What is Payroll Accounting?

Payroll is a process of calculating workers’ salaries, tax deductions, and paying them. Here are the basic steps you would follow in payroll accounting:

- Calculate and report an employee(s) gross pay

- Calculate employee(s) deductions

- Calculate employer(s) deductions

- Produce and send paychecks or process direct deposits on a regular basis

- Report to the IRS as required.

Payroll accounting also undertakes the activities such as preparation of tax returns, maintaining payroll records, and more. Accounting for payroll and other payroll-related transactions is fairly straightforward, but accuracy is vital. For this reason, most business owners entrust this activity to bookkeepers or accountants. Larger companies have a separate individual in the accounting department that is responsible solely for payroll accounting in this business.

It is not worth spending the whole day calculating the salaries of employees, taxes needed to be withheld and so on. The modern payroll accounting automation software allows you to correctly and quickly calculate the wages, salaries, and taxes and even automatically process payroll. Thanks to cloud hosting, you can calculate taxes and salaries anytime and anywhere. The payroll software simplifies many other tasks and offers other benefits for employees and employers.

What Is Involved in Payroll Accounting?

Payroll accounting involves a company’s recording of its workers’ compensation, including:

- Gross wages

- Salaries

- Allowances

- Bonuses

- Commissions and so on.

As you might be aware, employers are required to pay a portion of payroll taxes. Thus, in addition to these elements, the employer would need to account for the employer’s part of the payroll tax expense.

Journal Entries

Now, let’s review journal entries you would need to make to record payroll. Basically, you should be aware of two journal entries whether you have one employee or two hundred employees. These two journal entries are always the same in format. You must make both of them every time you issue any check. Luckily you do not have to make two hundred entries if you have one hundred employees. You would just total the wages and make one journal entry and total the payroll tax expense and make one journal entry for that.

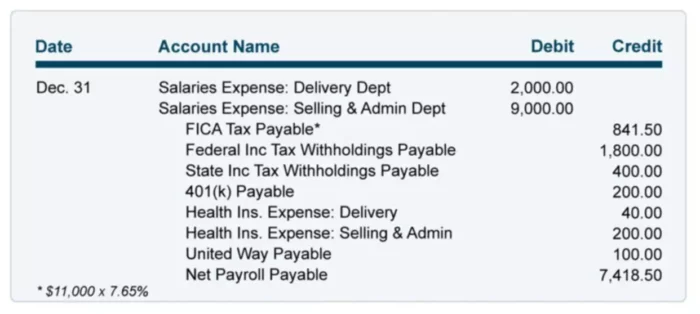

The first bookkeeping entry you would need to make to record gross wages, withholdings, and net pay. This would be your “employee” entry because you will be recording everything that has to do with employees’ pay.

For this journal entry, you will always debit the Wage Expense for gross payroll. This account might also be called Salary Expense or a company might have separate expense accounts for each department, and so on. Then, you will need to credit each Withholding account, such as FIT Payable, OASDI & Medicare Tax Payable, and health Insurance Premium Payable. These are liability accounts because the company owes this money to the IRS, insurance provider, etc.

The other account you would credit is a Cash account or Wages Payable account, depending on whether you are making the payment on the day of the journal entry or not. If making a payment later, the Wages payable will then be debited and Cash credited at the time of payroll processing. An example journal entry can be seen below.

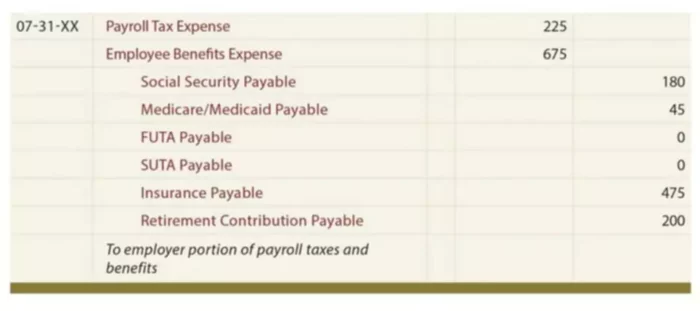

The second journal entry would be to record the employer’s payroll tax expense. This would be your “employer” journal entry because this is where you will be recording the employer’s portion of the Social security and Medicare taxes, as well as unemployment taxes for your state and federal taxes.

You will need to debit a Payroll Tax Expense for the total amount of payroll taxes that the employer pays. The balancing credit entries will be made for each tax liability, such as FUTA and Social security. An example journal entry for the employer’s portion of the payroll can be seen below. As with the first journal entry, you will debit the payable accounts once you actually make the payment to the respective parties.