In some companies, like a design studio, auditing firm, consulting business, or custom furniture manufacturer, every job is different. It is, therefore, necessary to estimate the cost of each individual job. This is in contrast to companies with products that are produced in large quantities according to the same specifications, such as in food processing or pharmaceutical companies.

Basic Job Costing Concepts

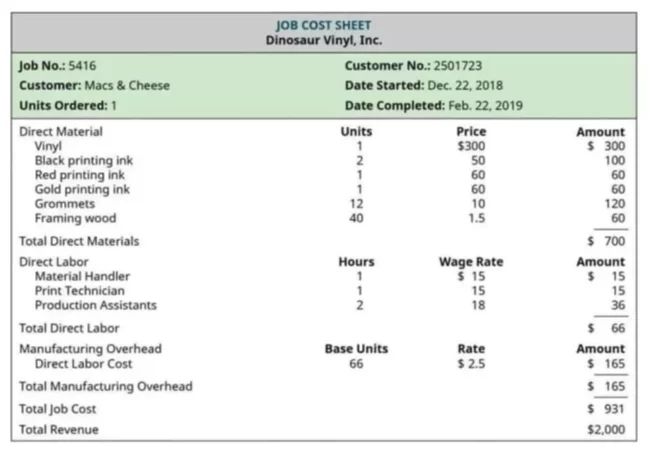

Job costing is a form of specific project costing under which each job or project is treated as cost unit and costs are calculated and recorded separately for each job. In other words, the basic concept of the job order costing system, as it is also known, is that it has direct costs that are directly traced to each job. There are also indirect costs shared by various jobs.

For example, direct costs in a design consulting business typically include the costs of printing several copies of the report, the cost of designers who report on a separate timesheet the hours they spend on each job, or the hours a subcontractor bills on the project. Indirect costs include the cost of the other departments that help designers across various projects, such as programmers, marketing, or human resources.

In a job order costing system, there are also cost pools, allocation bases, and allocation rates. Cost pools accumulate indirect costs that behave in a similar way. Each cost pool has its own allocation base and allocation rate. A unique characteristic of the job order costing method is that the cost of each unit, for example, each design, consulting engagement, or custom-made piece of furniture, is individually estimated. To do this, the cost system collects data on direct and indirect costs.

With this data, the full cost of the order can be calculated as the sum of its direct costs, for instance, $25,000 in direct costs and the indirect costs, estimated by multiplying the allocation rate for each cost pool. For instance, if the cost is $300/hour of programming and $1,200 per person employed and the design used 40 hours of programming and five individuals, the indirect costs will equal $18,000 and the full cost – $43,000.

When to Use Job Order Costing System

Process costing is used for similar products manufactured in a continuous process, while job costing is used for unique, often large and expensive goods or services. Job costing is more suitable where work is done according to customer specifications. This method is applicable mainly for activities like electrical shops, painting, engineering, repairing, decorating, automobile garages, shipbuilding, plumbing work, custom furniture production, and contract work.

Under this method, production is undertaken according to the demand of the customer, not for the storage purpose. It means that goods are produced and services are rendered after receiving a customer’s order. It is also applicable when a business needs to know the exact expenses and work that goes into making a specific product and how much profit (or loss) it will bring to the company.

Job Costing Pros and Cons

What are the advantages and disadvantages of this specific system? Let’s look at the positive sides first.

Advantages:

- Information on profitable or non-profitable goods or services – under this method, it is very easy to get information about which jobs are profitable and which are not.

- Cost estimation – it helps in the preparation of estimates when preparing quotations for similar projects.

- Helpful in preparation of budget – the past data helps the management when preparing budgets for the future.

- Helps with control of work capacity – the management is able to better control work capacity by comparing actual costs with estimated costs.

Disadvantages:

- More expensive – it is more expensive because it involves so much bookkeeping and accounting work while estimating the cost of material, labor, and overhead related to every job.

- Complex – the system is more complex because it involves lots of steps in determining cost, such as collection and classification of expenses, allocation of expenses, etc.

- Not suitable for small businesses – this system is more applicable to large-sized businesses.

Historical nature – being historical in nature, the limitations of job costing are the same as with historical costing. Therefore, it should be always up to date to be able to adjust the job process to cut costs and time, if necessary.