Financial Forecasting

The effective activity of enterprises in a market economy largely depends on how reliably they foresee the long-term and short-term prospects of their development, that is, on forecasting. Forecasting the activities of enterprises is an assessment of the prospects for their development based on an analysis of market conditions, changes in market conditions for the coming period, and other factors.

The results of forecasting the activities of enterprises are taken into account in the marketing plans, when determining the possible scale of sales of products, the expected changes in the conditions of sale, and promotion of goods.

Forecasting as a result of marketing research is the starting point for organizing production and selling exactly the products that the consumer needs. The main purpose of the forecast is to determine the trends of factors affecting the market conditions.

Financial forecasting is the study and determination of possible ways for the development of enterprise finances in the future. Financial forecasting, like financial planning, is based on financial analysis. Unlike financial planning, the forecast is based not only on reliable data but also on certain assumptions. During forecasting, the factors that influenced the economic activity of the enterprise now and in the future are studied.

The purpose of forecasting is to be able to evaluate the company’s work as “successful” or “unsuccessful” not by current indicators (profits, markets, dividends), but by those that could potentially be. The main task of financial forecasting is to identify additional financing needs that arise as a result of an increase in the volume of sales of goods, launch of new product lines, opening of a new location, the provision of new services, and so on.

The company can use internal or external financing. Internal financing refers to the cash flows generated by the normal operating activities of the company. External financing refers to capital provided by parties external to the company. The percentage of sales method is a great tool enterprises can use to make their financial forecasts and estimate what the future numbers will look like for the business.

Percentage of Sales Method

The percentage of sales method is one of the steps in financial planning. The essence of the method is that each of the elements of the financial documents is calculated as a percentage of the established sales value. It is one of the simplest and most effective methods of financial forecasting of an enterprise. Using this method, it is possible to determine the need for external financing, the participation of the organization’s financial structures in future financial transactions, and profit forecasting.

This method shows how much additional financing is needed for the company. The use of the percentage of sales method will help in determining the required amount of external financing. The calculation of the amount of required external financing is carried out in cases where the capacity of the enterprise (its fixed assets) turns out to be insufficient for an increase in sales and additional investments in fixed assets are required.

It is often the forecasts of future sales and related costs that provide the business with information to make proper forecasting of future external financing needs. This method involves estimating certain expenses, assets, and liabilities for the future period as a percentage of sales in the coming period, and then these percentages are used together with the forecast sales to compile the financial report. Percentage norms are determined based on:

- percentage ratios typical for the current activities of the firm;

- percentages calculated on the basis of retrospective analysis as an average over the past few years;

- the conclusion of the management, especially in cases where the existing percentage ratios do not satisfy the managers and they would like to change them to improve financial performance.

Thus, the resulting ratios, taking into account the planned sales volume, are then used to compile the forecasted financial statements.

How It Works

When looking at your sales and projecting that out into next year, you can also easily project out many other Balance Sheet items. Common accounts that are calculated as a percentage of sales include Accounts Receivable, Fixed Assets, Inventory, Cost of Goods Sold, and Accounts Payable. Why would you typically see these accounts when doing the percentage of sales method? This is because they are directly affected by an increase or decrease in sales volume.

In other words, if you are going to sell more, you will need more inventory and your cost of goods sold will also rise. To be able to produce more you are also going to involve more fixed assets and might need to accumulate more accounts payable to make everything happen. Since, in most cases, businesses provide their customers with an opportunity to buy on credit, as they sell more, their Accounts receivable also grows.

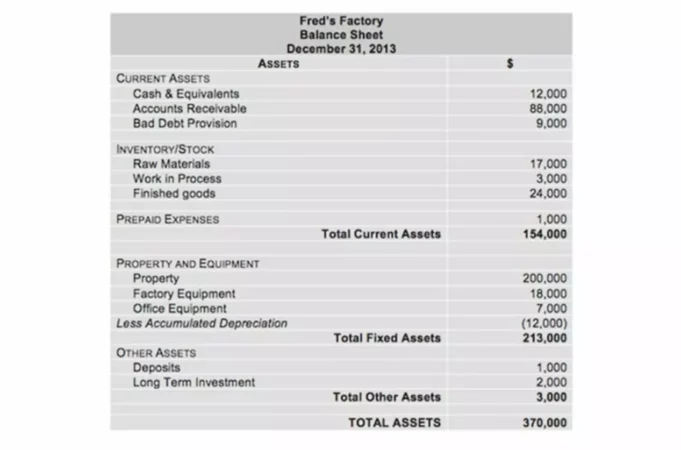

Let’s use the Balance Sheet report for Fred’s Factory and make some forecasts based on the data given to us. We are going to assume that during the same year, Fred’s Factory had Sales add up to $200,000. We are going to calculate values for Accounts Receivable, Inventory, and Fixed Assets. Once you have decided what accounts you need to forecast and have all the necessary data, you can proceed to the calculation of percentages of sales.

The calculation is as simple as dividing the line item by the sales amount of $200,000 and then multiplying the resulting number by 100 to get it into a percentage form. So, for Accounts Receivable, we are going to divide $88,000 by $200,000 and multiply by 100. This gives us 44%. This means that 44% of our sales revenue is tied up in Accounts Receivable. You can expect to have roughly the same amount of Accounts Receivable next year, unless specific measures are taken, for example, to reduce this amount.

The Inventory is 22% of Sales because we have a total Inventory of $44,000 when we add up raw materials, work-in-process, and finished goods, and $44,000/$200,000×100 is 22%. The last line item in our example is Fixed Assets, which are equal to $213,000. When we divide $213,000 by $200,000 of Sales and get it into percentage form, we arrive at the number that is higher than 100%. The result of 106.5% tells us that the Fixed Assets are larger than Sales.

This means that next year you should plan to have about the same amount of Fixed Assets to achieve the same level of Sales. If you forecast that the sales are going to grow by 10%, then you would need to plan to acquire more Fixed Assets, so their value would be 10% higher as well.

As you can see, the percentage of sales method helps us to project the financial data into the future with a simple calculation. Keep in mind that it makes sense to use this method only for items that you know are directly related to the Sales value. If you cannot trace this relationship, it makes no sense to make the calculation based on this number. Instead, you might want to calculate the line item as a percentage of Expenses or percentage of Liabilities if you know that it will go up or down with the increase or decrease in Expenses, for example, or Liabilities.

Finally, we would like to point out that your application of the percentage of sales method is not limited to just the Balance Sheet. You might want to find out what percentage of Sales is your company’s Cost of Goods Sold. Then, you can compare the result with previous years and see if it stays at about the same level or not. A decreasing amount is usually a good thing. If the number is higher, then you might need to evaluate what factors lead to this and maybe raise your price to compensate for this.