Accounting requires all accounts to be balanced in such a way that there is no unrecorded amount of money left over when accessing the books. This requires following the rules for debits and credits, depending through which account the money is entering or leaving the company. Every reporting period always comes to an end. Thus, you need to redirect the money found in the income and expense accounts so that they are shown on the balance sheet. One way to do this is to use an income summary account.

Definition

In bookkeeping, the Income Summary account falls into the Income Statement category of accounts and is only used at the end of the time period to close everything out. Thus, you will never see it on any financial statements nor does it have any normal balance sign. To be more specific, it is used to close temporary accounts, and by “close” we mean zero out the balance of these accounts.

Closing journal entries in bookkeeping is a formal process of moving revenues, expenses, and owner’s withdrawals to the owner’s capital. As you might already know, revenues increase equity (credits), while expenses and owner’s withdrawals decrease equity (debits). When we record closing journal entries, this is when those financial impacts on equity actually happen.

Thus, the income summary account essentially clears out the ledgers to start a new reporting period in accounting. It is also useful in the sense that it can provide information about whether the firm made a profit or loss over the time period.

Example

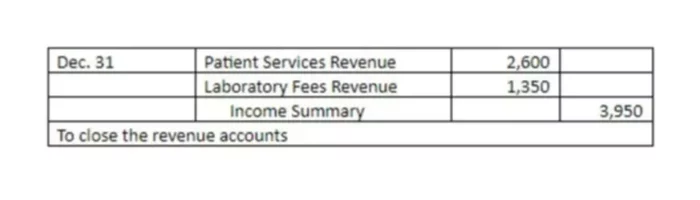

Now, we are going to review an example of creating the Income Summary account and posting closing journal entries to it. Assume that at the end of the period (December 31), there are credit balances of $2,600 in Patient Services Revenues and $1,350 in Laboratory Fees Revenues.

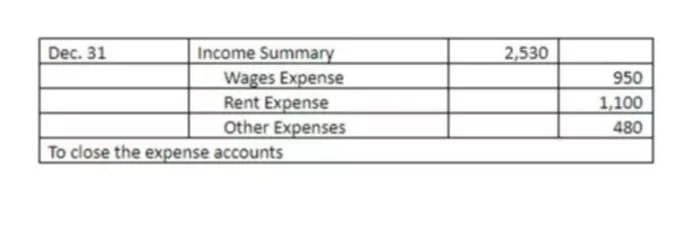

The second step in closing entries is to close all of our expense accounts because our expense accounts are also our temporary accounts. For the same period, the business had $950 in Wages Expense, $1,100 in Rent Expense, and other expenses added up to $480. The closing entry would look as follows.

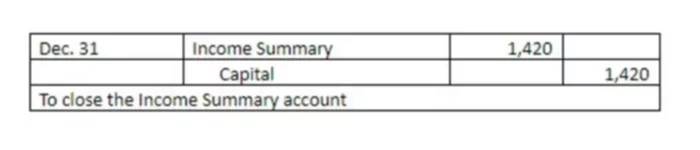

The final step would be to close this Income Summary account. Since our total revenues from the first step were $3,950 and total expenses were $2,530, the balance of this account would be 3,950 – 2,530 or $1,420 and it represents Net Income because the revenues are greater than expenses. Now, we will take this money out of this account and put it into our capital account.