up costing much less and who would not love to pay less.

Also, it is worth mentioning that besides securing a specific price, the company might beable to be confident that it will get a product or service that it needs when it needs.Lastly, it is a great way to get tax deductions, and some companies make advancepayments to take advantage of tax deductions.

Prepaid Expenses vs Accrued Expenses vs. Deferred Expenses

There is income and expenses that relate to this reporting period, but have not yet beenpaid in cash and not reflected in accounting, as well as rent and fees that are paid incash are reflected in accounting, but relate to different reporting periods and should bedistributed between them.

Accrued expenses are accounting expenses that are recognized before they are paid.Usually, these are current liabilities. Also, these expenses are generally recurring anddocumented in the company’s balance sheet due to the high probability that they will beincurred again.

Firms are almost exposed continuously to recurring expenses, such as salaries, intereston loans, and taxes. Even though they need to pay at a later date, they are usuallyreflected on the balance sheet of the company from the moment when the company canwith high confidence expect their occurrence, and until that time, when they are paid. Anexample of such costs is accrued interest, which periodically arises on a bank loan.

Deferred expenses, on the other hand, are expenses that have been paid in cash, arerecorded, but relate to different reporting periods, and should accordingly be allocatedbetween them. This means that during the reporting period expenses, which partiallyrelate to future reporting periods were paid in advance, and due to this should bereflected as deferred expenses.

The difference between deferred expenses and accrued expenses are that deferredcosts are an asset and represent prepayments that have not yet been incurred, while

accrued expenses are a liability and represent expenses that have been recognized butnot however paid. Now that we have deferred and costs accumulated out of the way,how are prepaid expenses differ from the two?

Prepaid expenses are very much like deferred expenses, and the two terms aresometimes used interchangeably. The difference between the two is that in accounting,prepaid expenses usually refer to payments for products/services that will be usedwithin a year. Deferred fees, on the other hand, are expenses that are also prepaid, butproducts/services will be used sometime in the future and not during this current year. Inother words, a journal entry for prepaid expenses will be under current assets, whiledeferred expense account is under long-term liabilities.

What is Prepaid Expense Amortization?

As you understood from the information presented above, products or services thatprepaid expenses covered will be used over some time and, accordingly, this should beaccounted for this.

The reconciliation spreadsheet included the amount of prepaid expense that is recordedat the time of payment. After the amount of amortization for appropriate periods isdetermined, an amortization schedule is created, which serves as the basis for adjustingjournal entries.

Initially, when the expense is paid for, a respective account for prepaid service orproduct is made. Journal entry for payment includes a Prepaid Rent account that isdebited and Cash account that is credited to account for the amount.

To record the consumption/use of the service or product, additional entries are beingadded. An amortization schedule will include journal entries at the end of each periodthat the service or product is used. In our case, this means that the prepaid expenseaccount, Rent Expense, will be debited in the income statement and Prepaid Rent assetaccount will be credited on the balance sheet.

It is essential to account for the use of services or products that have already been usedbecause it will reduce the prepaid asset by the corresponding amount until it reacheszero and one will be able to see an actual amount of prepaid expenses. The total in thereconciliation spreadsheet should match the total balance in the prepaid expensesaccount. Also, make sure to follow the accounting policy that governs the amortizationof prepaid expenses.