The return on investment comes with complex planning, accounting, calculation, and analysis process. To get a return on investment, you need to have experience and certain knowledge, otherwise, this task will be very difficult.

Each investor is interested when their capital investments will pay off and begin to bring sustainable profits. Several procedures, as well as an understanding of norms and indicators, allow determining the time frame when money is recouped. Next, we will talk in detail about how to calculate the payback period to assess the effectiveness of investments.

Definition

The Payback Period (PP) is the period that is required in order for the initial investment in the project to be fully reimbursed. That is, this is the period after which the initial investment will begin to generate a stable cash flow and allow the investor to make a profit. The payback period is one of the key parameters for making an investment decision: Is it worth investing in a project or not?

The payback period is simple and straightforward to understand and calculate. However, despite its convenience, it has a number of limitations, namely:

- all the risks arising from the investment are not taken into account;

- possible pauses that will inevitably arise during the implementation of the project are not taken into account;

- funds that will begin to flow after the moment of reaching the planned sales/production volumes are not taken into account.

Calculation

There are 2 ways to calculate the payback period:

- Simple (PP)

- Discounted / Dynamic (DPP)

Simple payback period

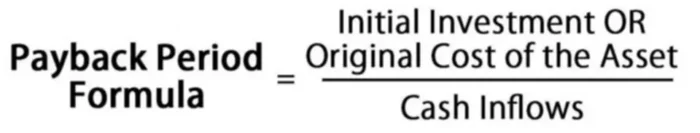

The simple payback period is calculated with the formula:

The calculation of a simple payback period will be correct only if the following prerequisites are met:

- investments are one-time and are invested at the start of the project;

- income comes in a stable and equal amount (fluctuates within 5%);

- the reporting period is the same.

Discounted payback period

In practice, the income comes in very unequal amounts. Moreover, the value of money changes over time. For example, $100 today is not the same $100 in 5 years. The time factor in the simple payback period is not taken into account. To calculate the payback period, taking into account the change in the value of money over time, a discounted calculation method is used.

The formula for calculating the discounted payback period is as follows:

The discounted method of calculation is based on bringing the value of future income to the present time, that is, how much future income will be worth in “today’s money”. This is done in order to reduce uncertainty. After all, the value of money in the future can change significantly, so it is easier to calculate future income based on already known factors.

Example

You are offered to invest in the project $120K. The business owner states that the project will bring on average $30K a year in net profit. Using the simplest calculations, we get a payback period for capital invested of four years (we divided 120,000 by 30,000).

However, such an example gives information without taking into account several factors mentioned earlier. Therefore, it is better to use the second formula if the investment amount is significant and the expected payback period is relatively short.