Definition

Investing activities are a type of cash flow activities. Accordingly, you will see an investing activities section in the cash flow financial statement. They reflect changes to fixed assets, meaning transactions that increase and decrease the company’s long-term assets. The most common transactions are purchases and sales. The data needed to complete this section of the cash flow report would be an Income statement, comparative Balance sheets, and some additional financial data.

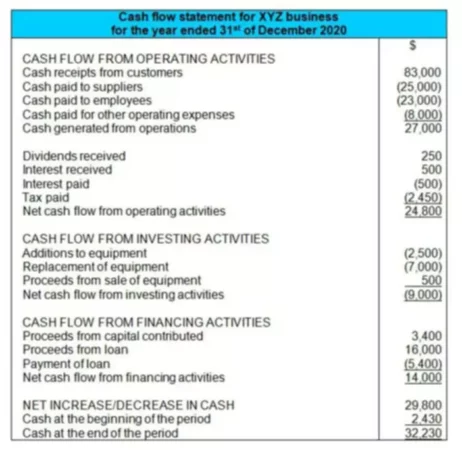

Cash Flows from Investing Activities

Cash flow from investing activities is often negative since it contains mainly the costs of implementing the initiative, as well as business expansion and modernization. It is usually covered by income received from the main activity of the enterprise (sale of goods or services).

Outflows consist of the following items:

- capital investments (research, development, and construction work);

- purchase and installation of the necessary equipment;

- acquisition of intangible assets (copyrights, licenses, permits, rights to use something, for example, a land plot);

- commissioning activities;

- liquidation activities (environmental protection measures, etc.);

- expenses aimed at increasing the volume of working capital.

Also, a number of non-capitalized expenses are considered to be outflows (costs for external infrastructure facilities, taxes on the land plot used for the project). If we are talking about construction, then investment investments should always be linked to the construction schedule. In accounting, costs associated with investing activities are classified by type of expense.

Examples of cash inflows typical for investing activities include:

- Income received from the sale of enterprise assets (surplus equipment or raw materials, unused buildings or premises). Their sale is most often made after the closure of the project, although this often happens during its implementation. In particular, if part of the equipment is no longer used in the production process, then it can be sold, the same can be said about the surplus of production and storage space.

- Funds raised in the course of the sale of intangible assets (copyrights, intellectual property). Such transactions are infrequent but result in significant inflows of funds.

- Proceeds from a decrease in working capital.

This can also include the non-operating income of the company. For example, a firm deposited temporarily unused money into a bank account. In this case, the interest on the deposit relates specifically to the investing activities, while the return of the principal amount of the deposit belongs to the financial activities.